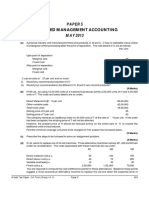

Solutions to Capital Budgeting Problems

Capital Budgeting Handout

3 Expansion Problems

Ellis Construction Company

T = 0 Initial Investment

Buy and modify equipment (60,000)

Change in NWC (2,000)

Total Initial Investment (62,000)

T = 1-3 Operations

Year 1 Year 2 Year 3

Inc. EBIT 20,000 20,000 20,000

Depreciation (19,800) (27,000) (9000)

Taxable Income 200 (7,000) 11,000

NOPAT 120 (4,200) 6,600

+ Depreciation 19,800 27,000 9,000

CF from Operations 19,920 22,800 15,600

T = 3 Termination

Sell the equipment 20,000

(6,320)

MV = 20,000

BV = 4,200

Gain 15,800

*T *.40

(6,320)

Reverse the Change in NWC 2,000

Total Cash Flow from Termination 15,680

NOTE: The depreciation amounts are from the MACRS 3-yr schedule [ yr. 1 = 33%, Yr.

2 = 45%, Yr. 3 = 15%, Yr. 4 = 7%] multiplied by the depreciable cost of the equipment.

Timeline

Year 0 1 2 3

CF (62,000) 19,920 22,800 15,600

15,680

TOTAL (62,000) 19,920 22,800 31,280

NPV = (1546.81)

IRR = 8.68%

MIRR = 9.08%

Payback Period = 2.62 years

Discounted Payback Period = never pays back on a discounted basis.

_____________________________________________________________

2nd Capital Budgeting Problem

T = 0 Initial investment

Buy and modify equipment (170,000)

Change in Net working Capital (8,000)

Total Initial Investment (178,000)

T = 1-3 Operations

Year 1 Year 2 Year 3

Inc. EBIT 50,000 50,000 50,000

Depreciation (53,333) (53,333) (53,333)

Taxable Income (3,333) (3,333) (3,333)

NOPAT (1,999.8) (1,999.8) (1,999.8)

+ Depreciation 53,333 53,333 53,333

CF from Operations 51,333 51,333 51,333

T = 3 Termination

Sell the equipment 60,000

(20,000)

MV = 60,000

BV = 10,000

Gain 50,000

*T *.40

(20,000)

Reverse the Change in NWC 8,000

Total Cash Flow from Termination 48,000

NOTE: The depreciation amounts are from using the straight line method and

depreciating over three years toward a 10,000 salvage value [170,000 – 10,000 divided

by 3 = 53,333].

Timeline

Year 0 1 2 3

CF (178,000) 51,333 51,333 51,333

48,000

TOTAL (178,000) 51,333 51,333 99,333

NPV = (20,541.34)

IRR = 5.87%

MIRR = 7.51%

Payback Period = 2.76 years

Discounted Payback Period = never pays back on a discounted basis

3rd Capital Budgeting Problem - Brauer

T = 0 Initial investment

Buy and modify equipment (120,500)

Change in Net working Capital (5,500)

Total Initial Investment (126,000)

T = 1-3 Operations

Year 1 Year 2 Year 3

Inc. EBIT 44,000 44,000 44,000

Depreciation (39,765) (54,225) (18,075)

Taxable Income 4,235 (10,225) 25,925

NOPAT 2,795 (6,748) 17,110

+ Depreciation 39,765 54,225 18,075

CF from Operations 42560 47,477 35,185

T = 3 Termination

Sell the equipment 65,000

(19,232)

MV = 65,000

BV = 8,435

Gain 56,565

*T *.34

19,232

Reverse the Change in NWC 5,500

Total Cash Flow from Termination 51,268

NOTE: The depreciation amounts are from the MACRS 3-yr schedule [ yr. 1 = 33%, Yr.

2 = 45%, Yr. 3 = 15%, Yr. 4 = 7%] multiplied by the depreciable cost of the equipment.

Timeline

Year 0 1 2 3

CF (126,000) 42,560 47,477 35,185

51,268

TOTAL (126,000) 42,560 47,477 86,453

NPV = 11,383.83

IRR = 16.58%

MIRR = 15.28%

Payback Period = 2.42 years

Discounted Payback Period = 2.82 years

Replacement Problems

Dauten Toy

T= 0 Initial Investment

Buy the new machine (8,000)

Change in NWC (1,500)

Sell the old machine 3,000

(160)

MV = 3000

BV = 2600

Gain = 400

*T *.4

Tax 160 _______

Total Initial Investment (6,660)

T = 1-6 Operations

1 2 3 4 5 6

Sales increase 1,000 1,000 1,000 1,000 1,000 1,000

Cost decrease (1,500) (1,500) (1,500) (1,500) (1,500) (1,500)

Change in EBIT 2,500 2,500 2,500 2,500 2,500 2,500

[line 1-2]

Change in 1,250 2,210 1,170 610 530 130

Depreciation

Taxable Income 1,250 290 1,330 1,890 1,970 2,370

[line 3-4]

NOPAT 750 174 798 1,134 1,182 1,422

+ Depreciation 1,250 2,210 1,170 610 530 130

CF from Operations 2,000 2,384 1,968 1,744 1,712 1,552

T=6 Termination

Net Salvage Cash Flow NEW Net Salvage Cash Flow OLD

Sell the new 800 Sell the old 500

(320)

MV = 800 MV = 500

BV = 0 BV = 500

Gain = 800 Gain = 0

*T *.4 no tax due

Tax 320

Rev. Change NWC 1,500

Net Salvage CF New 1,980 Net Salvage CF OLD 500

Difference 1980 – 500 = 1480 = the improved salvage value of the new over the old.

Timeline

Year 0 1 2 3 4 5 6

CF (6,660) 2,000 2,384 1,968 1,744 1,712 1,552

1480

TOTAL (6,660) 2,000 2,384 1,968 1,744 1,712 3032

NPV = 1334.89

IRR = 22.03%

MIRR = 18.56%

Payback Period = 3.18 years

Discounted Payback Period = 4.97 years

Yonan

T=O Initial Investment

Buy the new (150,000)

Change in NWC 1,000

Sell the old 65,000

(20,060)

MV = 65,000

BV = 6,000

Gain 59,000

*T *.34

Tax 20,060 __________

Total Initial Investment (104,060)

T = 1-5 Operations

1 2 3 4 5

Change in EBIT 50,000 50,000 50,000 50,000 50,000

Change in 24,000 48,000 28,500 18,000 16,500

Depreciation

Taxable Income 26,000 2,000 21,500 32,000 33,500

[line 1-2]

NOPAT 17,160 1,320 14,190 21,120 22,110

+ Depreciation 24,000 48,000 28,500 18,000 16,500

CF from Operations 41,160 49,320 42,690 39,120 38,610

T = 5 Termination

Net Salvage Cash Flow NEW Net Salvage Cash Flow OLD

Sell the new 0 Sell the old 10,000

3060 (3,400)

MV = 0 MV = 10,000

BV = 9,000 BV = 0

Loss = 9,000 Gain = 10,000

*T *.34 *T * .34

Tax 3,060 Tax 3,400

Credit

Rev. Change NWC (1,000)

Net Salvage CF New 2,060 Net Salvage CF OLD 6,600

Difference 2,060 – 6,600 = (4,540) = the loss of salvage value of the new over the old.

Timeline

Year 0 1 2 3 4 5

CF (104,060) 41,160 49,320 42,690 39,120 38,610

(4,540)

TOTAL (104,060) 41,160 49,320 42,690 39,120 34,070

Payback Period = 2.32 years

Discounted Payback Period = 3.21 years

NPV = 33,252.03

IRR = 29. 53%

MIRR = 22.61%

Baton Rouge

T= 0 Initial Investment

Buy the new machine (82,500)

Change in NWC (3,000)

Sell the old machine 30,000

(6,200)

MV = 30,000

BV = 14,500

Gain = 15,500

*T *.4

Tax 6,200 _______

Total Initial Investment (61,700)

T = 1-8 Operations

1 2 3 4 5 6 7 8

Change in EBIT 27,000 27,000 27,000 27,000 27,000 27,000 27,000 27,000

Change in 10,500 20,900 12,675 9,900 9,075 4,950 0 0

Depreciation

Taxable Income 16,500 6,100 14,325 17,100 17,925 22,050 27,000 27,000

[line 3-4]

NOPAT 9,900 3,660 8,595 10,260 10,755 13,230 16,200 16,200

+ Depreciation 10,500 20,900 12,675 9,900 9,075 4,950 0 0

CF from 20,400 24,560 21,270 20,160 19,830 18,180 16,200 16,200

Operations

T=8 Termination

Net Salvage Cash Flow NEW Net Salvage Cash Flow OLD

Sell the new 0 Sell the old 1,000

0 (400)

MV = 0 MV = 1,000

BV = 0 BV = 0

Gain =0 Gain = 1,000

no tax due *T _*.4

tax 400

Rev. Change NWC 3,000

Net Salvage CF New 3,000 Net Salvage CF OLD 600

Difference 3,000 – 600 = 2,400 = the improved salvage value of the new over the old.

Timeline

Year 0 1 2 3 4 5 6 7 8

CF (61,700) 20,400 24,560 21,270 20,160 19,830 18,180 16,200 16,200

2,400

TOT. (61,700) 20,400 24,560 21,270 20,160 19,830 18,180 16,200 18,600

Payback Period = 2.79 years

Discounted Payback Period = 3.68 years

NPV = 39,347.89

IRR = 29.48%

MIRR = 19.12%

McCullough

T=O Initial Investment

Buy the new (1,175,000)

Change in NWC 0

Sell the old 265,000

113,900

MV = 265,000

BV = 600,000

Loss 335,000

*T *.34

Tax 113,900 __________

Total Initial Investment (796,100)

T = 1-5 Operations

1 2 3 4 5

Change in EBIT 255,000 255,000 255,000 255,000 255,000

Change in 115,000 256,000 103,250 21,000 9,250

Depreciation

Taxable Income 140,000 (1,000) 151,750 234,000 245,750

[line 1-2]

NOPAT 92,400 (660) 100,155 154,440 162,195

+ Depreciation 115,000 256,000 103,250 21,000 9,250

CF from Operations 207,400 255,340 203,405 175,440 171,445

T = 5 Termination

Net Salvage Cash Flow NEW Net Salvage Cash Flow OLD

Sell the new 145,000 Sell the old 0

(25,330)

MV = 145,000 MV = 0

BV = 70,500 BV = 0

Gain = 74,500 Gain = 0

*T *.34 No tax due

Tax 25,330

Rev. Change NWC 0

Net Salvage CF New 119,670 Net Salvage CF OLD 0

Difference 119,670 - 0 = 119,670 = the increased salvage value of the new over the old.

Timeline

Year 0 1 2 3 4 5

CF (796,100) 207,400 255,340 203,405 175,440 171,445

119,670

TOTAL (796,100) 207,400 255,340 203,405 175,440 291,115

Payback Period = 3.74 years

Discounted Payback Period = 4.91 years

NPV = 14,095.48

IRR = 12.7%

MIRR = 12.39%