0 ratings0% found this document useful (0 votes)

321 views22 pagesAudit Reviewer

Accounting For audit( Cash and cash equivalents)

Uploaded by

Rica Mae TestaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

0 ratings0% found this document useful (0 votes)

321 views22 pagesAudit Reviewer

Accounting For audit( Cash and cash equivalents)

Uploaded by

Rica Mae TestaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

You are on page 1/ 22

AUDIT OF CASH

PROBLEM No. 1

‘Shown below is the bank reconciliation for Marikina Company for November 2016

Balance per bank, Noy. 30, 2016 150,000

Add: Deposits in transit 24,000

Total 174,000

Less: Outstanding checks 28,000

Bank credit recorded in error 10.000 __38,000

Cash balance per books, Nov. 30, P136,000

2016

‘The bank statement for December 2016 contains the following data:

Total deposits P110,000

Total charges, including an NSF check of

P8,000 and a service charge of P00 96,000

All outstanding checks on November 30, 2016, including the bank credit, were cleared

in the bank In December 2006.

‘There were outstanding checks of P30,000 and deposits in transit of P38,000 on

December 31, 2016,

Questions:

Based on the above and the result of your audit, answer the following:

1. How much is the cash balance per bank on December 31, 2016?

2. How much is the December receipts per hooks?

3. How much is the December disbursements per books?

How much Is the cash balance per books on December 31, 2016?

‘The adjusted cash in bank balance as of December 31, 2016 is

Question No. 1

Balance per bank, Nov. 30, 2016, 150,000

Add: Total deposits per bank statement 110.000

Total 260,000

Less: Total charges per bank statement 96,000

Balance per bank, Dec. 31, 2016 164,000

Question No. 2

Total deposits per bank statement P110,000

Less deposits in transit, Nov. 30 24,000

Dec. receipts cleared through the bank 86,000

Add deposits in transit, Dec. 31 38,000

December receipts per booksQuestion No. 3

Total charges per bank statement 96,000

Less: Outstanding cheeks, Nov. 30 28,000

Correction of erroneous bank 10,000

credit

December NSF check 8,000

December bank service charge _400

Dec. disb. cleared through the bankx

Add outstanding checks, Dec. 31

December disbursements per books

Question No, 4

Balance per books, Nov. 30, 2016 136,000

‘Add December receipts per books 124,000

Total "260,000

Less December disbursements per books 79.600

Balance per books, Dec. 31, 2016 PT80.400

Question No. 5

Balance per bank statement, 12/31/16 164,000

Deposits in transit 38,000

‘Outstanding checks 30,000)

Adjusted bank balance, 12/31/16 21Z2,000

Balance per books, 12/31/16 180,400

NSF cheek { 8.000)

Bank service charges 400)

Adjusted book balance, 12/31/16 £172,000

PROBLEM NO. 2

‘The accountant for the Muntinlupa Company assembled the following data:

June 30 July 3

Cash account balance P 15,822 P_39.745

Bank statement balance 107.082 137,817

Deposits in transit 8201 12.880

Outstanding cheeks 27718 30,112

Bank service change 72 60

Customer's check deposited July 10, 8,250

returned by bank on July 16 marked

NSF, and redeposited immediately: no

entry made on books for return or

redeposit

Collection by bank of company's 71,815 80,900

notes receivable‘The bank statements and the company's cash records show these totals:

Disbursements in July per bank 218,373

statement

Cash receipts in July per Muntinlupa's 236,452

books

QUESTIONS:

Based on the application of the necessary audit procedures and appreciation of the

above data, you are to provide the answers to the following:

1. How much is the adjusted cash balance as of June 30?

How much is the adjusted bank receipts for July?

How much is the adjusted book disbursements for July?

ee NS

How much is the adjusted cash balance as of July 31?

a

How much is the cash shortage as of July 31?

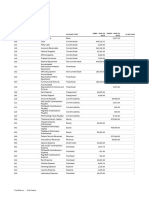

Muntnlupa Company

Reconciliation of Receipts, Disbursements, and Bank Balance

For the month ended July 31

Beginning Ending

une 30 Receipts Disb. July SI

Balance per hank

statement P107,082 P249,108" ——-P218,973. P137,817

Deposits in transit:

sume 30 8,201 (8,201)

July 31 12,880 12,880

Outstanding checks

June 30 (27.718) (27.718)

July 31 30,112 (80,112)

NSF check redeposited

(8.250) (8.250)

Adjusted bank balance

P8756 P245.537 PID.

Balance per books P 15,822 P236,452 ——P212,529 39,745

Bank service charge:

June (72) 72)

July 60 (60)

Collection of notes

receivable

June 71,815 (71,815)

July 80,900 100

Adjusted book balance P.87,585 P245587 —P219,517 120,585

* (P137.817 + F218.373-P107.082)

» (P15.922 + 296,452 ~ P99.745)AUDIT OF CASH AND CASH EQUIVALENTS.

PROBLEM NO. 1

In connection with your audit of Caloocan Corporation for the year ended December 31, 2006, you

gathered the following:

1, Current account at Metrobank 2,000,000,

2. Current account at BPI (100,000)

8. Payroll account 500,000

3. Foreign bank account ~ restricted [in equivalent pesos) 1,000,000

5. Postage stamps. 1.000

© Employee's post dated check 4,000

7. 10U from controllers sister 10,000

8. Credit memo from a vendor for a purchase return, 20,000

9. Traveler's check 50,000

10. Not-sufficient-funds check 15,000

11. Money order 30,000

12. Petty cash fund (P4,000 in currency and expense

receipts for P6,000) 10,000

13, Treasury bills, due 3/31/07 (purchased 12/31/06) 200,000

14, Treasury bills, due 1/31/07 {purchased 1/1/06) 300,000

‘Question.

Based on the above information and the result of your audit, compute for the cash and cash

‘equivalent that would be reported on the December 31, 2006 balance sheet.

‘a. 2,784,000 &. P2,790,000

\b. F3,084,000 d._ 2,703,000

‘Suggested Solution:

Current account at Metrobank 2,000,000

Payroll account 500,000

‘Traveler's checle 30,000

Money order 30,000

Potty cash find (P3,000 in currency)

‘Treasury bills, due 3/31/07 (purchased 12/31/06)

Total 'P2,784,000

Answer: A

PROBLEM NO. 2

Im the course of your audit of the Las Pitas Corporation, its controller is attempting to determine

the amount of cash to be reported on its December 31, 2006 balance cheet. The following

information is provided:

1, Commercial savings account of P1,200,000 and a commercial checking account balance of

1,800,000 are held at PS Bank.

2, Travel advances of P500,000 for executive travel for the first quarter of the next year (employee

to reimburse through salary deduction).

3. A separate cash fund in the amount of P3,000,000 is restricted for the retirement of a long term

debt

4. Petty cash fund of P10,000,

5. An LOWU, from a company officer in the amount of 40,000.

6. A bank overdraft of P250,000 has oceurred at one of the banks the company uses to deposit its

cash receipts, At the present time, the company has no deposits at this bani.

7. The company has two certificates of deposit, each totaling P1,000,000. These certificates of

deposit have maturity of 120 days.

8, Las Pinas has received a check dated January 2, 2007 in the amount of P150,000.

9. Las Pinas has agreed to maintain a cash balance of P200,000 at all times at PS Bank to ensure

future credit availability.

10. Currency and coin on hand amounted to P15,000,

Question

Based on the above and the result of your audit, how much will be reported as cash and cash

equivalent at December 31, 2006?

&. 3,028,000 fe. P2,575,000

b. 2,825,000 4. P5,025,000(CEBU CAR CENTER, WC. www.Cebu-CPAR.com

Suggested Sotution:

Savings account at PS Bank 1,200,000

Checking account at PS Bank 1,800,000

Petty cash fund 10,000

Curreney and coin, 15,000

Total 3,025,000

Answer: A

PROBLEM NO. 3

‘The cash account of the Makati Corporation as of December 31, 2006 consists of the following:

(On deposit in current account with Real Bank P 900,000

Cash collection not yet deposited to the bank 350,000

A-customer's check returned by the bank for insufficient 150,000

fund

A check drawn by the Vice-President of the Corporation

ajed January 15, 2007 70,000

Accheck draven by a supplicr dated December 28, 2006 for

{goods returned by the Corporation (00,000

A check dated May 31,2006 drawn by the Corporation

‘against the Piggy Bank in payment of customs duties

Since the importation did not materialize, the check was

renirned by the customs broker. This check was an

outstanding check in the reconciliation of the Pigey

Bank acconint 410,000

Peity Cash fund of which P5,000 is in currency:

{orm of employees" I.0.U. &; and P1,400 is supported by

approved petty cash vouchers for expenses all dated

prior to closing of the books on December 31, 2006 0.000

‘Total 7,980,000

Less: Overdratt with Piggy Bank secured by a Chattel

mortgage on the inventories 300,000

Balance per ledger ELese,000

Question

At what amount will the account “Cash” appear on the December 31, 2000 balance sheet?

1,315,000 ©. 1,495,000

b. 1,425,000 4. P1,725,000

‘Suggested Solution:

‘Current account with Real Bank P- 900,000

Undeposited collection 350,000

‘Supplier's check for goods returned by the Corporation 60,000

Unexpended petty cash 5,000

Current account with Piggy Banke (P410,000 - P300,000) 10.000

“Total usa

Answer: B

PROBLEM NO. 4

You noted the following composition of Malabon Company's “cash account” as of December 31, 2006

in conneetion with your audit:

Demand deposit account P2,000,000

‘Time deposit - 30 days 1,000,000

NSF check of customer 40,000

Money market placement (due June 30, 2007) 1,500,000

Savings deposit in a closed bank 100,000

10U from employee 20,000,

Pension fund 3,000,000

Potty cash fund 10,000

‘Customer's check dated January 1, 2007 50,000

Customer's checl outstanding for 18 months 49,009

Total FEzc0.000CEBU Chak CENTER, We. www.Cebu-CPAR.com

Adalitional information follows:

‘8} Check of P200,000 in payment of accounts payable was recorded on December 31, 2006 but

mailed to suppliers on January 5, 2007.

1b) Check of P100,000 dated January 15, 2007 in payment of accounts payable was recorded and

mailed on December 31, 2000.

The company uses the calendar year. ‘The cash receipts journal wos held open until January

15, 2007, during which time P400,000 was collected and recorded on December 31, 2008,

Question:

‘The cash and cash equivalents to be shown on the December 31, 2006 balance sheet is

a. P3,310,000 ‘© P2,910,000

b. P1,910,000 4. P4410,000

Suggested Solution:

Demand deposit account as adjusted:

Demand deposit account per books 2,000,000

Undelivered check 200,000

Postdated check ierted 100,000

Window dretsing of collection (400,000) P1,900,000

‘Time deposit - 30 days 1,000,000,

Petty cash fund 10,000

Cash and cash equivalents Pisie.vo0

Answer: ©

PROBLEM NO. 5

You were able to gather the following from the December 31, 2006 trial balance of Mandaksyonz

Corporation in connection with your audit of the company:

‘cash on hand P 500,000

Peity cash fund 10,000

BPI current account 1,000,000

Security Bank current account No. O1 1,080,000

Security Banik current aecotint No, 02 (80,000)

PNB savings account 1,200,000

PNB time deposit 500,000

Cash on hand inchides the following items:

a. Customer's check for P#0,000 returned by bank on December 26, 2006 due to insufficient

fund but subsequently redeposited and cleared by the bank on January &, 2007.

bb. Customer's check for 20,000 dated January 2, 2007, received on December 29, 2006,

© Postal money orders received from customers, P30,000.

‘The petty cash Fund consisted of the following items aa of December 31,

Currency and coins

Employees’ vales

Currency in an envelope marised “collections for charity* with

names attached 1,200

Unrepienished petty cash vouchers 1/300

(Check drawn by Mandaluyong Corporation, payable to the

petty cashier 4,000

10.100

Included among the checks drawn by Mandaluyong Corporation against the BPI current account

‘and recorded in December 2006 are the following:

8. Check written and dated December 29, 2006 and delivered to payee on January 2, 2007.

30,000,

b. Check written on December 27, 2006, dated January 2, 2007, delivered to payee on

December 29, 2000, P40,000,

‘The credit balance in the Security Bank current account No. 2 represents checks drawn in excess of

the deposit balance. These checks were still outstanding at December 31, 2006,

‘The savings account deposit in PNB has been set aside by the board of directors for acquisition of

new equipment. This account is expected to be disbursed in the next 2 months from the balance

sheet date

3CEBU CMR CENTER, INC. wow-Cebu-CPAR.com

Questions:

[Based on the above and the result of your audit, determine the adjusted balances of following:

1. Cash on hand

b.PS30,000 4. PAioo00

2. Petty cash fund

@ P6,000 ©. 2,000

b. P7,200 a. PA,900)

3. BPI current account

a P1,000,000 ©. 1,080,000

b. P1,120,000 a. P1,040,000

4. Cash and cash equivalents

a P2,917.200 © 3,052,000

>, P3,074.900 4. P3,000,000,

Suggested Solution

Question No. 1

Unadjusted eash on hand 500,000

NSF check (40,000)

Post dated check received (20,000)

Adjusted cash on hand 40.000

(Question No. 2

Petty cash find per total 10,100

‘Employees’ vales @OU) (2.000)

Currency in envelope marked “collections for ehacity (1.200)

Unreplenished petty cash vouchers 1,300)

Petty cash find, as adjusted B 6,000

Alternative computation:

currency and coins 2,000

Replenishment checi: 4,000

Dotty cash fund, a6 adjusted 6,000

Question No. 3

Unadjusted BPI current sosount 1,000,000

Tnpeleased check 50,000,

Post dated check delivered 49.000

Adjusted 801 current account 21,120,009

(Question Wo. 4

‘cash on hand (see no. 3) P 440,000

Petty cash fund (see no, 2) 6,000

BP! current account jace no. 3) 1,120,000

Sccurity Bank current account [net of

‘overdraft of P80,000) 1,000,000

PNB time deposit

Cash and cash equivalents, as adjusted

Answers: 1) D: 2) A: 9) B: 4) D

PROBLEM NO. 6

‘The books of Manila's Service, Inc, disclosed a eash balance of P697,570 on December 31, 2006,

‘The bank statement as of Decemher 31 showed a balance of P547.800, Additional information that

might be useful in reconciling the two balances follows:CEBU CPAR CENTER, INC. www-Cebu-CPAR.com

(a) Check number 748 for 30,000 was originally recorded on the books as 143,000

{b) A customer's note dated September 25 waa discounted on October 12. The note was dishonored

fon December 29 (maturity date). The bank charged Manila’s account for P142,650, inchiding a

protest fee of P2,650,

{| The deposit of December 24 was recorded on the books 2 P25,950, but it was actually deposit

of P27,000

{a} Outetanding checks totaled 798,850 ae of December 31

le) There were bank service charges for December of P2,100 not yet recorded on the books.

(i) Manilas account had been charged on December 26 for a customer's NSF check for P12,960.

(g) Manila properly deposited Po,000 on Decenther 3 that Was nat recorded by the bank.

(h) Receipts of December 31 for P14, 280 were recorded by the banle on January 2.

(i) A bank memo stated that a customers note for P45,000 and interest of P1,050 had been

collected on December 27, and the bank charged a P360 collection fee

(Questions:

[Based on the above and the result of your audit, determine the folowing!

1. Adjusted cash in bank balance

fa. P583,200 © 589,200

B. P57.200 a, 7512.00

2, Net adjustment to cash ae of December 31, 2000

a. 104.370 © P 98,370

b. Pi10;370 a. P175,170

Suggested Solution:

Question No.1

Balance per bank statement, 12/31/06 597,800

Add: Deposits in transit Pis4,250

Bank error-deposit not recorded 8.000 140.250

Total 058.050

Lees: Outetancling checks 8,850

Adjusted bank: balance, 12/31/06 509,200

Balance per books, 12/31/08 607.570

Add: Book error ~ Check No. 742 13,000

Customer note collected by bank 80.299 _gu a4

total 748,800

Lees: Dishonored note 142,650,

Bool: error-improperly recorded 1.950

deposit

NSP check 12,900

Bank service charges 202 159,600

Adjusted book balance, 12/91/06 509,200,

Question No. 2

Unadjusted balance per books, 12/91/05 697,570

Adjusted books balance, 12/31/08 ‘549,200

Net adjustment to cash ~ credit p 99.371

Ansivers'1) G2) €

PROBLEM NO. 7

‘Shown below ie the bank reconciliation for aatikina Company for November 2000:

‘Balance per banlk, Nov. 36, 2000 130,000

Add: Deposite in transit 23,000,

Tora Yra000

Less: Outstanding checks 28,000

Plank credit recorded in error 30,090 __a8,000

cash balance per books, Nov. 30, 2000 Bise.conCEBU CPAR CENTER, NC. www.Cebu-CPAR.com

‘The bank statement for December 2000 contains the following data:

Total deposits 110,000

‘Total charges, including an NSF check of P8,000 and a

service charge of P40 96,000

All outstanding checks on November 30, 2006, including the bank credit, were cleared in the bank

in December 2000,

‘There were outstanding checks of P30,000 and deposits in transit of P38,000 on December 31,

2006.

Questions:

‘Based on the above and the result of your audit, anewor the following:

1. How much is the cash halance per bank on December 31, 20052

a. P154,000 ‘c. P164,000

5. PIs0.000 a. p172,400

2. How much is the December receipts per books?

a. P124,000 © P110,000

b. P 96,000 d._ P143,000

3, How much is the December disbursements per book:

a, P96,000 fc, P59,000

b. P79,000 . 98,000

4 How much is the eash balance per books an December 31, 2000?

a. P150,000 ©. P180,400

b. P170,400 d. 102,000

5. The adjusted cash in bank balance as of December 31, 2006 is

a. P1160 . P172,000

b. P162,000 d._ 196,000

Suggested Solution:

(Question No. 1

‘alance per bank, Nav. 30, 2000

Add: Total deposits per bank statement

‘Total

‘Less: Total charges per bank statement

Balance per bank, Dee. 31, 2000

Question No. 2

‘Total deposits per bank statement 110,000

‘Less deposits in transit, Nov. 30, 24,000

Dee. receipts cleared through the bank 86,000

Add deposits in transit, Dec. 31 38,000

December receipts per books Bi2s.000

(Question No. 3

‘Total charges per bank statement 96,000

Lese: Outstanding checks, Nov. 20 28,000

Correction of erroneous bank credit 10,000

December NSF check 3,000

December bank service charge 400 46.400

bee. dish. cleared through the banie 49,000

Add outstanding checks, Dec. 31 30,000

December disbursements per books Pz2,000

Question No. 4

Balance per book, Nov. 20, 2006 136,000

Add December receipts per books 124,000

Total 260,000,

Less December disbursements per books 79,600

Balance per books, Dee. 31, 2006 180,400CEBU CDAR CENTER, INC. www.Cebu-CPAR.com

Question No. 5

Balance per bank statement, 12/31/06 163,000

Deposits in transit 38,000

‘Outstanding checks 30,000)

‘Adjusted bank balance, 12/31/06 Pi72,000

salance per books, 12/31/00 130,400

NSF check (8,000)

Bank service charges “400)

Aajuated book balance, 12/31/00 BEzz.000

Answers: 1) C; 2) A: 3)B; 4)@; 5)

PROBLEM NO. 8

“The accountant for the Muntinlupa Company assembled the following data

June 30 ly 31

‘cash account balance P13a22° P39,785

‘Bank statement balance 107,082 137.81

Deposits in transit 9.201 12,990,

Outstanding checks 27.718 30,112

‘Bank service charge 72 0

Customer's check deposited July 10, returned by 250

bonk on July 16 marked NSF, and redeposited

Immediately; no entry made on books for

return oF redeposit

Collection by bank of company's notes receivable 71,815 80,900

‘The bank statements and the company’s cash records show these totals

Disbursements in July per bank statement 213,373

Cash receipts in July per Muntinlupa’s books 230,852

‘OUESTIONS:

Bosed on the application of the necessary audit procedures and appreciation of the above data, you

are to provide the answers to the following:

1. How much is the adjusted cash balance as of June 30?

a. P87,308 fe. P107,082

BL (5,093) a. Pis,22

How much is the adjusted bank receipts for July?

a. P253,787 ce. P245,837

b, P214.902 a. 232,851

Mow much is the adjusted book disbursements for July?

a. P220,707 © Pisi,782

b. P2u2.517 206,673,

4. How much is the adjusted cash balance as af July 317

a. P137,817 c. P22,513

b. pr12,335 d. Pi20.5a5

‘5. How much is the cash shortage as of July 31?

a P8250 ce Pl96,144

B Priais, «Po(CEBU CAR CENTER, INC. www.Cebu-CPAR.com

Suggested Solution:

Muntinlupa Company

Reconciliation of Receipts, Disbursements, and Bank Balance

or the month ended staly 31

Beginning nding

June 20 Receipts Disb, Julai

Balance per bank

‘statement Pio7,082 pa49,108" —Pa1s.s73—P37,817

Deposits in transit

‘June 20 2.201 (8,201)

Guys 12880 12,880

Outstanding cheeks:

Sune 20 enns

Suly 31 (90.112)

NSE cheek

edeposited (2,250)

Adjusted bane

balance Bazsos poassa7 pizo.sn

Balance per books «15,822 P2052 -P2I2,5299 39,745

Dank service charge

une 73) (73)

uly 00 (00)

Collection of notes,

‘esetvabe

Tiss (71.015)

Adjusted book:

‘balance Pe7s0s p2assa7 paasi7pua,.ses

«137,817 + 9218373 - P107,082)

1 (15.822 + 236,452 P39,745)

Answers: 1) &; 2); 3)B; 4)D: 3)D

PROBLEM NO. 9

Jn the oudit of Pasig Company's cash aceaunt, you obtained the following information:

‘The company's boaklcceper prepared the following banlc reconciliation a3 of November 20, 20001

Bank balance ~ November 20, 2006 90,200

Undepasited collections 5,000

Bank service charges 100

Bank collection of customer's note (8,000)

Outstanding checks:

Book balance ~ November 30, 2006 ‘BZT.900

Additional data are given as follows:

8. Company recorclings for December

"Total collections from customers P165,000

‘Total ehecks drawn 88,000

1b. Banke statement totale for December :

Credits 163,000

©. Cheek no, 7139 dated November 25, 2000, was entered as P3,000 in payment of a voucher for

30,000. Upon examination of the check returned by the bank, the actual amount of the

‘check wae P30,000.

4. Check no. 8113 dated Decomber 20, 2006 was iscued to replace a mutilated check (n0.7767),

Which was returned by the payee Roth checks were recorded in the amaunt drawn, PS,000, but

zo eny was made to cancel check no. 7767.

The December bank statement included a check drawn by Sipag Company for P1,500.

‘Undeposited collections on December 31, 2000 - Ps,000,

g The service charge for December was P150 which was charged by the bank te another client

1h. The bank collected a nate receivable of P7,000 on December 28, 2000, biit the collection was not

received on time to be recorded by PasigCEBU CPAR CENTER, NC. www.Cebu-CPAR.com

i. The outstanding checks on December 31, 2006, were:

Check No. Amount Check No, Amount

Tie7 —P5,000, 8910 2,300

8850 1,300 8925 4.100

QUESTIONS,

Based on the above and the result of your audit, determine the following

1. Unadjusted cash balance per books as of December 31, 2000

a. P1S2,300 ‘©. 144,900

b. P152,750 ._ P103,700

2. Adjusted cash balance as of November 30, 2006

a. P85,800 € P63,300

b. P58,300 . 90,800

3. Adjusted book receipts for December 2000

a. P170,500 ©. P172,000

b. P182,000 . 173,000

4. Adjusted bank disbursement for December 2006

fa. P120,150 . P128,180

bP 70,150 d. P 98,150

5. Adjusted cash balance as of December 31, 2008

a. P132,650 ©. 'P1s7,s00

b. P137,650 . PL34,650

‘Suggested Solution:

‘Question No. 1

‘Unadjusted book balance, 11/30/06 77,900,

‘Add unadjusted book receipts:

Collection from customers 165,000

Note collected by bank in Nov.

presumed recorded in Dec 8.000 _173,000

‘Total 250,900

Less unadjusted book disbursements:

‘Checks drawn

BSSC for Nov. presumed recorded in Dec 95,100

Unadjusted book balance, 12/31/06 Bis2.00

‘Question Nos. 2t0 5

Posig Company

Proof of Cash

For the month ended December 31, 2006

Beginning Ending

Nov.30 Receipts Disb Dec.

Balance per bank

statement P9080 P109,000 P123,800P130,0001

Deposits in transit:

Nowember 30 3,000 (9,000)

December 31 18,000 8,000

‘Outstanding checks:

‘November 30 (32,000) (82,000)

December 31 7,700 (7,700)

‘Rank errors Dec,

‘Check of Sipag Co. 11,500) 1,500

BSC charged! to

‘another client 150 150)

Adjusted banic

‘balance 03.800 P172,.000 P_98,150 P137,650

Balance per books 77,900 P173,000 98,100 _P152,800

Customer's note

collected by bank:

November 8,000 (8,000)

December 7,000 7,000

Bank service charge:

‘November (200) (100)

December 150 (130)CEBU CAR CENTER, INC. www.Cebu-CPAR.com

Beginning Ending

Nov. 30 Receipte Disb, Dee $1

Books errors

Cheek na, 7159

(30.000-73.000, (27.000) (27,000)

cheek no. 7767

(toatloted heck) 5,000 5,000

Adjusted book

Balance po3.000 piTzq0n posiso pis7.6s0

+ 90,800 + P169,000 ~P123,800)

Answers: 1) A; 2)€; 9) C; 4D. 5)B

PROBLEM NO. 10

You obtained the following information on the current account of Parahague Company during your

examination ofits financial statements for the year ended December 31, 2006.

‘The bank statement on November 30, 2006 showed a belance of P306,000. Among the bank credits

sin November wae customer's note for P10U,000 collected for the account of the company which the

company recognized in December among ite receipts. Included in the bank debite wore cost of

checkbooks amounting to P1,200 and a P40,000 check which was charged by the bank in error

Against Paranaque Co. account, iso in November yout ascertained that there were deposits sn

transit amounting to Ps0,000 and outstanding checks totaling P170,000,

‘The bank statement for the month of December showed total eredits of P416,000 and total charges

of P204.000. ‘The company's books for December showed total debits of P795.600, total credits of

407,200 and a balance of (45,000. Bank debit memos for December were: No. 121 for service

charges, P1,000 and No, 122 on a customer's roturned check marked “Refer to Drawer" for P24,000.

‘on December $1, 2000 the company placed with the bank a customer's promissory note with a face

value of P120,000 for collection. ‘The company treated this note as part ofits receipts although the

Janke was able to collect on the note only in Jansiary, 2007,

A check for P9,960 was recorded in the company cash payments boolks in December as P39,600.

QUESTIONS:

‘Based on the application of the necessary audit procedures and appreciation of the above data, you

are © provide the answers to the following:

L. How much is the undeposited collections as of December 31, 20007

>. PIT9,000 4. P139,000

2. How much is the outstanding checks as of December 31, 20067

a. P191,960 © P301,900

b. Pse7\000 a. Ps03,160

3. How much is the adjusted each balance as of November 30, 20067

8, P216,000 ‘© P176,000

b, P250,000 @. P157,200

4. How much is the adjusted bank receipts for December?

8, P635,500 ©. PA75,600

b. P515,900 a. P495,600

5. How much is the adjusted book disbursements for December?

a. P395,960 © P225,960,

b, P491,900 d. P997,160

6. How much is the adjusted cash balance as of December 31, 20007

a. PO25,040 © P220,000,

b. P195,040 a. P37S,640

40(CEBU CPAR CENTER, INC. www.Cebu-CPAR.com

CEBU CPAR CENTER, INO

‘Suggested Solution:

Question No. 1

Deposits in transit, 11/90/06 30,000

|Add collections in December:

December book receipts 735,600,

Less receipts not representing

collections in December:

‘Customer's note collected by

tank in Nov. recorded in Dec. P100,000

Uncollected customer's note

treated as receipts 120,000, 220,000 _$15,600

Total 595,600

Less deposits credited by the bank in

December:

December bank receipts 410,000

Less receipts not representing

oposite:

Erroneous bank debit, Nov.

corrected Dec. 49,000 _376,000

Deposits in transit, 12/91/00 213.600

Question No. 2

Outstanding checks, 11/30/06 170,000

‘Add checks issued in December

December book disbursements 407,200

Less disbursements not

Tepresenting checks issued in

December

ranie service charge, Nov.s

recorded Dec. P1,200

rvor in recording a check

{should be P3,960, recorded

‘as P39,600} 35,040 370,360

“Total 540,360

Less checks paid by the bank in

December’

December bank disbursements 204,000

Less disbursements not

representing checks:

sank service charge, Dec 1,000

SF check, Dec 24,000 _25,000 _175,100

outstanding checks, 12/31/00 361,960

Question Nos. 310 6

Paranaque Company

Proof of Cash

For the month ended December 31, 2006

Beginning, Ending

ior.20 — Receints Dish. Deca

Balance per bank

statement 300,000 416,000 204,000 P519,000*

Deposits in transit:

Nowemnber 30 80,000 _{60,000)

December 31 219,600 219,600

outstanding checks:

Noverber 30 (170,000) (170,000)

December 31 361,960 (361,960)

Erroneous bane

debit-Noverber —s0.000, 40,000) __

Adjusted bank

Balance 756,000, P515,600 595.960 pa75,010CEBU Cha CENTER, Ne. www-Cebu-CPAR.com

Seligman i OE

joni ‘ending

Poor 8) Receots Disb, Dec. SL

Balance per books 157,200" —F733,000 407.200 405,600

collected by bank

overnber 100,000 (100,000),

Bank service charge:

‘Novernber (1,200) (1,200)

December i600 (1,600)

NSW cheek -

December 24,000 (24,000)

Book errors ~

December

uncollected

Customer's note

treated ae

receipts

Brror in recording

1 cheek (should

be P3,900,

recorded as .

59,000) oe 5.010 25,010

Adjusted book

balance easo.o00 puls.c00 Eavs.s00 © Fars.cto

= 306,000 + 416,000 - P204,000)

* (P485,600 + 407,200 - P735,600)

{120,000} (120,000)

Answers: 1)€; 2) C; 3)B, 4)B; 3) A; 0)D

PROBLEM NO. 11

You were able to obtain the following information in connection with your audit of the Cash account

of the Pasay Company as of December 31, 2006:

‘Nevernber 20

Balances per bank 480,000 20,000

5. Balances per books 503,000 539,000

© Undeposited collections 244.000 300,000

Outstanding checke 150,000 120,000

The bank statement for the month of December showed total credits of P240,000 while the

obits per books totaled P735,000.

{NSF checks are recorded asa reduction of cash receipts. NSF checks which are later

redeposited are then recorded as regular receipts. Data regarding NSF checks are as follows:

1. Returned by the bank in Nov. and recorded by the company in Dee., P10,000.

2, Returned by the bank in Dec. and recorded by the company in Dee, P23,000,

3. Returned by the bank in Dec. and recorded by the company in Jan. P29,000.

Check of Pasaway Company amounting to P90,000 was charged to the company’s account by

the bank in errar on December 31

1h. A bank memo stated that the company's account was credited for the net proceeds of Anito’s

note for P160,000.

1. The company has hypothecated its accounts receivable with the bank under an agreement

whereby the bank lends the company 80% of the hypothecated accounts receivable. ‘The

company performs accounting and collection of the accounts, Adjustments of the loan are made

from daily sales reports and deposite.

J. The bank credits the company account and increases the amount of the lean far 80% of the

Feported sales, The loan agreement states specifically that the sales report must be accepted by

the bank before the company is credited. Sales reports are forwarded by the company to the

bank on the first day following the date of sale. The bank allocates each deposit 80% to the

payment of the loan, and 20% to the company account, Thus, only 80% of each day's sales and

20% of each collection deposits are entered on the bank statement. The company accountant

records the hypothecation of new accounts receivable (80% of sales) as a debit to Cash and a

Credit to the banie loan as of the date of sales. One hundred percent of the collection on

accounts receivable is recorded as a cash receipt; 80% of the collection is recorded in the cash,

disbursements books as a payment on the loan, In connection with the hypothecation, the

following facts were determined!

12(CEBU CPAR CENTER, INC. www.Cebu-CPAR.com

+ Included in the undepasited collections is cash from the hypothecation of accounts

receivable. Sales were P180,000 on November 50, and P200.000 at December 31. The

balance was made up from collections which were entered on the books in the manner

indicated above

+ Collections on accounts receivable deposited in December, other than deposite in transit

totaled 725.000.

Ik. Interest on the bank Joan for the month of December charged by the bank but not recorded in

the booke, amounted to P32,000

‘oursrto

[Based on the above and the result of your audit, answer the following:

L. How much is the adjusted cash balance as of November 30, 2000?

a. P574,000 fe. 430,000

b, P394,000 , P350,000

2. How much is the adjusted book receipts for December, 20067

‘a. P860,000 fe. P876,000

>, P280,000 . 290,000

3. How much is the adjusted book disbursements for December. 2006?

a P1s0,000 fe. P1s0,000

>. P903,000 . 700,000

4. How much is the adjusted cash balance as of December 31, 2006?

'. P530,000 d. 490,000

5. How much ie the cash shortage as of December 21, 2006?

, P90,000 d. PO.

Suggested Solution:

Pasay Company

Proof of Cash

For the month ended December 31, 2000

Beginning Ending

Novo Receipts Disb, Dee 31

Dalanice per bank

statement 380,000 P240,000 300,000" 420,000

Deposits in transit

‘November 30 100,000" (100,000)

December 31 140,000 140,000,

Outstanding checks

November 30 (230,000) (150,000),

December 31 120,000 (220,000)

Erroneous bank

ddebit-December (90,000) 90,000

Deposite with loan

payment

[P2500 x 50%) 580.000 _580,000

Adjusted bank

Dalance Basoon0 —pago.o00prgp.000 © B30.000

Balance per books ——-P504,000P735,000 PTO0,000% —_P539,000

NEF checle:

Returned in Noy.

‘recorded in Dec. (10,000) 10,000

Retumed and

‘eeordded in Dee: 23,000 23,000

Retumed in Dee,

recorded ina 29,000 (29,000)

customer's note

collected by bank

December 100,000, 100,000,

Anticipated loan

‘proceeds from AR

bhypothecation:

Nov. 30 sales

(Pin0,O00% 5%) (149,000) —-144,000,

Dec. 31 sales enn

{200,000 x 80% (260,000),

13Beginning.

Nov 30, Disb.

Anticipated loan

payment from

‘undeposited

collections:

Nov. 30

1P100,000 x #0) 80,000 80,000

[P140,000 = 6035) (112,000)

Interest charge for

bank Joan in Dee, 38.000

Adjusted! book

Balance 30,000 860,000 760,000

+ (P480,000 + P240,000 - P420,000)

» |P508,000 + 735,000 ~ P330,000)

°244,000 — (P180,000 x 80%)

|412300,000 ~ (P200,000 x 80%

Answers: 1) @; 2) A; 3)D; 4) B; 5)D

PROBLEM NO. 12

In connection with your audit, Quezan Metals Company presented to you the following information

Quezon Metals Company

Ending

Dec 31

112,000

—taa.000,

520,000

‘Comparative Balance Sheets

December 31, 2006 and 2005,

2000,

Assets

cash P 470,000

Available for sale securities 236,000

‘Accounts Receivable 1,248,000

Inventory 1,112,000

Prepaid expenses 140,000

‘Total Current Assets 3.212.000

Property, plant, and equipment 2.144.000

Accumulated depreciation [30,000)

1,540,000

Total Assets 75,052,000

Current Liabilities

Accounts Payable P 548,000

Acenuedd expenses 332,000

Dividends Payable 160,000

‘Total Current Liabilities 1,400,000

Notes Payable - due 2008 000,

‘Total Liabilities 1,900,000

Stockholders’ Equity

‘Common Stock 2,400,000

Retained carnings "752,000

tal Stockholders’ Equity 3,152,000

‘Total Liabilities and Stockholders’ Rqnity 5.052.000

Quezon Metals Company

2005

P 392,000

1,016,000

950,000

24,000

72.348,000

1,030,000

(212,000)

1,824,000

3,572,000

792,000

304,000

41,096,000,

1,096,000

2,200,000

576,000

2,770,000

2a.s72.000

Condensed Comparative Income Statements

For the Years Ended December 31, 2006 and 2005,

2006

Net sales 14,244,000

Cost of Goods Sold 11,156,000

Gross Profit, 3,088,000

Expenses 2,094,000

14

2005

13,016,000

10,272,000

27444,000

1,944,000CEBU CAR CENTER, INC. www.CebusCPAR.com

Additional information for Quezon:

{a} All accounts receivable and accounts payable relate to trade merchandise,

(b} The proceeds from the notes payable were used to finance plant expansion,

(c) Capital stock was sold to provide additional working capital.

uesions:

[Hased on the above and the result of your audit, compute the following for 2000:

1. Cash collected from accounts receivable, assuming all sales are on account

a. P14,012,000 . P14.476,000

&. P 796,000 dd. P16,508,000

2. Cash payments made on accounts payable to suppliers, assuming that all purchases of

Bb. PI1,212,000 4. 11,256,000

9. Cash payments for dividends

a. P 828,000 e. P_ 668,000

b. P1,020,000 4. P1,180,000

4. Cash receipts that were not provided by operations.

a. P192,000 ‘©. P700,000

, P500,000, dP oo

5. Cash payments for assets that were not reflected in operations,

a. P1,412,000 ‘eB. 308,000

bP 749,000 4. P1,170,000

‘Suggested Solution’

Question No. 1

Accounts receivable, 1/1/00 P 1,010,000

‘Add sales for 2000 14,244,000

Total collectible accounts 15,200,000

Less accounts reeeiable, 12/31/00 1/248,000

Cash collected from accounts receivable Bia.012:000

‘Question No. 2

Accounts payable, 1/1/06 P 792,000

‘Add purchases for 2006:

‘Cost of goods told for 2000 P11, 150,000

Add Inventory. 12/31/05 1.112.000

‘Total goods available for sale T2208,000

Less Inventory, 1/1/00 '950,000 _11,312,000

‘Total accounts to be paid 12,104,000

Less accounts payable, 12/31/06 ‘348,000,

(Cash payments made on AP Piz230'000

‘Question No. 3

Retained earnings, 1/1/00

‘Add net income for 2006

Total

Less retained earnings, 12/31/00

Total dividends declared

Lees increase in dividends payable

Cash payments for dividends

‘Question No. +

Proceeds from notes payable 500,000

Proceeds from issuance of common stock

(P2,400,000 - P2,200,000) 200,000

Cash receipts not provided by operations

(cash provided from financing) 700,000

Question No. 5

Purchase of available for sale securities 236,000

Purchase of PPE [P2,144,000 - P1,630,000) 508,000

Cash payments for assets that were not reflected

{in operations Pz14,000,

Answers: 1) A, 2)D; 3) €; 4)C; 5)B

15CEBU CPAR CENTER, INC. www.Cebu-CPAR.com

PROBLEM NO. 13

‘The Valenzuela Corporation was organized on January 15, 2000 and started operation soon

thereafter, The Company cashier who acted also as the boolkkecper had kept the accounting

records very haphazardly. ‘The manager suspects him of defalcation and engaged you to audit is

‘account to find put the extent of the fraud, if there is any.

(On November 15, when you started the examination of the accounts, you find the cash on hand to

be 23,700. Fromm inqnity at the bank, it was ascertained that the balance of the Company's bank

deposit in current account on the same date was P131,640. Verification revealed that the checie

issued for PU,200 ic not yet paid by the bank. The corporation sells at 40% above cost

‘Your examination of the available records disclosed the following information

Capital stock issued at par for cash 1,600,000

‘Real state purchased and paid in full 1,000,000

‘Mortgage liability sacured by real state %400,000

Furniture and fixtares (gross) bought on which there

3s still balance unpaid of P30,000, 145,000

‘outstanding notes due to bank: 160,000

‘Yoral amount awed t9 creditors on open account 231,420

Total sales 1.615.040

‘Total amount still due from customers ‘420,000

Inventory of merchandise on November 15 at cost 469,000

Expenses paid excluding purchases 303,750

QUESTIONS,

FRased on the above and the result of your audit, compute for the flowing as of November 15, 2000

1, Collections from sales

a. P1,188,140 © P1015,090

b, P1.133,600 a. P2.0si.s40

2. Payments for purchases

a. P1,854,620 &. P1,207,204

b P1,391,780 @. 922180

9, Total cash disbursements

a. P2,340,900, ce. P2,810,560

Bb. p3.273,400 a. P2023,988

4. timadjusted cash halance

a. P 74.740 ©. 1,007,180

b. P722,156 d. P'sa7;se0

5. Cash shortage

a. P874,076 c. P859,100

B pasa,s00) apo

‘Suggested Solution:

Question No. 1

Salee 1,615,040

Less accounts receivable, 11/15 320,909

Collections from sales Biiss.140

Question No. 2

Cost of sales [P1.015,040/1.4) 1,159,600

Add Merchandise inventory, 11/15 465,600

Purchases 1,623,200

Less Accounts payable, 11/15 2511320

Payments for purchases Higou7ao

Question No. 3

Purchase of real estate 1,000,000

Paymont for furniture and fixturce

|P143,000 - 230,000) 113,000

Expenses paid 303,780

Payments for purchases (see no. 2} 1,391,780

‘Total cash disbursements Pes10'500

Question No. 4

Proceeds from isetance of common stock 1,600,000

Proceeds from mortgage note payable "400,000

Procesds from notes payable - bank 160,000,

16CEBU CAR CENTER, INC, www.Cebu-CPAR.com

Collections from sales (see no, 1) 98.140

Total cash receipts 3,348,140

Less cash disbursements (eee no. 3) 2810,360

Unadjusted cash balance B5a7.500

Question No. 5

Cash accountability sa7,380

Less cash accounted (Adjusted cash

balance):

Unadjusted Dank balance P131,040

Deposit in transit 25,700

Outstanding checks 9.260) _148,080

cash shortage 359,500

Answers: 1) A; 2)B; 3)C; 4) D, 5) B

PROBLEM NO. 14

‘You were engaged fo audit the accounts of Taguig Corporation for the year ended December 31,

2006. In your examination, you determined that the Cash account represents both cash on hand

‘and cash in bank, You further noted that the company’s internal control over cash is very poor.

‘You started the audit on January 15, 2007. Based on your cash count on this date, cash on hand

‘amounted to P19,200, Examination of the cash book and other evidence of transactions disclosed.

the following:

a. January collections per duplicate receipts, P75,200,

>, Total duplicate deposit slips, all dated January, P44,000, This amount inchides a deposit

representing collections on December 31

©. Cash book balance at December 31, 2000 amounted to P186,000, representing both cash on

hhand and cash in bank.

4. Bank statement for December showed a balance of P170,¢00.

© Outstanding checks at December 31:

November checks December checks

No. 280 1,800 No. 331 P2,400

280 6,000 339 1,600

345 20,000

353 3,600,

3e3 10,000

© Undeposited collections at December 31, 2006 amounted to P20,000.

g An amount of P4,400 representing proceeds of a clean draft on a customer was credited by

Dank, but is not yet taken up in the company’s books.

bh. Bank service charges for December, P400.

The company cashier presented to you the following reconciliation statement for December, 2006,

which he has prepared

‘alance per books, December 31, 2000 180,000

‘Add outstanding checks

No. 331 2,400

339 1600

345 2/000

353 3,600

304 ive 10.500

‘Total 791-200

Bank service charge 00)

Undeposited collections '20,400)

Ballance per bank, December 3

‘quEsTions:

Based on the above and the result of your audit, anawer the following

|, 2000 Fuzo00

1, How much is the adjusted cash balance as of December 31, 2006?

a. P152,500 © PISO,200

>. P144.400 apo

2. How much is the cash shortage as of December 31, 2000?

a. PAS,600 ©. P37.200

>. P 4.400 . ps1,200

17(CEBU CDAR CENTER, NC. ww. Cebu-

3) How muuch is the eash shortage for the period January | to 15, 20077

‘a. P30,500 31,200

b. p32,800 a. P32,000

CPAR.com

4. Which of the following is not a method! ised by the cashier to cover-up the shortage as of

December 31, 2006?

a. Understating outstanding checks by P27,000.

Not recording the bank collection of P4.400.

© Understating the books balance by P5,400.

a. Overstatement of undeposited collections by P00.

Suggested Solution.

Questions No. I and 2

Bank Boal

Unadjusted balances 170,400 P166,000

‘Ada (deduct) adjustments:

Outstanding checks: (46,000)

Undeposited collections 20,000

Unrecorded bank collection +400

Banlk cervice charge (300)

Balances, TH3A05 790,000

Shortage 145,600)

Adjusted balances pisga00 pis3,300

Question No. 3

Collections per records prs,200

Add undeposited collections, Deo. 31 20,000

‘Total cash that should be deposited in January 95,200

Less January deposits 44.000

Undeposited collections, Jan. 15 51,200

Less tundepesited collections per cash count 9.200

Shortage, Jan. 1 to 15, 2007 E2000

(Question Wo. 4

Cover-up for the December 31, 2006 shortage

‘Nan-fecording of hank collection P 4,00

Understatement of book balance

(P180,000 - P180,000) 3.400

Understatement of outstanding checks

(P46,000 - P10,000), 35,400

Overstatement of undeposited collections

(20,400 - P20,000) 400

‘Total shortage, December $1, 2000 Eason0

Answers 1) B; 2) A: 3)D, 4) A

PROBLEM NO. 15

‘Select the best answer for each of the following:

L. An auditor would consider a cashier's job description to contain compatible duties if the cashier

receives remittance from the mailroom and also preparce the

a. Daily deposit slip. © Remittance advices,

1. Prelist of idividtsal checks. fd, Monthly bank reconciliation,

2. Which of the following internal control procedures will most likely provent the concealment of

cash shortage resulting from improper write-off of a trade account receivable?

a. Write-offs must be supported by an aging schedule chowing that only receivables everdue

for several manths have been written aff.

b. Write-offs must be approved by the cashier who is in @ position to know if the receivables

have, in fact, been collected

© Write-olfs must be approved by a responsible officer after review of credit department

recommendations and supporting evidence.

|, Write-offs must be authorized by company Feld sales employees who are in a position to

determine the financial standing of the customers,

4. An entity's internal control structure requires every check request that there be an approved

voucher. supported by a prenumbered purchase order and a prenumbered receiving report. To

determine whether chacke are boing iscued for unauthorzed oxpenditures, an auditor most

likely would select items for testing from the population of all

a. Cancelled checks, © Purchaae orders,

b. Approved vouchers fA, Receiving reports,

18CEBU CPAR CENTER, INC. www.Cebu-CPAR.com

10.

Waich of the following auditing procedures would the auditor not apply to a cutoff bank

statement?

a. Trace year end outstanding checks and deposits in transit to the cuteff bank statement.

b. Reconcile the bank account as of the end of the cutoff period,

c. Compare dates, payees and endorsements on returned checks with the cash disbursements

record,

d. Determine that the year end deposit in transit was credited by the bank on the first working

day of the fallawing accounting period

A client maintains oo bank accounts. One of the accounts, Bank A, has an overdraft of

P 100,000. The other account, Bank B, has a positive balance of P50,000. To conceal the

overdraft from the auditor, the client may decide to

a, Draw a check for at least P100,000 on Bank A for deposit in Bank B. Record the receipt but

not the disbursement and list the receipt ae a deposit in transit. Record the disbursement

at the beginning of the following year,

b. Draw a check for at least P100,000 on Bank B for deposit in Bank A. Record the receipt but

not the disbursement and list the receipt as a deposit in transit, Record the disbursement

at the beginning of the following year.

©. Draw a check for P100,000 on Bank B for deposit in Bank A. Record the disbursement but

not the receipt. List the disbursement as an outstanding check, but do not list the receipt

as a deposit in transit, Record the receipt at the beginning of the following period.

d. Draw a check for at least P100,000 on Bank A for deposit in Bank B. Record the

disbursement but not the receipt and list the disbursement as an outstanding check.

Record the receipt at the beginning of the following year.

While performing an audit of cash, an auditor begins to suspect check kiting. Which of the

following is the best evidence that the auditor could obtain concerning whether kiting is taking

place?

a. Documentary evidence obtained by vouching credits on the latest bank statement to

supporting documents

b, Documentary evidence obtained by vouching entries in the cash account to supporting

documents.

©. Oral evidence obtained by discussion with controller personnel.

d._ Evidence obtained by preparing a schedule of interbank transfers.

‘Two months before year-end, the bookkeeper erroneously recorded the receipt of long-term

benk loan by a debit to cash and a credit to sales, Which of the following is the most effective

procedure for detecting this type of error?

‘Analyze bank confirmation information.

b. Analyze the notes payable journal.

©. Prepare year-end bank reconciliation.

d. Prepare a year-end bank transfer schedule.

Postdated checks received by mail in settlement of customer's accounts should be

Returned to customer.

Stamped with restrictive endorsement

Deposited immediately by the cashier

Deposited the day after together with cash receipts.

apee

he cashier of Milady Jewelries covered a shortage in the cash working fund with cash obtained at

December 31 from a bank by cashing but not recording a check drawn on the company out of

town bank. How would you as an auditor discover the manipulation?

8. By confirming all December 31 banlc balances.

b, By counting the cash working fund at the close of business on December 31,

©. By investigating items returned with the bank cut-off statements of the succeeding month.

d._ By preparing independent bank reconciliations as of December 31

An essential phase of the audit of the cash balance at the end of the year is the auditor's review of

cutoff hank statement, ‘This specific procedure ie not useful in determining if

a. Kiting has occurred.

b. Lapping has occurred,

c. The cash receipts journal was held open.

d. Disbursements per the bank statement can be reconciled with total checks written.

Answers: 1) A; 2)C; 3) A; 4)B, 5) B; 6) D; 7) A; 9) B; 9) C; 10) B

You might also like

- Post Test Cash and Cash Equivalents Name: Date: Professor: Section: ScoreNo ratings yetPost Test Cash and Cash Equivalents Name: Date: Professor: Section: Score5 pages

- The External Assessment: Strategic Management: Concepts & Cases 13 Edition Fred DavidNo ratings yetThe External Assessment: Strategic Management: Concepts & Cases 13 Edition Fred David47 pages

- F. What Is The "Balance" For? G. To Add A New GL Account, What Is The First Thing You Do (After You Go To Financials Chart ofNo ratings yetF. What Is The "Balance" For? G. To Add A New GL Account, What Is The First Thing You Do (After You Go To Financials Chart of10 pages

- Liquidation Procedures for PartnershipsNo ratings yetLiquidation Procedures for Partnerships28 pages

- The Influence of Internship Experience On Mtim Students Career Selection in The Accounting IndustryNo ratings yetThe Influence of Internship Experience On Mtim Students Career Selection in The Accounting Industry40 pages

- Partnership Liquidation and Capital DeficiencyNo ratings yetPartnership Liquidation and Capital Deficiency3 pages

- AAA and BBB Are Partners With Capital of P60No ratings yetAAA and BBB Are Partners With Capital of P605 pages

- Partners HIP - Pretest: - Introduction and FormationNo ratings yetPartners HIP - Pretest: - Introduction and Formation38 pages

- 23 Chapter 23 Interim Financial ReportingNo ratings yet23 Chapter 23 Interim Financial Reporting6 pages

- Solution To Module 1: Practice Problem Set #1No ratings yetSolution To Module 1: Practice Problem Set #11 page

- Date Particular DR CR: La Bambina Inc. Journal EntriesNo ratings yetDate Particular DR CR: La Bambina Inc. Journal Entries5 pages

- Explain The Three Basic Principles of Effective Corporate GovernanceNo ratings yetExplain The Three Basic Principles of Effective Corporate Governance2 pages

- Accounting for Joint Operations ExplainedNo ratings yetAccounting for Joint Operations Explained72 pages