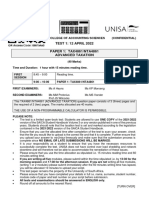

SAICA Code of Professional Conduct 2024

Uploaded by

Michele AudrySAICA Code of Professional Conduct 2024

Uploaded by

Michele AudryCode of Professional Conduct

of the South African Institute

of Chartered Accountants

including Independence Standards

2024 Edition

This gratis electronic version is proudly prepared and supplied by LexisNexis.

The purpose of the gratis Code is to ensure SAICA members (CA(SA)s and

AGA(SA)s) have access to the Code because they are required to comply with

it in terms of SAICA’s by-laws.

Students should take note that this e-book contains only a portion (the Code

only) of Volume 2 of the SAICA Student Handbook and are required to ensure

that they have the hard copy of Volume 2, which contains other examinable

information.

Code of Professional Conduct of the South African Institute of Chartered Accountants, 2024 Edition ET – 1

Code of Professional Conduct of the

South African Institute of Chartered Accountants

including Independence Standards

2024 Edition

STATUS OF THE CODE

This document contains the SAICA Code of Professional Conduct (“the Code”), 2024 Edition.

The Board of the South African Institute of Chartered Accountants (“SAICA”) has adopted the

International Code of Ethics for Professional accountants (including International Independence

Standards) as released by the International Ethics Standards Board for Accountants’ (IESBA) in

2018 in its entirety. SAICA is a member of the International Federation of Accountants (IFAC)

and has adopted the International Code of Ethics for Professional accountants with the per-

mission of IFAC but has however included additional guidance to assist in the local application

of certain requirements applicable to all SAICA members and associates.

The Code is applicable to all SAICA members and associates as defined in the SAICA Constitu-

tion. A contravention of, or failure to comply with any requirements of the Code, may be regarded

as a Punishable Conduct or misconduct in terms of sections 4.1.5, 4.1.7, 4.2.5, 5.1.5, 5.2.2, 6.1.5,

6.1.8 and 6.2.2 of Appendix 4 of the SAICA By-laws1 and as such may be investigated and if appro-

priate the member or associate may be found guilty and may be liable for penalties as described

in the By-laws.

Sections 4.3 and 5.1.12 of the By-laws state that Punishable Conduct on the part of a trainee

accountant shall include any conduct which would amount to Punishable Conduct had it been

perpetrated by a Member, Associate General Accountant or Accounting Technician. Annexure 3,

item 2.4 of the SAICA training regulations requires that trainee accountants should at all times

keep the affairs of the training office and its clients confidential and not breach any codes of

professional conduct, disciplinary rules or by-laws that apply to the profession of a CA(SA) or an

AGA(SA) and, if applicable, a Registered Auditor. The Code also conforms to the Independent

Regulatory Board for Auditors (IRBA) Code of Professional Conduct for Registered Auditors.

South African amendments to the IESBA Code of Ethics are underlined and in italics in the Code.

CHANGES OF SUBSTANCE FROM THE 2023 EDITION

The SAICA Code of Professional Conduct

This document replaces the 2023 edition of the Code of Professional Conduct of the South African

Institute of Chartered Accountants, and incorporates the following revisions:

• The revised definition of a public interest entity (PIE) which, among other matters, specifies a

broader list of mandatory PIE categories, including a new category “publicly traded entity” to

replace the category of “listed entity.”

• Changes to the definitions of “audit client” and “group audit client” in the Glossary arising from

the approved revisions to the definitions of listed entity and public interest entity.

• Technology-related provisions of the Code.

Approved Changes that Are Not Yet Effective

The 2024 edition of the handbook contains:

• Tax planning and related services provisions of the Code

Section 280 will be effective for tax planning activities beginning after June 30, 2025.

ET – 2 SAICA Student Handbook 2024/2025

Section 380 and the consequential amendments to Section 321 will be effective for tax planning

services beginning after June 30, 2025.

Transitional provision: For tax planning services or activities commenced before the above

effective date, such services or activities may be continued and be completed under the extant

provisions of the Code.

Early adoption is permitted.

Code of Professional Conduct of the South African Institute of Chartered Accountants, 2024 Edition ET – 3

SAICA Code of Professional Conduct (2024 Edition)

CONTENTS

Page

Guide to the Code .................................................................................................................. 3

SAICA Code of Professional Conduct (2024 Edition) ..................................................... 9

Definitions, including Lists of Abbreviations and Standards ............................................... 12

Part 1 – Complying with the Code, Fundamental Principles and Conceptual

Framework......................................................................................................................... 26

Part 2 – Professional Accountants in Business ..................................................................... 43

Part 3 – Professional Accountants in Public Practice ........................................................... 70

Independence Standards (Parts 4A and 4B) ..................................................................... 108

Part 4A – Independence for Audit and Review Engagements .............................................. 108

Part 4B – Independence for Assurance Engagements other than Audit and Review

Engagements ..................................................................................................................... 192

Effective Date ........................................................................................................................ 221

GUIDE TO THE CODE

(This Guide is a non-authoritative aid to using the Code.)

Purpose of the Code

1. The SAICA Code of Professional Conduct (including Independence Standards) (“the

Code”) sets out fundamental principles of ethics for professional accountants, reflecting

the profession’s recognition of its public interest responsibility. These principles establish

the standard of behaviour expected of a professional accountant. The fundamental principles

are: integrity, objectivity, professional competence and due care, confidentiality, and pro-

fessional behaviour.

2. The Code provides a conceptual framework that professional accountants are to apply in

order to identify, evaluate and address threats to compliance with the fundamental prin-

ciples. The Code sets out requirements and application material on various topics to help

professional accountants apply the conceptual framework to those topics.

3. In the case of audits, reviews and other assurance engagements, the Code sets out Inde-

pendence Standards, established by the application of the conceptual framework to threats

to independence in relation to these engagements.

How the Code is Structured

4. The Code contains the following material:

• Definitions, which contain defined terms (together with additional explanations where

appropriate) and described terms which have a specific meaning in certain parts of the

Code. For example, as noted in the Definitions, in Part 4A, the term “audit engagement”

applies equally to both audit and review engagements. The Definitions also include lists

of abbreviations that are used in the Code and other standards to which the Code refers.

• Part 1 – Complying with the Code, Fundamental Principles and Conceptual Framework,

which includes the fundamental principles and the conceptual framework and is applic-

able to all professional accountants.

ET – 4 SAICA Student Handbook 2024/2025

• Part 2 – Professional Accountants in Business, which sets out additional material that

applies to professional accountants in business when performing professional activities.

Professional accountants in business include professional accountants employed,

engaged or contracted in an executive or non-executive capacity in, for example:

o Commerce, industry or service.

o The public sector.

o Education.

o The not-for-profit sector.

o Regulatory or professional bodies.

Part 2 is also applicable to individuals who are professional accountants in public prac-

tice when performing professional activities pursuant to their relationship with the firm,

whether as a contractor, employee or owner.

• Part 3 – Professional accountants in Public Practice, which sets out additional material

that applies to professional accountants in public practice when providing professional

services.

• Part 4 – Independence Standards, which sets out additional material that applies to pro-

fessional accountants in public practice when providing assurance services, as follows:

o Part 4A – Independence for Audit and Review Engagements, which applies when

performing audit or review engagements.

o Part 4B – Independence for Assurance Engagements Other than Audit and Review

Engagements, which applies when performing assurance engagements that are not

audit or review engagements.

5. The Code contains sections which address specific topics. Some sections contain sub-

sections dealing with specific aspects of those topics. Each section of the Code is struc-

tured, where appropriate, as follows:

• Introduction – sets out the subject matter addressed within the section, and introduces

the requirements and application material in the context of the conceptual framework.

Introductory material contains information, including an explanation of terms used,

which is important to the understanding and application of each Part and its sections.

• Requirements – establish general and specific obligations with respect to the subject

matter addressed.

• Application material – provides context, explanations, suggestions for actions or

matters to consider, illustrations and other guidance to assist in complying with the

requirements.

How to Use the Code

The Fundamental Principles, Independence and Conceptual Framework

6. The Code requires professional accountants to comply with the fundamental principles of

ethics. The Code also requires them to apply the conceptual framework to identify, evaluate

and address threats to compliance with the fundamental principles. Applying the con-

ceptual framework requires exercising professional judgement, remaining alert for new

information and to changes in facts and circumstances, and using the reasonable and

informed third party test.

7. The conceptual framework recognises that the existence of conditions, policies and pro-

cedures established by the profession, legislation, regulation, the firm, or the employing

organisation might impact the identification of threats. Those conditions, policies and

procedures might also be a relevant factor in the professional accountant’s evaluation of

whether a threat is at an acceptable level. When threats are not at an acceptable level, the

Code of Professional Conduct of the South African Institute of Chartered Accountants, 2024 Edition ET – 5

conceptual framework requires the professional accountant to address those threats. Apply-

ing safeguards is one way that threats might be addressed. Safeguards are actions individ-

ually or in combination that the professional accountant takes that effectively reduce threats

to an acceptable level.

8. In addition, the Code requires professional accountants to be independent when performing

audit, review and other assurance engagements. The conceptual framework applies in the

same way to identifying, evaluating and addressing threats to independence as to threats to

compliance with the fundamental principles.

9. Complying with the Code requires knowing, understanding and applying:

• All of the relevant provisions of a particular section in the context of Part 1, together

with the additional material set out in Sections 200, 300, 400, 500, 600, 800 and 900,

as applicable.

• All of the relevant provisions of a particular section, for example, applying the pro-

visions that are set out under the subheadings titled “General” and “All Audit Clients”

together with additional specific provisions, including those set out under the subhead-

ings titled “Audit Clients that are not Public Interest Entities” or “Audit Clients that are

Public Interest Entities.”

• All of the relevant provisions set out in a particular section together with any additional

provisions set out in any relevant subsection.

Requirements and Application Material

10. Requirements and application material are to be read and applied with the objective of

complying with the fundamental principles, applying the conceptual framework and, when

performing audit, review and other assurance engagements, being independent.

Requirements

11. Requirements are designated with the letter “R”, are numbered in bold and, in most cases,

include the word “shall.” The word “shall” in the Code imposes an obligation on a pro-

fessional accountant or firm to comply with the specific provision in which “shall” has

been used.

12. In some situations, the Code provides a specific exception to a requirement. In such a situ-

ation, the provision is designated with the letter “R” but uses “may” or conditional wording.

13. When the word “may” is used in the Code, it denotes permission to take a particular action

in certain circumstances, including as an exception to a requirement. It is not used to denote

possibility.

14. When the word “might” is used in the Code, it denotes the possibility of a matter arising, an

event occurring or a course of action being taken. The term does not ascribe any particular

level of possibility or likelihood when used in conjunction with a threat, as the evaluation

of the level of a threat depends on the facts and circumstances of any particular matter,

event or course of action.

Application Material

15. In addition to requirements, the Code contains application material that provides context

relevant to a proper understanding of the Code. In particular, the application material is

intended to help a professional accountant to understand how to apply the conceptual

framework to a particular set of circumstances and to understand and comply with a

specific requirement. While such application material does not of itself impose a require-

ment, consideration of the material is necessary to the proper application of the requirements

of the Code, including application of the conceptual framework. Application material is

designated with the letter “A”.

ET – 6 SAICA Student Handbook 2024/2025

16. Where application material includes lists of examples, these lists are not intended to be

exhaustive.

APPENDIX TO THE GUIDE TO THE CODE (INCLUDING

SOUTH AFRICAN ADAPTATIONS AND AMENDMENTS)

17. This Appendix to this Guide provides an overview of the Code.

South African Adaptations and Amendments

18. South African adaptations and amendments to the IESBA International Code of Ethics for

Professional Accountants are underlined and in italics.

19. South African adaptions include the following:

• A change to the name of the Code;

• A change in the definition of professional accountants to include SAICA members and

associates;

• Additional sub-headings for clarity;

• Additional words to certain paragraphs; and

• Strikethrough of IESBA Code paragraphs that have not been adopted in South Africa.

20. South African amendments, which are more substantive than adaptations, and require a

change to the numbering system, are represented as follows:

• South African requirements and application material will include a reference to “SA”,

e.g. R115.3 SA or 350.8 A1 SA;

• Paragraphs inserted between two consecutively numbered paragraphs will include an

“a” in the paragraph number, e.g. R400.8a SA; and

• Paragraphs that are not South African paragraphs but that have been amended to

reflect a change in status (e.g. from application material to a requirement) will also

include a reference to “SA”, e.g. application paragraph changed to a requirement,

120.9 A2 to R120.9a SA.

21. South African laws and regulations may impose requirements that regulate the conduct of

professional accountants and their clients. These requirements may be in addition to the

content of the Code, or are more restrictive than the Code. A list of such laws and regu-

lations is not provided in this Code, but a proper identification, understanding and appli-

cation of such matters, is necessary.

22. South African amendments (excluding definitions) are listed below:

Paragraph Number Detail

Subsection 113 – Professional Competence and Due Care

R113.4 SA South African requirement

Subsection 115 – Professional Behaviour

Multiple Firms and Assisted Holding Out

R115.3 SA South African requirement

R115.4 SA South African requirement

Signing Conventions for Reports

R115.5 SA South African requirement

Code of Professional Conduct of the South African Institute of Chartered Accountants, 2024 Edition ET – 7

Paragraph Number Detail

R115.6 SA South African requirement

Use of Electronic Signatures

115.7 A1 SA South African application material

115.7 A2 SA South African application material

115.7 A3 SA South African application material

115.7 A4 SA South African application material

115.7 A5 SA South African application material

R115.8 SA South African requirement

115.9 A1 SA South African application material

115.9 A2 SA South African application material

115.10 A1 SA South African application material

115.11 A1 SA South African application material

115.11 A2 SA South African application material

Section 120 – The Conceptual Framework

R120.9a SA 120.9 A2 (which is an application paragraph in the IESBA Code of Ethics)

has been elevated into a South African requirement R120.9a SA.

Section 320 – Professional Appointments

R320.6a SA South African requirement

R320.7a SA South African requirement

Section 321 – Second Opinions

321.3 A4 SA South African application material

R321.3a SA South African requirement

321.3a A1 SA South African application material

R321.3b SA South African requirement

R321.5 SA South African requirement

321.5 A1 SA South African application material

Section 330 – Fees and Other Types of Remuneration

R330.4 SA South African requirement

Section 350 – Custody of Client Assets

R350.4a SA 350.4 A1 (which is an application paragraph in the IESBA Code of Ethics)

has been elevated to a South African requirement R350.4a SA

R350.6 SA South African requirement

R350.7 SA South African requirement

R350.8 SA South African requirement

350.8 A1 SA South African application material

ET – 8 SAICA Student Handbook 2024/2025

Paragraph Number Detail

R350.9 SA South African requirement

Section 400 – Applying the Conceptual Framework to Independence for Audit and Review

Engagements

Public Interest Entities

400.22 SA South African application material

R400.23 SA South African requirement

DEFINITIONS, INCLUDING LIST OF ABBREVIATIONS AND STANDARDS

(ALL PROFESSIONAL ACCOUNTANTS)

PART 1

COMPLYING WITH THE CODE, FUNDAMENTAL PRINCIPLES

AND CONCEPTUAL FRAMEWORK

(ALL PROFESSIONAL ACCOUNTANTS – SECTIONS 100 TO 199)

PART 2 PART 3

PROFESSIONAL ACCOUNTANTS PROFESSIONAL ACCOUNTANTS

IN BUSINESS IN PUBLIC PRACTICE

(SECTIONS 200 TO 299) (SECTIONS 300 TO 399)

(PART 2 IS ALSO APPLICABLE TO INDIVIDUAL

PROFESSIONAL ACCOUNTANTS IN PUBLIC PRACTICE

WHEN PERFORMING PROFESSIONAL ACTIVITIES

PURSUANT TO THEIR RELATIONSHIP

WITH THE FIRM)

INDEPENDENCE STANDARDS

(PARTS 4A AND 4B)

PART 4A – INDEPENDENCE FOR AUDIT

AND REVIEW ENGAGEMENTS

(SECTIONS 400 TO 899)

PART 4B – INDEPENDENCE FOR ASSURANCE

ENGAGEMENTS OTHER THAN

AUDIT AND REVIEW ENGAGEMENTS

(SECTIONS 900 TO 999)

Code of Professional Conduct of the South African Institute of Chartered Accountants, 2024 Edition ET – 9

SAICA CODE OF PROFESSIONAL CONDUCT (2024 EDITION)

CONTENTS

Page

Definitions, including Lists of Abbreviations and Standards ............................................... 12

Lists of Abbreviations and Standards referred to in the Code .............................................. 25

Part 1 – Complying with the Code, Fundamental Principles and

Conceptual Framework .................................................................................................. 26

Section 100 ............................................................................................................................ 26

Complying with the Code ................................................................................................ 26

Section 110 ............................................................................................................................ 28

The Fundamental Principles ............................................................................................ 28

Subsection 111 – Integrity ............................................................................................... 29

Subsection 112 – Objectivity ........................................................................................... 29

Subsection 113 – Professional Competence and Due Care ............................................. 29

Subsection 114 – Confidentiality .................................................................................... 30

Subsection 115 – Professional Behaviour ....................................................................... 32

Section 120 ............................................................................................................................ 35

The Conceptual Framework ............................................................................................ 35

Part 2 – Professional Accountants in Business ................................................................. 43

Section 200 ............................................................................................................................ 44

Applying the Conceptual Framework – Professional Accountants in Business ............. 44

Section 210 ............................................................................................................................ 48

Conflicts of Interest ......................................................................................................... 48

Section 220 ............................................................................................................................ 50

Preparation and Presentation of Information ................................................................... 50

Section 230 ............................................................................................................................ 54

Acting with Sufficient Expertise ..................................................................................... 54

Section 240 ............................................................................................................................ 55

Financial Interests, Compensation and Incentives linked to Financial Reporting

and Decision Making ................................................................................................... 55

Section 250 ............................................................................................................................ 56

Inducements, Including Gifts and Hospitality ................................................................. 56

Section 260 ............................................................................................................................ 60

Responding to Non-Compliance with Laws and Regulations ......................................... 60

Section 270 ............................................................................................................................ 68

Pressure to Breach the Fundamental Principles .............................................................. 68

Part 3 – Professional Accountants in Public Practice ...................................................... 70

Section 300 ............................................................................................................................ 71

Applying the Conceptual Framework – Professional Accountants in Public Practice ..... 71

Section 310 ............................................................................................................................ 77

Conflicts of Interest ......................................................................................................... 77

Section 320 ............................................................................................................................ 81

Professional Appointments .............................................................................................. 81

Section 321 ............................................................................................................................ 85

Second Opinions .............................................................................................................. 85

ET – 10 SAICA Student Handbook 2024/2025

Page

Section 325 ............................................................................................................................ 86

Objectivity of an Engagement Quality Reviewer and other Appropriate Reviewers ..... 86

Section 330 ............................................................................................................................ 88

Fees and Other Types of Remuneration .......................................................................... 88

Section 340 ............................................................................................................................ 90

Inducements, including Gifts and Hospitality ................................................................. 90

Section 350 ............................................................................................................................ 94

Custody of Client Assets ................................................................................................. 94

Section 360 ............................................................................................................................ 96

Responding to Non-Compliance with Laws and Regulations ......................................... 96

International Independence Standards (Parts 4A and 4B) ............................................. 108

Part 4A – Independence for Audit and Review Engagements ........................................ 108

Section 400 ............................................................................................................................ 108

Applying the Conceptual Framework to Independence for Audit

and Review Engagements............................................................................................ 108

Section 410 ............................................................................................................................ 130

Fees .................................................................................................................................. 130

Section 411 ............................................................................................................................ 140

Compensation and Evaluation Policies ........................................................................... 140

Section 420 ............................................................................................................................ 141

Gifts and Hospitality ........................................................................................................ 141

Section 430 ............................................................................................................................ 141

Actual or Threatened Litigation ...................................................................................... 141

Section 510 ............................................................................................................................ 142

Financial Interests ............................................................................................................ 142

Section 511 ............................................................................................................................ 145

Loans and Guarantees ...................................................................................................... 145

Section 520 ............................................................................................................................ 146

Business Relationships .................................................................................................... 146

Section 521 ............................................................................................................................ 148

Family and Personal Relationships.................................................................................. 148

Section 522 ............................................................................................................................ 150

Recent service with an Audit Client ................................................................................ 150

Section 523 ............................................................................................................................ 151

Serving as a Director or Officer of an Audit Client ........................................................ 151

Section 524 ............................................................................................................................ 152

Employment with an Audit Client ................................................................................... 152

Section 525 ............................................................................................................................ 154

Temporary Personnel Assignments ................................................................................. 154

Section 540 ............................................................................................................................ 155

Long Association of Personnel (including Partner Rotation) with an Audit Client ........ 155

Section 600 ............................................................................................................................ 159

Provision of Non-Assurance Services to an Audit Client ............................................... 159

Subsection 601 – Accounting and Bookkeeping Services .............................................. 167

Subsection 602 – Administrative Services ...................................................................... 169

Code of Professional Conduct of the South African Institute of Chartered Accountants, 2024 Edition ET – 11

Page

Subsection 603 – Valuation Services .............................................................................. 170

Subsection 604 – Tax Services ........................................................................................ 171

Subsection 605 – Internal Audit Services........................................................................ 178

Subsection 606 – Information Technology Systems Services ........................................ 180

Subsection 607 – Litigation Support Services ................................................................. 182

Subsection 608 – Legal Services ..................................................................................... 184

Subsection 609 – Recruiting Services ............................................................................. 187

Subsection 610 – Corporate Finance Services ................................................................ 188

Section 800 ............................................................................................................................ 190

Reports on Special Purpose Financial Statements that include a Restriction on Use

and Distribution (Audit and Review Engagements).................................................... 190

Part 4B – Independence for Assurance Engagements other than Audit

and Review Engagements ............................................................................................... 192

Section 900 ............................................................................................................................ 193

Applying the Conceptual Framework to Independence for Assurance Engagements

other than Audit and Review Engagements ................................................................ 193

Section 905 ............................................................................................................................ 200

Fees .................................................................................................................................. 200

Section 906 ............................................................................................................................ 203

Gifts and Hospitality ........................................................................................................ 203

Section 907 ............................................................................................................................ 204

Actual or Threatened Litigation ...................................................................................... 204

Section 910 ............................................................................................................................ 204

Financial Interests ............................................................................................................ 204

Section 911 ............................................................................................................................ 206

Loans and Guarantees ...................................................................................................... 206

Section 920 ............................................................................................................................ 208

Business Relationships .................................................................................................... 208

Section 921 ............................................................................................................................ 209

Family and Personal Relationships.................................................................................. 209

Section 922 ............................................................................................................................ 211

Recent Service with an Assurance Client ........................................................................ 211

Section 923 ............................................................................................................................ 212

Serving as a Director or Officer of an Assurance Client ................................................. 212

Section 924 ............................................................................................................................ 213

Employment with an Assurance Client ........................................................................... 213

Section 940 ............................................................................................................................ 214

Long Association of Personnel with an Assurance Client .............................................. 214

Section 950 ............................................................................................................................ 216

Provision of Non-Assurance Services to Assurance Clients ........................................... 216

Section 990 ............................................................................................................................ 219

Reports that include a Restriction on Use and Distribution

(Assurance Engagements other than Audit and Review Engagements) ..................... 219

Effective Date ........................................................................................................................ 221

Changes to the Code .............................................................................................................. 221

ET – 12 SAICA Student Handbook 2024/2025

DEFINITIONS, INCLUDING LISTS OF ABBREVIATIONS AND

STANDARDS

In the SAICA Code of Professional Conduct, the singular shall be construed as including the plural

as well as the reverse, and the terms below have the following meanings assigned to them.

In this Definitions section, explanations of defined terms are shown in regular font; italics are used

for explanations of described terms which have a specific meaning in certain parts of the Code or

for additional explanations of defined terms. References are also provided to terms described in

the Code.

Acceptable level A level at which a professional accountant using the reasonable and

informed third party test would likely conclude that the professional

accountant complies with the fundamental principles.

Accredited A status granted by the IRBA to a professional body that meets and con-

Professional Body tinues to meet the prescribed accreditation standards.

“Accreditation” means the status afforded to a professional body in

accordance with Part 1 of Chapter III [of the Act], which status may be

granted in full or in part”1.

“Professional body” means a body of, or representing:

(a) registered auditors and registered candidate auditors; or

(b) accountants, registered auditors and registered candidate auditors”.2

Act The Auditing Profession Act, No. 26 of 2005, as amended.

Advanced electronic An advanced electronic signature, as defined in the Electronic Commu-

signatures nications and Transactions Act, 2002 (No. 25 of 2002), is “an electronic

signature which results from a process which has been accredited by the

Authority as provided for in section 37”.

Advertising The communication to the public of information as to the services or

skills provided by professional accountants in public practice with a view

to procuring professional business.

Appropriate reviewer An appropriate reviewer is a professional with the necessary knowledge,

skills, experience and authority to review, in an objective manner, the

relevant work performed or service provided. Such an individual might

be a professional accountant.

This term is described in paragraph 300.8 A4.

Assisted holding out Assisting an individual to contravene Sections 41(1) and/or 41(2) of the

Act

Associate A person who has been admitted and registered as an associate general

accountant (AGA) with the Institute and therefore entitled to use the

designation “Associate General Accountant” or “Associate General

Accountant (South Africa)” or the initials “AGA(SA)” or a person who

has been admitted and registered as an associate (AT) with the Institute

and therefore entitled to use the designation of Fellow Member of Asso-

ciation of Accounting Technician or the initials “FMAAT(SA)” or

Member of Association of Accounting Technicians or the initials

“MAAT(SA)” or Public Sector Member of Association of Accounting

Technician or the initials “PSMAAT(SA)”.

________________________

1 Section 1 v “accreditation”.

2 Section 1 v “professional body”.

Code of Professional Conduct of the South African Institute of Chartered Accountants, 2024 Edition ET – 13

Assurance client The responsible party and also, in an attestation engagement, the party

taking responsibility for the subject matter information (who might be

the same as the responsible party).

Assurance An engagement in which a professional accountant in public practice aims

engagement to obtain sufficient appropriate evidence in order to express a conclusion

designed to enhance the degree of confidence of the intended users other

than the responsible party about the subject matter information.

(ISAE 3000 (Revised) describes the elements and objectives of an assur-

ance engagement conducted under that Standard, and the Assurance

Framework provides a general description of assurance engagements to

which International Standards on Auditing (ISAs), International Stand-

ards on Review Engagements (ISREs) and International Standards on

Assurance Engagements (ISAEs) apply.)

In Part 4B, the term ‘assurance engagement’ addresses assurance

engagements other than audit engagements or review engagements.

Assurance team (a) All members of the engagement team for the assurance engagement;

(b) All others within, or engaged by, the firm who can directly influence

the outcome of the assurance engagement, including:

(i) Those who recommend the compensation of, or who provide

direct supervisory, management or other oversight of the assur-

ance engagement partner in connection with the performance

of the assurance engagement;

(ii) Those who provide consultation regarding technical or industry

specific issues, transactions or events for the assurance engage-

ment; and

(iii) Those who perform an engagement quality review, or a review

consistent with the objective of an engagement quality review,

for the engagement.

Attestation An assurance engagement in which a party other than the registered

engagement auditor in public practice measures or evaluates the underlying subject

matter against the criteria.

A party other than the registered auditor also often presents the resulting

subject matter information in a report or statement. In some cases, how-

ever, the subject matter information may be presented by the registered

auditor in the assurance report. In an attestation engagement, the regis-

tered auditor’s conclusion addresses whether the subject matter infor-

mation is free from material misstatement.

The registered auditor’s conclusion may be phrased in terms of:

(i) The underlying subject matter and the applicable criteria;

(ii) The subject matter information and the applicable criteria; or

(iii) A statement made by the appropriate party.

Audit In Part 4A, the term “audit” applies equally to “review”.

Audit client An entity in respect of which a firm conducts an audit engagement. When

the client is a publicly traded entity in accordance with paragraphs

R400.22 and R400.23, audit client will always include its related entities.

When the audit client is not a publicly traded entity, audit client includes

those related entities over which the client has direct or indirect control.

(See also paragraph R400.27.)

ET – 14 SAICA Student Handbook 2024/2025

In Part 4A, the term “audit client” applies equally to “review client.”

In the case of a group audit, see the definition of group audit client.

Audit engagement A reasonable assurance engagement in which a professional accountant

in public practice expresses an opinion whether financial statements are

prepared, in all material respects (or give a true and fair view or are

presented fairly, in all material respects), in accordance with an applic-

able financial reporting framework, such as an engagement conducted in

accordance with International Standards on Auditing. This includes a

Statutory Audit, which is an audit required by legislation or other

regulation.

In Part 4A, the term “audit engagement” applies equally to “review

engagement.”

Audit report In Part 4A, the term “audit report” applies equally to “review report”.

Audit team (a) All members of the engagement team for the audit engagement;

(b) All others within, or engaged by, the firm who can directly influence

the outcome of the audit engagement, including:

(i) Those who recommend the compensation of, or who provide

direct supervisory, management or other oversight of the

engagement partner in connection with the performance of the

audit engagement, including those at all successively senior

levels above the engagement partner through to the individual

who is the firm’s Senior or Managing Partner (Chief Executive

or equivalent);

(ii) Those who provide consultation regarding technical or industry-

specific issues, transactions or events for the engagement; and

(iii) Those who perform an engagement quality review, or a review

consistent with the objective of an engagement quality review,

for the engagement; and

(c) Any other individuals within a network firm who can directly influ-

ence the outcome of the audit engagement.

In Part 4A, the term “audit team” applies equally to “review team”. In

the case of a group audit, see the definition of group audit team.

Chartered Accountant Means a chartered accountant registered as such with the Institute and

therefore entitled to use the designation “Chartered Accountant”,

“Geoktrooieerde Rekenmeester”, Chartered Accountant (South Africa)”,

“Geoktrooieerde Rekenmeester (Suid-Afrika)”, “Chartered Accountant

(SA)” OR “Geoktrooieerde Rekenmeester (SA)”, or the initials “CA”,

“GR”, “CA(SA)” or “GR(SA)”.

Client account A bank account which is used solely for the banking of clients’ monies.

Client monies Any monies, including documents of title to money such as bills of

exchange and promissory notes, as well as documents of title that can be

converted into money such as bearer bonds, received by a registered

auditor to be held or paid out on the instruction of the person from whom

or on whose behalf they are received.

Close family A parent, child or sibling who is not an immediate family member.

Component An entity, business unit, function or business activity, or some combin-

ation thereof, determined by the group auditor for purposes of planning

and performing audit procedures in a group audit.

Code of Professional Conduct of the South African Institute of Chartered Accountants, 2024 Edition ET – 15

Component audit A component in respect of which a group auditor firm or component

client auditor firm performs audit work for purposes of a group audit. When a

component is:

(a) A legal entity, the component audit client is the entity and any

related entities over which the entity has direct or indirect control;

or

(b) A business unit, function or business activity (or some combination

thereof), the component audit client is the legal entity or entities to

which the business unit belongs or in which the function or business

activity is being performed.

Component auditor A firm performing audit work related to a component for purposes of a

firm group audit

Conceptual framework This term is described in Section 120.

Confidential Any information, data or other material in whatever form or medium

information (including written, electronic, visual or oral) that is not publicly available.

Contingent fee A fee calculated on a predetermined basis relating to the outcome of a

transaction or the result of the services performed by the firm. A fee that

is established by a court or other public authority is not a contingent fee.

Cooling-off period This term is described in paragraph R540.5 for the purposes of para-

graphs R540.11 to R540.19.

Criteria In an assurance engagement, the benchmarks used to measure or

evaluate the underlying subject matter. The “applicable criteria” are the

criteria used for the particular engagement.

Direct engagement An assurance engagement in which the registered auditor in public prac-

tice measures or evaluates the underlying subject matter against the

applicable criteria and the registered auditor presents the resulting sub-

ject matter information as part of, or accompanying, the assurance report.

In a direct engagement, the registered auditor’s conclusion addresses the

reported outcome of the measurement or evaluation of the underlying

subject matter against the criteria.

Direct financial A financial interest:

interest (a) Owned directly by and under the control of an individual or entity

(including those managed on a discretionary basis by others); or

(b) Beneficially owned through a collective investment vehicle, estate,

trust or other intermediary over which the individual or entity has

control, or the ability to influence investment decisions.

Director or officer Those charged with the governance of an entity, or acting in an equiva-

lent capacity, regardless of their title, which might vary from jurisdiction

to jurisdiction.

Eligible audit This term is described in paragraph 800.2 for the purposes of Section

engagement 800.

Eligible assurance This term is described in paragraph 990.2 for the purposes of Section

engagement 990.

Engagement partner The partner or other person in the firm who is responsible for the engage-

ment and its performance, and for the report that is issued on behalf of

the firm, and who, where required, has the appropriate authority from a

professional, legal or regulatory body.

ET – 16 SAICA Student Handbook 2024/2025

Engagement period The engagement period starts when the audit team begins to perform the

(Audit and Review audit. The engagement period ends when the audit report is issued. When

Engagements) the engagement is of a recurring nature, it ends at the later of the notifi-

cation by either party that the professional relationship has ended or the

issuance of the final audit report.

Engagement period The engagement period starts when the assurance team begins to perform

(Assurance assurance services with respect to the particular engagement. The engage-

Engagements Other ment period ends when the assurance report is issued. When the engage-

than Audit and Review ment is of a recurring nature, it ends at the later of the notification by

Engagements) either party that the professional relationship has ended or the issuance

of the final assurance report.

Engagement quality An objective evaluation of the significant judgements made by the

review engagement team and the conclusions reached thereon, performed by the

engagement quality reviewer and completed on or before the date of the

engagement report.

Engagement quality A partner, other individual in the firm, or an external individual,

reviewer appointed by the firm to perform the engagement quality review.

Engagement team All partners and staff performing the engagement, and any other individ-

uals who perform procedures on the engagement, excluding external

experts and internal auditors who provide direct assistance on the

engagement.

In Part 4A, the term “engagement team” refers to individuals perform-

ing audit or review procedures on the audit or review engagement,

respectively. This term is further described in paragraph 400.9.

ISA 220 (Revised) provides further guidance on the definition of engage-

ment team in the context of an audit of financial statements.

ISA 620 defines an auditor’s expert as an individual or organisation

possessing expertise in a field other than accounting or auditing, whose

work in that field is used by the auditor to assist the auditor in obtaining

sufficient appropriate audit evidence. ISA 620 deals with the auditor’s

responsibilities relating to the work of such experts.

ISA 610 (Revised 2013) deals with the auditor’s responsibilities if using

the work of internal auditors, including using internal auditors to

provide direct assistance on the audit engagement.

In Part 4B, the term “engagement team” refers to individuals perform-

ing assurance procedures on the assurance engagement.

Existing accountant A professional accountant in public practice currently holding an audit

appointment or carrying out accounting, tax, consulting or similar pro-

fessional services for a client.

External expert An individual (who is not a partner or a member of the professional staff,

including temporary staff, of the firm or a network firm) or organisation

possessing skills, knowledge and experience in a field other than account-

ing or auditing, whose work in that field is used to assist the professional

accountant in obtaining sufficient appropriate evidence.

Financial interest An interest in an equity or other security, debenture, loan or other debt

instrument of an entity, including rights and obligations to acquire such

an interest and derivatives directly related to such interest.

Code of Professional Conduct of the South African Institute of Chartered Accountants, 2024 Edition ET – 17

Financial statements A structured representation of historical financial information, including

related notes, intended to communicate an entity’s economic resources

or obligations at a point in time or the changes therein for a period of

time in accordance with a financial reporting framework. The related

notes ordinarily comprise a summary of significant accounting policies

and other explanatory information. The term can relate to a complete set

of financial statements, but it can also refer to a single financial state-

ment, for example, a balance sheet, or a statement of revenues and

expenses, and related explanatory notes.

The term does not refer to specific elements, accounts or items of a finan-

cial statement.

Financial statements In the case of a single entity, the financial statements of that entity. In

on which the firm will the case of consolidated financial statements, also referred to as group

express an opinion financial statements, the consolidated financial statements.

Firm (a) A partnership, company or sole proprietor referred to in section 383

of the Act;

(b) An entity that controls such parties in (a), through ownership,

management or other means; and

(c) An entity controlled by such parties in (a), through ownership,

management or other means.

Paragraphs 400.4 and 900.3 explain how the word “firm” is used to

address the responsibility of professional accountants and firms for com-

pliance with Parts 4A and 4B, respectively.

Fundamental principles This term is described in paragraph 110.1 A1. Each of the fundamental

principles is, in turn, described in the following paragraphs:

Integrity R111.1

Objectivity R112.1

Professional competence and due care R113.1

Confidentiality 114.1 to R114.3

Professional behaviour R115.1

Group A reporting entity for which group financial statements are prepared.

Group audit The audit of group financial statements.

Group audit client The entity on whose group financial statements the group auditor firm

conducts an audit engagement. When the entity is a listed entity, group

audit client will always include its related entities and any other com-

ponents at which audit work is performed. When the entity is not a listed

entity, group audit client includes related entities over which such entity

has direct or indirect control and any other components at which audit

work is performed.

See also paragraph R400.22.

Group auditor firm The firm that expresses the opinion on the group financial statements.

Group audit team (a) All members of the engagement team for the group audit, including

individuals within, or engaged by, component auditor firms who

perform audit procedures related to components for purposes of the

group audit;

________________________

3 Section 1 v “firm”.

ET – 18 SAICA Student Handbook 2024/2025

(b) All others within, or engaged by, the group auditor firm who can

directly influence the outcome of the group audit, including:

(i) Those who recommend the compensation of, or who provide

direct supervisory, management or other oversight of the group

engagement partner in connection with the performance of the

group audit, including those at all successively senior levels

above the group engagement partner through to the individual

who is the firm’s Senior or Managing Partner (Chief Executive

or equivalent);

(ii) Those who provide consultation regarding technical or industry-

specific issues, transactions or events for the group audit; and

(iii) Those who perform an engagement quality review, or a review

consistent with the objective of an engagement quality review,

for the group audit;

(c) Any other individuals within a network firm of the group auditor

firm’s network who can directly influence the outcome of the group

audit; and

(d) Any other individuals within a component auditor firm outside the

group auditor firm’s network who can directly influence the out-

come of the group audit.

Group engagement The engagement partner who is responsible for the group audit.

partner

Group financial Financial statements that include the financial information of more than

statements one entity or business unit through a consolidation process.

Historical financial Information expressed in financial terms in relation to a particular entity,

information derived primarily from that entity’s accounting system, about economic

events occurring in past time periods or about economic conditions or

circumstances at points in time in the past.

IESBA Code IESBA International Code of Ethics for Professional Accountants

(including International Independence Standards).

Immediate family A spouse (or equivalent) or dependent.

Independence Independence comprises:

(a) Independence of mind – the state of mind that permits the expression

of a conclusion without being affected by influences that comprom-

ise professional judgement, thereby allowing an individual to act

with integrity, and exercise objectivity and professional scepticism.

(b) Independence in appearance – the avoidance of facts and circum-

stances that are so significant that a reasonable and informed third

party would be likely to conclude that a firm’s, or an audit or assur-

ance team member’s, integrity, objectivity or professional scepti-

cism has been compromised.

As set out in paragraphs 400.5 and 900.4, references to an individual or

firm being “independent” mean that the individual or firm has complied

with Parts 4A and 4B, as applicable

Indirect financial A financial interest beneficially owned through a collective investment

interest vehicle, estate, trust or other intermediary over which the individual or

entity has no control or ability to influence investment decisions.

Code of Professional Conduct of the South African Institute of Chartered Accountants, 2024 Edition ET – 19

Inducement An object, situation, or action that is used as a means to influence another

individual’s behaviour, but not necessarily with the intent to improperly

influence that individual’s behaviour.

Inducements can range from minor acts of hospitality between business

colleagues (for professional accountants in business), or between pro-

fessional accountants and existing or prospective clients, to acts that

result in non-compliance with laws and regulations. An inducement can

take many different forms, for example:

• Gifts.

• Hospitality.

• Entertainment.

• Political or charitable donations.

• Appeals to friendship and loyalty.

• Employment or other commercial opportunities.

• Preferential treatment, rights or privileges.

Institute The South African Institute of Chartered Accountants (SAICA)

Key audit partner The engagement partner, the individual responsible for the engagement

quality review, and other audit partners, if any, on the engagement team

who make key decisions or judgements on significant matters with

respect to the audit of the financial statements on which the firm will

express an opinion. Depending upon the circumstances and the role of the

individuals on the audit, “other audit partners” might include, for

example, engagement partners for certain components in a group audit

such as significant subsidiaries or divisions.

May This term is used in the Code to denote permission to take a particular

action in certain circumstances, including as an exception to a require-

ment. It is not used to denote possibility.

Might This term is used in the Code to denote the possibility of a matter arising,

an event occurring or a course of action being taken. The term does not

ascribe any particular level of possibility or likelihood when used in

conjunction with a threat, as the evaluation of the level of a threat

depends on the facts and circumstances of any particular matter, event

or course of action.

Network A larger structure:

(a) That is aimed at co-operation; and

(b) That is clearly aimed at profit or cost sharing or shares common

ownership, control or management, common quality management

policies and procedures, common business strategy, the use of a

common brand-name, or a significant part of professional resources.

Network firm A firm or entity that belongs to a network.

For further information, see paragraphs 400.50 A1 to 400.54 A1.

Non-compliance with Non-compliance with laws and regulations (“non-compliance”) com-

laws and regulations prises acts of omission or commission, intentional or unintentional,

(Professional which are contrary to the prevailing laws or regulations committed by

accountants in the following parties:

Business) (a) The professional accountant’s employing organisation;

(b) Those charged with governance of the employing organisation;

ET – 20 SAICA Student Handbook 2024/2025

(c) Management of the employing organisation; or

(d) Other individuals working for or under the direction of the employing

organisation.

This term is described in paragraph 260.5 A1.

Non-compliance with Non-compliance with laws and regulations (“non-compliance”) com-

laws and regulations prises acts of omission or commission, intentional or unintentional,

(Professional which are contrary to the prevailing laws or regulations committed by

accountants in Public the following parties:

Practice) (a) A client;

(b) Those charged with governance of a client;

(c) Management of a client; or

(d) Other individuals working for or under the direction of a client.

This term is described in paragraph 360.5 A1.

Office A distinct sub-group, whether organised on geographical or practice

lines.

Ordinary electronic An electronic signature, as defined in the Electronic Communications

signatures and Transactions Act, 2002 (No. 25 of 2002), is “data attached to,

incorporated in, or logically associated with other data and which is

intended by the user to serve as a signature”.

Predecessor accountant A professional accountant in public practice who most recently held an

audit appointment or carried out accounting, tax, consulting or similar

professional services for a client, where there is no existing accountant.

Professional accountant A generic term in this Code to refer to a chartered accountant [see

Chartered Accountant] or an associate [see Associate] as required by

the context of its use in a requirement or application material of this

Code, and taking into account that this Code is applicable to all

chartered accountants and associates in terms of the SAICA By-laws.

In Part 1, the term “professional accountant” refers to individual pro-

fessional accountants in business and to professional accountants in

public practice and their firms.

In Part 2, the term “professional accountant” refers to professional

accountants in business.

In Parts 3, 4A and 4B, the term “professional accountant” refers to

professional accountants in public practice and their firms.

Professional accountant A professional accountant working in areas such as commerce, industry,

in business service, the public sector, education, the not-for-profit sector, or in

regulatory or professional bodies, who might be an employee, contractor,

partner, director (executive or non-executive), owner-manager or

volunteer.

Professional accountant A professional accountant, irrespective of functional classification (for

in public practice example, audit, tax or consulting) in a firm that provides professional

services.

The term “professional accountant in public practice” is also used to

refer to a firm of professional accountants in public practice.

Professional activity An activity requiring accountancy or related skills undertaken by a

professional accountant, including:

• auditing, review, other assurance and related services;

Code of Professional Conduct of the South African Institute of Chartered Accountants, 2024 Edition ET – 21

• accounting;

• tax;

• management consulting; and

• financial management.

Professional judgement Professional judgement involves the application of relevant training,

professional knowledge, skill and experience commensurate with the

facts and circumstances, taking into account the nature and scope of the

particular professional activities, and the interests and relationships

involved.

This term is described in paragraph 120.5 A4.

Professional services Professional activities performed for clients. These include but are not

limited to the following:

(a) Audit, review, other assurance and related services:

(i) Financial statement audits and reviews, other assurance and

related services such as regulatory reporting, sustainability,

compliance and performance reporting; and

(ii) Preparation of financial statements in accordance with recog-

nised financial reporting standards and applicable statutes;

(b) Accounting services:

(i) Preparation of accounting records;

(c) Company statutory services;

(d) Taxation services:

(i) Tax return preparation and submission;

(ii) Tax calculations for the purpose of preparing accounting

entries;

(iii) Tax planning and other tax advisory services; and

(iv) Assistance in the resolution of tax disputes;

(e) Management consulting and advisory services:

(i) Accounting advisory and financial management advisory ser-

vices; accounting support, conversion services for new and

revised accounting standards, financial modelling and project

management;

(ii) Business performance services; business effectiveness, people

and change management, operational and business finance;

(iii) Internal audit; risk and compliance services, review and moni-

toring of internal controls, risk management, compliance

services, corporate governance and audit committee advisory

services;

(iv) Corporate finance service; mergers and acquisitions, valu-

ations, infrastructure financing, debt and capital markets, due

diligence reviews, transaction services and designated advisor

services;

(v) Corporate recovery services; liquidation and insolvency

administration, curator bonis, administration of deceased

estates, judicial management and trusteeships;

ET – 22 SAICA Student Handbook 2024/2025

(vi) Financial risk management services; actuarial services, bank-

ing and risk advisory, regulatory and compliance services, and

technical accounting;

(vii) Information technology (IT) advisory; security, privacy and

continuity, enterprise resource planning; information system

audit services, IT project advisory, governance and perform-

ance; and

(viii) Forensic services; dispute advisory and resolution, ethics and

integrity monitoring, fraud risk management, intellectual prop-

erty and other investigations and regulatory compliance.

Proposed accountant A professional accountant in public practice who is considering accept-

ing an audit appointment or an engagement to perform accounting, tax,

consulting or similar professional services for a prospective client (or in

some cases, an existing client).

Public interest entity For the purposes of Part 4A, an entity is a public interest entity when it

falls within any of the following categories:

(a) A publicly traded entity;

(b) An entity one of whose main functions is to take deposits from the

public;

(c) An entity one of whose main functions is to provide insurance to the

public; or

(d) An entity specified as such by law, regulation or professional stand-

ards to meet the purpose described in paragraph 400.15.

Paragraph R400.23 SA more explicitly defines the categories of public

interest entities in (b) and (c) above, and specifies those additional

entities that are deemed to be public entities to meet the interest purpose

described in paragraph 400.15, as contemplated in paragraph (d) above.

Publicly traded entity An entity that issues financial instruments that are transferrable and

traded through a publicly accessible market mechanism, including

through listing on a stock exchange.

A listed entity as defined by relevant securities law or regulation is an

example of a publicly traded entity.

Reasonable and The reasonable and informed third party test is a consideration by the

informed third party professional accountant about whether the same conclusions would

Reasonable and likely be reached by another party. Such consideration is made from the

informed third party test perspective of a reasonable and informed third party, who weighs all the

relevant facts and circumstances that the accountant knows, or could

reasonably be expected to know, at the time that the conclusions are

made. The reasonable and informed third party does not need to be a

professional accountant, but would possess the relevant knowledge and

experience to understand and evaluate the appropriateness of the

accountant’s conclusions in an impartial manner.

These terms are described in paragraph R120.5 A9.

Registered auditor An individual or firm registered as an auditor with the Regulatory

Board4.

________________________

4 Section 1 v. “registered auditor”.

Code of Professional Conduct of the South African Institute of Chartered Accountants, 2024 Edition ET – 23

This term, when used in the Code, includes a registered candidate

auditor in so far as it is applicable, as required by the context of its use

in a requirement or application material of this Code, and considering

this Code, as applicable.

Registered Candidate Means an individual who has obtained a registered auditor designation

Auditor from an accredited professional body, who is registered as a candidate

auditor with the Regulatory Board and who is serving under the super-

vision of a registered auditor5.

Regulatory Board The Independent Regulatory Board for Auditors established by Section

3 of the Act6.

Related entity An entity that has any of the following relationships with the client:

(a) An entity that has direct or indirect control over the client if the client

is material to such entity;

(b) An entity with a direct financial interest in the client if that entity has

significant influence over the client and the interest in the client is

material to such entity;

(c) An entity over which the client has direct or indirect control;

(d) An entity in which the client, or an entity related to the client under

(c) above, has a direct financial interest that gives it significant

influence over such entity and the interest is material to the client

and its related entity in (c); and

(e) An entity which is under common control with the client (a “sister

entity”) if the sister entity and the client are both material to the

entity that controls both the client and sister entity.

Responsible party In an assurance engagement, the party responsible for the underlying

subject matter.

Review client An entity in respect of which a firm conducts a review engagement.

Review engagement An assurance engagement, conducted in accordance with International

Standards on Review Engagements or equivalent, in which a professional

accountant in public practice expresses a conclusion on whether, on the

basis of the procedures which do not provide all the evidence that would

be required in an audit, anything has come to the professional account-

ant’s attention that causes the professional accountant to believe that the

financial statements are not prepared, in all material respects, in accord-

ance with an applicable financial reporting framework.

Review team (a) All members of the engagement team for the review engagement;

and

(b) All others within, or engaged by the firm who can directly influence

the outcome of the review engagement, including:

(i) Those who recommend the compensation of, or who provide

direct supervisory, management or other oversight of the

engagement partner in connection with the performance of the

review engagement, including those at all successively senior

levels above the engagement partner through to the individual

who is the firm’s Senior or Managing Partner (Chief Executive

or equivalent);

________________________

5 Section 1 v “registered candidate auditor”.

6 Section 1 v “Regulatory Board”.

ET – 24 SAICA Student Handbook 2024/2025

(ii) Those who provide consultation regarding technical or in-

dustry specific issues, transactions or events for the engage-

ment; and

(iii) Those who perform an engagement quality review, or a

review consistent with the objective of an engagement quality

review for the engagement; and

(c) Any other individuals within a network firm who can directly

influence the outcome of the review engagement.

Safeguards Safeguards are actions, individually or in combination, that the profes-

sional accountant takes that effectively reduce threats to compliance

with the fundamental principles to an acceptable level.

This term is described in paragraph 120.10 A2.

Senior professional Senior professional accountants in business are directors, officers or

accountant in business senior employees able to exert significant influence over, and make

decisions regarding, the acquisition, deployment and control of the

employing organisation’s human, financial, technological, physical and

intangible resources.

This term is described in paragraph 260.11 A1.

Special purpose Financial statements prepared in accordance with a financial reporting

financial statements framework designed to meet the financial information needs of

specified users.

Subject matter The outcome of the measurement or evaluation of the underlying

information subject matter against the criteria, i.e., the information that results from

applying the criteria to the underlying subject matter.

Substantial harm This term is described in paragraphs 260.5 A3 and 360.5 A3.

Those charged with The person(s) or organisation(s) (for example, a corporate trustee) with