Maf201 Tutorial Test2-1

Uploaded by

NURUL NAJWA IZUANI BINTI ABD KHALIDMaf201 Tutorial Test2-1

Uploaded by

NURUL NAJWA IZUANI BINTI ABD KHALIDMAF201

TUTORIAL: TEST 2

MAF201 TEST 2 QUESTIONS

TUTORIAL

2

Test 2 Questions:

July 2024

Jan 2024

July 2023

Jan 2023

July 2022

Jan 2022

July 2021

Jan 2021

3 TEST2 JULY 2024

TEST2 JULY 2024

4 Q1 A TFQ

1. T

2. T

3. F

Variable Cost per unit: RM

Direct Material 36.00

Direct Labour 18.00

Variable Manufacturing OH 36.00

?

Fixed Costs: RM

Ren 24,000

Salaries 100,000

Advertising 80,000

Depreciation on Equipment 6,000

Manufacturing OH 90,000

?

TEST2 JULY 2024

5

4. b.

i) BEP 5,000 units

NP = SX – VX – FC

0 = SX – VX – FC

BEP [RM] RM750,000

BEP [Units] x SP

ii) MOS 1,000 units

MOS = Sales [units] – MOS [units]

MOS [RM] = MOS [units] x SP RM150,000

iii) Net Profit

NP = SX – VX – FC RM600,000

TEST2 JULY 2024

6

c.

New Variable Cost = RM36 x 120% = RM43.20

New Direct Labour Cost per unit = RM18 x 110% = RM19.80

New TVC pr unit = RM36 + RM19.80 + RM43.20 = RM99.00

New Fixed Cost = RM300,000 + RM4,995 = RM304,995

NP = SX – VX – FC

RM649,995 = RM150X – RM99X – RM304,996

X = 12,745 units

TEST2 JULY 2024

7

Product SP VC Contribution Sales Mix WACM

[RM] [RM] [RM] [RM]

Wireless Speakers 150 70 80 6,000/15,000 = 40% 32

On-the-Go Speakers 200 80 120 9,000/15,000 = 60% 72

Total ?

BEP (all products) = TFC

WACM

= RM300,000 + RM30,000

RM104.00

= 3,173 units

BEP (single product)= 5,000 units

Advice: The company should proceed with the production of the new proposal as

new BEP units for multi-products are lower by 1,827 units (5,000 units – 3,173

units). This means the company will need to sell fewer units to achieve the BEP.

TEST2 JULY 2024

8

QUESTION 2

Multiple Choice Questions.

1. A

2. B

3. B

4. C

5. D

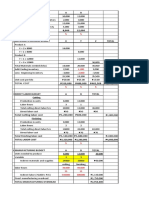

TEST2 JULY 2024 Jaguh Sdn Bhd

Cash Budget Cash Budget for the Third Quarter of 2024

July August September

9 RM RM RM

1 Opening cash balance 15,000 27,900 59,170

Add: Cash Receipts

Cash Sales 9,800 13,720 17,640

2 Collection from Credit Sales 54,000 90,000 126,000

10,000 - -

Dividend from Fixed Deposits

Total Cash Receipts ? ? ?

Total Cash Available ? ? ?

Less: Cash Payments

Payment to Creditors/Suppliers 15,000 20,000 22,000

Wages 18,000 15,000 15,000

3 Production OH 4,000 4,000 4,000

Sales Commission 650 750 800

Sales OH 14,250 15,200 17,100

Admin OH 9,000 10,000 8,000

Purchase of new CM - 7,500 17,500

Rental of Warehouse - - 6,000

Total Cash Payments ? ? ?

4

Closing cash balance ?

TEST2 JULY 2024

10

Sales June July August Sept

Total Sales 60,000 100,000 140,000 180,000

Cash Sales 10% x 100,000 x 98% 10% x 140,000 x 98% 10% x 180,000 x 98%

[10%; 20% trade disc] = 9,800 = 13,720 = 17,640

Credit Sales 90% x 60,000 90% x 100,000 90% x 140,000

[90% after 1 month] = 54,000 = 90,000 = 126,000

Production OH

RM6,000 – RM2,000 = RM4,000 per month

TEST2 JULY 2024

11

Sales OH June July August Sept

Total Sales OH 13,000 15,000 16,000 18,000

Sales Commission 5% x 13,000 5% x 15,000 5% x 16,000

[5% after 1 month] = 650 = 750 = 800

Sales OH 95% x 15,000 95% x 16,000 95% x 18,000

[95% after same = 14,250 = 15,200 = 17,100

month]

Purchase of a new Cutting Machine

30% x RM25,000 = RM7,500 [pay in August]

70 x RM25,000 = RM17,500 [pay in September]

12 TEST2 JULY 2024

TEST2 JAN 2024

13 Q1 A TFQ

1. T

2. F

3. T

Variable Cost per packet: RM

Materials 1.80

Labour [12 + 8 + 5] / 60 minutes x RM3 1.25

Overhead Costs [RM285,000 x 60%] / [15,000 x 12 months] 0.95

?

CS Ratio = SP – VC

SP

CS Ratio = RM5 – RM4 = 20%

RM5

= 0.2

TEST2 JAN 2024

14

4. b.

i) BEP [RM] = TFC RM114,000/ 0.2

CS Ratio RM570,000

ii) MOS 184,000 packets

iii) NP = SX - VX - FC RM4.48

SP =

TEST2 JAN 2024

15

c.

Net profit using marginal costing approach:

New Fixed Costs = RM114,000 + [RM250,000/5]

= RM164,000

New total Variable Cost per unit = RM1.80 X 1.25] + RM1.25 + RM0.95

= RM4.45

New Selling Price = RM6

New Sales Volume = [15,000 x 12]/0.6 = 300,000

Marginal Costing Approach RM

Sales Revenue [300,000 x RM6] 180,000

Less: Variable Costs [300,000 x RM4.45] [1,335,000]

Contribution Margin 465,000

Less: Total Fixed Costs [164,000]

Net Profit ?

TEST2 JAN 2024

16

Product SP VC Contribution Sales Mix WACM

[RM] [RM] [RM] [RM]

Beef Frankfurter 5.00 4.00 1.00 0.35 0.35

Lamb Frankfurter 7.00 5.00 2.00 0.35 0.70

Lamb Ball 9.00 6.50 2.50 0.30 0.75

Total ?

BEP (all products) = TFC

WACM

= RM114,000 + RM69,750

RM1.75

= 105,000 packets

TEST2 JAN 2024

17

Product SP VC Contribution Sales Mix WACM

[RM] [RM] [RM] [RM]

Beef Frankfurter 5.00 4.00 1.00 0.40 0.4

Lamb Frankfurter 7.00 5.00 2.00 0.30 0.6

Lamb Ball 9.00 6.50 2.50 0.30 0.75

Total ?

BEP (all products) = TFC

WACM

= RM114,000 + RM69,750

RM1.80

= 102,083 packets

Advice:

The business should proceed with Proposal 2 because the BEP is lower by 2,917

packets (105,000 – 102,083).

TEST2 JAN 2024

18

QUESTION 2

Multiple Choice Questions.

1. A

2. D

3. C

4. B

5. D

TEST2 JAN 2024

19

Cocoa Couture Sdn Bhd

Sales Budget for the year 2024

Products Couverture Compound

Sales unit 40,000 20,000

(x) Selling Price [RM] 60.00 40.00

Sales Value [RM] ? ?

Cocoa Couture Sdn Bhd

Production Budget for the year 2024

Couverture Compound

Sales unit (packets) 40,000 20,000

(+) Closing Stock 5,000 1,000

(-) Opening Stock (3,000) (1,000)

Units to be produced ? ?

TEST2 JAN 2024

20

Direct Material Purchase Budget

Cocoa Couture Sdn Bhd

Direct Material Purchase Budget for the year 2024

Cocoa Liquor Butter

kg Total Total

Units to be produced

Conventure: 42,000 2 84,000 1 42,000

Compound: 20,000 3 60,000 2 40,000

Total usage of direct material ? ?

(+) Closing stock 10,000 5,000

(-) Opening stock (6,000) (2,000)

Unit to be purchased ? ?

(x) Purchase Price Per Unit 2.50 3.50

Purchase Value 370,000 297,500

TEST2 JAN 2024

21

Direct Labour Budget

Cocoa Couture Sdn Bhd

Direct Labour Budget for the year 2024

Couverture Compound

Production Unit 42,000 20,000

Direct Labour hours 2.50 1.50

Total Direct Labour hours ? ?

(x) Rate per hour (RM) 6.00 6.00

Total Direct Labour Cost RM630,000 RM180,000

TEST2 JAN 2024

22

Production Cost Budget

Cocoa Couture Sdn Bhd

Production Cost Budget for the year 2024

Couverture Compound

RM RM

Direct Materials: DM Usage x Rate DM usage x Rate

Cocoa liquor 84,000 x 2.50 210,000 60,000 x 2.50 ?

Butter 42,000 x 3.50 147,000 40,000 x 3.50 ?

Direct Labour ? ?

Production Overhead

Indirect Material 67,742 32,258

Dep of PM 5,419 2,581

Supervision 105,000/135,000 ? 30,000/135,000 x ?

x RM40,000 RM40,000

Factory Maintenance 42,000/62,000 x ? 20,000/62,000 x ?

RM15,000 RM15,000

Total Production Costs 1,101,433 518,567

23 TEST2 JULY 2023

TEST2 JULY 2023

24 Q1 A TFQ

1. T

2. F

3. F

Variable Cost per packet: RM

Direct Materials [Coffee] 2.00

Direct Labour 1.00

Selling & Distribution 0.85

Other OH Expenses RM45,000/300,000 2.00

?

Fixed Costs: RM

Administration expenses 155,000

Other OH expenses 45,000

?

TEST2 JULY 2023

25

4. b.

i) BEP = TFC/CM 100,000 packets

= RM200,000/RM2.00

BEP [RM] RM600,000

= BEP [units] x SP

= 100,000 x RM6.00

ii) MOS 200,000

MOS [RM] RM1,200,000

iii) NP =SX - VX - FC RM400,000

TEST2 JULY 2023

26 Variable Cost per unit: RM

Direct Materials [Coffee] 2.10

Direct Labour 1.00

Selling & Distribution 0.85

Other OH Expenses RM45,000/300,000 0.15

Total VC per unit 4.10

Total FC RM200,000 + RM20,000 220,000

Selling Price 6.60

Sales Unit 270,000 units

c.

NP = SX – VX – FC

NP = RM6.60 x 270,000 – (RM4.10 x 270,000) - RM220,000

NP = RM455,000

TEST2 JULY 2023

27

Product SP VC Contribution Sales Mix WACM

[RM] [RM] [RM] [RM]

Golden Roast 6.00 4.00 2.00 50% 1.00

Ketagih Coffee 8.00 5.00 3.00 25% 075

Saigon Coffee 10.00 5.00 5.00 25% 1.25

Total 2.00 ?

BEP (all products) = TFC

WACM

= RM240,00

RM3.00

= 80,000 boxes

BEP (single product)= 6,700 boxes

The company should proceed with the new proposal because the BEP decreased

by 20,000 units [100,000 – 80,000] which means that the company now needs to sell

less in order to break even.

TEST2 JULY 2023

28

QUESTION 2

Multiple Choice Questions.

1. B

2. C

3. A

4. D

5. D

TEST2 JULY 2023

29

Lurve Design Sdn Bhd

Sales Budget for July 2023

Products Exclusive Luxury

Sales unit 1,788 1,985

(x) Selling Price [RM] 250 300

Sales Value [RM] ? ?

Lurve Design Sdn Bhd

Production Budget for July 2023

Exclusive Luxury

Sales unit (packets) 1,788 1,985

(+) Closing Stock 132 165

(-) Opening Stock (120) (150)

Units to be produced ? ?

TEST2 JULY 2023

30

Direct Material Purchase Budget

Lurve Design Sdn Bhd

Direct Material Purchase Budget for July 2023

Brocade Lace

metres Total metres Total

Units to be produced

Exclusive: 1,800 2.5 4,500 2 3,600

Luxury: 2,000 3 6,000 2.5 5,000

Total usage of direct material ? ?

(+) Closing stock 315 210

(-) Opening stock (300) (200)

Unit to be purchased ? ?

(x) Purchase Price Per Unit 50 35

Purchase Value RM525,750 ?

TEST2 JULY 2023

31

Direct Labour Budget

Lurve Design Sdn Bhd

Direct Labour Budget for July 2023

Exclusive Luxury

Production Unit (Packets) 1,800 2,000

Direct Labour hours 3 2

Total Direct Labour hours ? ?

(x) Rate per hour (RM) 10 10

Total Direct Labour Cost RM54,000 ?

TEST2 JULY 2023

32

Production Cost Budget

Lurve Design Sdn Bhd

Production Cost Budget for July 2023

Exclusive Luxury

RM RM

Direct Materials: DM Usage x Rate DM usage x Rate

Brocade 4,500 x RM50 225,000 6,000 x RM50 ?

Lace 3,600 x RM35 126,000 5,000 x RM35 ?

Direct Labour ? ?

Variable Production OH 2,000 2,500

Fixed Production OH 1,800/3,800 x ? 2,000/3,800 x ?

RM7,500 RM7,500

Total Production Costs 410,553 521,447

33 TEST2 JAN 2023

TEST2 JAN 2023

34 Q1 A TFQ

1. T

2. F

3. F

Variable Cost per unit: RM

Direct Materials 720,000/6,000 120

Direct Labour 1,080,000/6,000 180

Production OH [¾ x 640,000]/6,000 80

Selling Expenses [2/3 x 630,000]/6,000 70

?

Fixed Costs: RM

Production OH ¼ x 640,000 160,000

Selling expenses 1/3 x 630,000 210,000

Fixed Administrative 330,000

?

TEST2 JAN 2023

35

4. b.

i) BEP = TFC/CM 2,800 units

= RM700,000/[RM700 – RM450]

ii) MOS 3,200 units

MOS [RM] = MOS [units] x SP RM2,240,000

iii) NP = SX - VX - FC RM800,000

TEST2 JAN 2023

36

Ii) New VC per unit = [120 x 110%] + 180 + 80 + 70

= RM462

New FC = 700,000 + 30,000 = 730,000

New Sales Volume = 6,000 x 105% = 6,3000 units

NP = SX – VX - FC

= [SP – VC]X – FC

= [(RM700 – RM462)6,300 – RM730,000

= RM769,400

This marketing plan should not be implemented because the net profit will be

reduced by RM30,600

TEST2 JAN 2023

37

Product SP VC Contribution Sales Mix WACM

[RM] [RM] [RM] [RM]

Casserole 700 450 250 3/4 187.50

Skillet 550 240 310 1/4 77.50

Total ?

BEP (all products) = TFC

WACM

= RM728,750

RM265

= 2,750

Old BEP units = 2,800 units

New BEP units = 2,750 units

The company should proceed with the plan because the BEP is lower with the

new plan by 50 units [2,800 – 2,750] which means that the company now needs to

sell less in order to break even.

TEST2 JAN 2023

38

QUESTION 2

Multiple Choice Questions.

1. B

2. A

3. C

4. C

5. D

TEST2 JAN 2023 SweetBelle Cosmetic Sdn Bhd

Cash Budget Cash Budget for the fourth quarter of 2023

39

October November December

1 RM RM RM

Opening cash balance (14,500) (13,750) (15,510)

2 Add: Cash Receipts

Cash Sales 18,000 20,000 26,000

Receipts from debtors 138,600 151,200 169,200

8,500 8,500 8,500

Interest on fixed deposits

Total Cash Receipts ? ? ?

Total Cash Available ? ? ?

Less: Cash Payments

3 Payment to Creditors 81,730 87,460 89,010

Direct Labour 19,500 20,500 21,500

Variable OH 14,920 15,840 17,520

Fixed OH 15,800 15,800 15,800

Advertising 14,400 16,000 20,800

Office expenses 18,000 20,000 26,000

4 New Motor Van - 1,200

Consultation Fee 5,500

TEST2 JAN 2023

40

Sales Aug Sept Oct Nov Dec

Sales 150,000 160,000 180,000 200,000 260,000

Cash Sales (10%) 15,000 16,000 18,000 20,000 26,000

Credit Sales (90%) 135,000 144,000 162,000 180,000 234,000

40% Credit Sales 57,600 64,800 72,000

1 month after

60% Credit Sales 81,000 86,400 97,200

2 month after

Total Collection 138,600 ? ?

TEST2 JAN 2023

41 Sept Oct Nov Dec

Total Purchases 76,150 85,450 88,800 89,150

Payment:

60% in the month 51,270 53,280 53,490

of purchase

40% 1 month after 30,460 34,180 35,520

Total Payment ? ? ?

Sales Sept Oct Nov Dec

Production units 11,700 12,800 13,400 15,200

X Variable OH [RM] 1.20 1.20 1.20 1.20

Total Variable OH 14,040 15,360 16,080 18,240

2/3 of the month 9,360 10,240 10,720 12,160

incurred

1/3 1 month after 4,520 4,680 5,120 5,360

Total OH paid ? ? ?

42 TEST2 JULY 2022

TEST2 JULY 2022

43 Q1 A TFQ

1. F

2. T

3. F

Variable Cost per unit: RM

Direct Materials 600,000/6,000 30

Direct Labour 240,000/6,000 12

Production OH 310,000 – [RM10 x 20,000] 10

Selling Expenses [513,000 - 213,000]/20,000 15

?

Fixed Costs: RM

Production OH 110,000

Selling expenses 213,000

Other OH 365,000

?

TEST2 JULY 2022

44

4. b.

i) BEP =TFC/CM 16,000 units

= RM668,000/ [RM110 – RM67]

BEP [RM] RM1,760,000

ii) MOS 4,000 units

MOS [RM] RM440,000

It shows that the maximum number of units to be reduced to reach

break-even is 4,000 units. If management reduces more than these

units, the company will incur a loss.

TEST2 JULY 2022

45

c.

New Sales Volume = 115% x 20,000 = 23,000 units

New FC = 688,000 + 150,000 = RM838,000

New SP = 110% x RM110 = RM121

New VC per unit = (105% x 30) + 12 + 10 + 15 = RM68.5

NP = SX – VX - FC

= [SP – VC]X – FC

NP = [(RM121 – RM68.5 ) x 23,000 units ] – RM838,000

= RM 369,500

Net profit will increase by RM197,500 (RM369,500 – RM172,000 - old profit)

TEST2 JULY 2022

46

Product SP VC Contribution Sales Mix WACM

[RM] [RM] [RM] [RM]

Sport 110 67 43 20,000/50,000 = 40% 17.20

Casual 150 80 70 30,000/50,000 = 60% 42.00

Total ?

BEP (all products) = TFC

WACM

= RM688,000 + RM21,986

RM59.20

= 11,993 units

Old BEP units = 16,000 units

The company should proceed with the plan because the BEP is lower with the

new plan by 4,007 [16,000 – 11,993] which means that the company now needs to

sell less to break even.

TEST2 JULY 2022

47

QUESTION 2

Multiple Choice Questions.

1. C

2. D

3. C

4. D

5. D

TEST2 JULY 2022

48

GlassNetwork Sdn Bhd

Sales Budget for August 2022

Products NGFM RGFM

Sales unit 1,500 1,400

(x) Selling Price [RM] 400 500

Sales Value [RM] ? ?

GlassNetwork Sdn Bhd

Production Budget for August 2022

NGFM RGFM

Sales unit 1,500 1,400

(+) Closing Stock 20,500 13,500

(-) Opening Stock (20,000) (10,000)

Units to be produced ? ?

TEST2 JULY 2022

49

Direct Material Purchase Budget

GlassNetwork Sdn Bhd

Direct Material Purchase Budget for August 2022

Mirror Stainless steel

Total Total

Units to be produced RM RM

NGFM: 2,000 8 16,000 4 8,000

RGFM: 4,900 10 49,000 6 29,400

Total usage of direct material ? ?

(+) Closing stock 1,100 1,890

(-) Opening stock 1,000 1,800

Unit to be purchased ? ?

(x) Purchase Price Per Unit 10 15

Purchase Value 651,000 ?

TEST2 JULY 2022

50

Direct Labour Budget

GlassNetwork Sdn Bhd

Direct Labour Budget for August 2022

Skilled Semi-skilled

Production Units:

NGFM: 2,000 4 8,000 2 4,000

RGFM: 4,900 6 29,400 3 14,700

Total Direct Labour hours ? ?

(x) Rate per hour (RM) 10 8

Total Direct Labour Cost RM374,000 ?

TEST2 JULY 2022

51

Production Cost Budget

GlassNetwork Sdn Bhd

Production Cost Budget for August 2022

NGFM RGFM

RM RM

Direct Materials: DM Usage x Rate DM usage x Rate

Mirror: 16,000 10 160,000 10 ?

Stainless steel: 8,000 15 120,000 15 ?

Direct Labour ? ?

Skilled: 8,000 10 80,000 10 294,000

Semi skilled: 4,000 8 32,000 8 117,600

Variable Production OH 3,000

Fixed Production OH 2,000/6,900 x 3,478 4,900/6900 x ?

12,000 12,000

Total Production Costs 398,478 ?

52 TEST2 JAN 2022

TEST2 JAN 2022

53

Variable Cost per jar: RM

Direct Materials RM660,000/60,000 11.00

Direct Labour RM420,000/60,000 7.00

Direct Expenses RM420,000/60,000 7.00

Variable Selling Expenses RM150,000/60,000 2.50

?

Fixed Costs: RM

Fixed Production OH 330,750

Fixed Administration Expenses 280,500

Fixed Selling & Distribution 300,000

?

TEST2 JAN 2022

54

4. b.

i) BEP 40,500

BEP [RM] RM2,025,000

ii) MOS 19,500

MOS [RM] RM975,000

TEST2 JAN 2022

55

c.

Predict the new selling price per packet to be set for Ququrose Chantique if

the company wishes to earn a net profit of RM632,000 for the year 2022.

Selling price = Total Fixed Cost + Target Profit + Total Variable Cost

Sales Volume

Selling price = (RM911,250 + RM40,750) + RM632,000 + (RM30 x 72,000)

(120% x 60,000)

Selling price = RM3,744,000 = RM52.00

72,000

d.

Thus, the company should proceed with the new business plan as new BEP

packets are lower than single product BEP by 2,647 packets (40,500 – 37,853).

TRUE OR FALSE QUESTIONS

For each of the following statements, indicate whether it is TRUE or FALSE.

1) T

2) F

TEST2 JAN 2022

56

QUESTION 2

Multiple Choice Questions.

1. D

2. B

3. B

4. C

TEST2 JAN 2022

57

ABC Limited

Sales Budget for January 2022

Products A B

Sales unit 3,300,000 1,800,000

(x) Selling Price [RM] 440 360

Sales Value [RM] ? ?

ABC Limited

Production Budget for January 2022

A B

Sales unit 7,500 5,000

(+) Closing Stock 2,400 1,600

(-) Opening Stock (3,000) (2,000)

Units to be produced ? ?

TEST2 JAN 2022

58

Direct Material Purchase Budget

ABC Limited

Direct Material Purchase Budget for January 2022

DM 11 DM21 DM 31

Total Total

Units to be produced

A: 6,900 5 34,500 - 5 34,500

B: 4,600 - 10 46,000 5 23,000

Total usage of direct material ? ?

(+) Closing stock [90% X OS] 22,050 18,450 15,750

(-) Opening stock (24,500) (20,500) (17,500)

Unit to be purchased ? ?

(x) Purchase Price Per Unit RM2 RM4 RM1

Purchase Value 64,100 ? ?

TEST2 JAN 2022

59

Direct Labour Budget

ABC Limited

Direct Labour Budget for January 2022

A B

Production Units 6,900 4,600

X Hour per unit 2 4

Total Direct Labour hours 13,800 18,400

(x) Rate per hour (RM) 12.50 12.50

Total Direct Labour Cost ? ?

You might also like

- Bmac5203 Accounting For Business Decision Making Rosehamidi KamaruddinNo ratings yetBmac5203 Accounting For Business Decision Making Rosehamidi Kamaruddin24 pages

- Cost and Management Accounting - Ii - HonoursNo ratings yetCost and Management Accounting - Ii - Honours4 pages

- Accounting & Finance Assignment 1 - Updated 2.00% (1)Accounting & Finance Assignment 1 - Updated 2.015 pages

- 680a2982fce9475c531eb32c - ## - Marathon 02 Class Notes - Cost and Management Accounting - Removed (4) - RemovedNo ratings yet680a2982fce9475c531eb32c - ## - Marathon 02 Class Notes - Cost and Management Accounting - Removed (4) - Removed43 pages

- Costing Full Length 2 - May 24 (Solution) 8-4No ratings yetCosting Full Length 2 - May 24 (Solution) 8-416 pages

- Workshop-8-Qs Warwick Assignments AndvsolutionsvNo ratings yetWorkshop-8-Qs Warwick Assignments Andvsolutionsv3 pages

- Math Problem Solving and Equations GuideNo ratings yetMath Problem Solving and Equations Guide4 pages

- Sail Bso Ludhiana Ofa 2000009058a CR Coil - 122720 - 1.00No ratings yetSail Bso Ludhiana Ofa 2000009058a CR Coil - 122720 - 1.004 pages

- Employee Activation: Future of MarketingNo ratings yetEmployee Activation: Future of Marketing36 pages

- Support Ticketing System To Organise The Requests From CustomersNo ratings yetSupport Ticketing System To Organise The Requests From Customers2 pages

- Impact of Globalization On Indian RetailNo ratings yetImpact of Globalization On Indian Retail19 pages

- Determinants of Corporate Social Responsibility DisclosureNo ratings yetDeterminants of Corporate Social Responsibility Disclosure18 pages