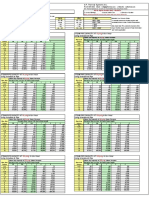

Q1)

Depreciation 1720

Tax Rate 21% Discount Rate 14%

Investment 8600

Sales Revenue 6545

Operating Cost 2365

Depreciation 1720

EBIT 2460

Tax 516.6

PAT 1943.4

Add Depreciation 1720

Net Income 3663.4

PV of Cash Inflows for 5 years 12576.74882

NPV 3976.75

Q2

Year 0 1 2 3

Revenue 14900 16300 17800

Cost 3200 3400 4500

Depreciation 8100 8100 8100

EBT 3600 4800 5200

Tax 792 1056 1144

PAT 2808 3744 4056

Add Depreciation 8100 8100 8100

Cash Flow from Operations 10908 11844 12156

Investment -32400

Change in NWC -350 -220 -250 -150

Cash flow from Investment -32750 -220 -250 -150

Total Cash Flow of Project -32750 10688 11594 12006

NPV @12% 1584.57

Q3

Depreciation 726666.6667 Return 12%

Tax Rate 21%

Year 0 1 2 3

Initial investment -2180000

Sales Revenue 1645000 1645000 1645000

Costs 610000 610000 610000

Depreciation 726666.7 726666.66667 726666.7

EBT 308333.3 308333.33333 308333.3

Tax 64750 64750 64750

PAT 243583.3 243583.33333 243583.3

Add Depreciation 726666.7 726666.66667 726666.7

Net Cash flow from Operations 970250 970250 970250

Net PV of Cash inflows 2330376.788

NPV of the project 150376.788

Q4)

Depreciation 726666.6667 Return 12%

Tax Rate 21%

Year 0 1 2 3

Initial investment -2430000

Sales Revenue 1645000 1645000 1645000

Costs 610000 610000 610000

Depreciation 726666.7 726666.66667 726666.7

EBT 308333.3 308333.33333 308333.3

Tax 64750 64750 64750

PAT 243583.3 243583.33333 243583.3

Add Depreciation 726666.7 726666.66667 726666.7

Net Cash flow from Operations 970250 970250 1112450

Net PV of Cash inflows 2431591.939

NPV of the project 1591.939231

Q6)

Q7)

Depreciation 107000

After-tax Salvage Value 22800

Year 0 1 2 3

Cash Outflow -475000 -60000

Cash Inflow 151080 151080 151080

Net Cash Flow -475000 151080 151080 91080

IRR 12.51%

22)

Real net cash flows 295000

g -3.50%

R 4%

PV of cash 3933333.333

23)

After Tax Salvage Value 15015

Depreciation 45000

Now

OCF= (Revenue-Cost)*(1-T)+T*Depreciation

OCF -1739

PV of Cost -128489.4042

EAC -53496.43243

24)

Depreciation 85000

After Tax Salvage Value 27300

Year 0 1 2 3

Investment -425000

Revenue 0 0 0

Cost -95000 -95000 -95000

Depreciation 85000 85000 85000

EBT 10000 10000 10000

Tax 2200 2200 2200

PAT 7800 7800 7800

Add Depreciation 85000 85000 85000

Cash Inflowfrom Operations 92800 92800 92800

Change Net Working Capital 40000 -40000

Salvage Value 27300

Net Cash Flow -385000 92800 92800 80100

NPV -42101.22156

4

13700

3100

8100

2500

550

1950

8100

10050

970

970

11020

(This will include the after-tax cost earned due to sale of that asset)

Method 2:

Depreciation 107000

Salvage Value 22800

Year 0 1

4 5 Investment -535000

Changes in NWC 60000

151080 113880

151080 113880 Cash Inflow 151080

OCF -475000 151080

IRR 16.18%

4 5

0 0

-95000 -95000

85000 85000

10000 10000

2200 2200

7800 7800

85000 85000

92800 92800

-40000

27300

92800 80100

2 3 4 5

-60000 Rev-Cost 165000

Depr 107000

151080 151080 151080 173880 EBT 58000

PAT 44080

151080 151080 151080 113880 OCF 151080