0% found this document useful (0 votes)

14 views5 pagesSession 1

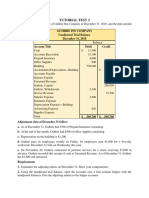

The document presents a financial overview including a balance sheet and income statement detailing assets, liabilities, revenues, and expenses. Key transactions include initial investments, bank borrowing, and sales of T-shirts, leading to a net income of $80. The end-of-year balance shows total assets of $2,080, total liabilities of $800, and shareholders' equity of $1,280.

Uploaded by

archit.tolasariaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

14 views5 pagesSession 1

The document presents a financial overview including a balance sheet and income statement detailing assets, liabilities, revenues, and expenses. Key transactions include initial investments, bank borrowing, and sales of T-shirts, leading to a net income of $80. The end-of-year balance shows total assets of $2,080, total liabilities of $800, and shareholders' equity of $1,280.

Uploaded by

archit.tolasariaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 5