On January 1, 2024, WILL Corporation organized SERFORT Company as a subsidiary in Hong

Kong with an initial investment cost of HK$150,000. SERFORT December 31, 2024 Trial Balance,

in Hong Kong Dollar (HK$), is as follows:

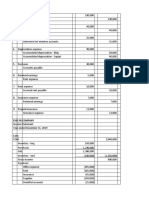

DEBIT CREDIT

Cash 10,500

Accounts Receivable (net) 30,000

Receivable from WILL Corp. 7,500

Inventory 37,500

Plant & equipment 150,000

Accumulated Depreciation 15,000

Accounts payable 18,000

Bonds payable 75,000

Ordinary Share 90,000

Sales 225,000

Cost of Sales 105,000

Depreciation expenses 15,000

Operating expenses 45,000

Dividends paid 22,500

423,000 423,000

Additional Information:

Purchases of inventory goods are made evenly during the year. Items in ending inventory were

purchased November 1. Equipment is depreciated by straight-line method with a 10-year life and

no residual value. A full year’s depreciation is taken in the year of acquisition. The equipment was

acquired on March 1. The dividends were declared and paid on November 1. Exchange rates

were as follows:

HK$ PHP

January 1 1.00 3.80

March 1 3.50

November 1 1.00 3.60

December 31 1.00 3.00

Average for the year 3.30

Average or the last 2 months 3.40

Requirements:

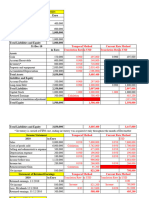

Using the current rate method:

1. Prepare the translated Income Statement and Balance Sheet as of December 31, 2024.

2. How much is the cumulative translation adjustment gain/loss?

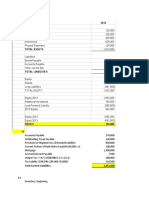

Using the Temporal Method:

1. Prepare the translated Income Statement and Balance Sheet as of December 31, 2024.

2. How much is the cumulative translation adjustment gain/loss?