CORPORATE LIQUIDATION

1. Shaky Corporation is experiencing severe financial difficulties and is considering filing a bankruptcy

petition. At this time, it has the following information:

o Notes payable amounting to P92,000 is secured by Furniture estimated to be sold at P102,500

which is 2/3 of its recorded amount.

o Of the P244,500 loans payable, P68,750 is secured by a machinery with a carrying amount of

P96,000 expected to make proceeds equal to 70% of its book value.

o Equipment with a carrying amount of P161,250 has an estimated realizable value of P123,750.

o Other unrecorded liabilities are accrued interest on notes, P3,875; salaries payable, P21,750; taxes

payable, P14,500; and trustee’s fee, P10,625.

o Cash available prior to liquidation amounts to P14,875.

o Total assets of Shaky Corp. presented in the Statement of Financial Position prior to liquidation

amounts to P600,000 including prepaid expenses and goodwill amounting to P9,500 and P27,500,

respectively which have no estimated realizable values. Remaining assets other than those whose

estimated realizable values were mentioned above has a realizable value of 60% of the recorded

amount.

o Total liabilities of Spectrum Corp. presented in the Statement of Financial Position prior to

m

liquidation amounts to P475,000.

er as

Req. 1: What are the amount of net free assets?

co

a. P189,575 c. P180,650

eH w

b. P202,850 d. P236,450

o.

Req. 2: What is the estimated payment to the partially secured creditor?

a. P68,087

rs e c. P68,160

ou urc

b. P68,130 d. P68,750

2. Glued Company located at the center of the business district where rapid technological changes

o

occur, experienced financial difficulties due to economic downturns and litigation losses resulting to its

insolvency. Because of its inability to meet obligations as they come due the court accepted the

aC s

petition and granted an order for relief. The company comes under the authority of the bankruptcy

vi y re

court so that any distributions will be made in a fair manner. An interim trustee was appointed by the

court regarding the administration of the estate of Glued and is to prepare a preliminary report.

Presented below is its Statement of Financial Position before the start of liquidation:

Cash P4,050,000 Notes Payable P 750,000

ed d

Machinery & Equipment 3,750,000 Wages Payable 2,250,000

Building 7,200,000 Income tax Payable 1,500,000

ar stu

Loan Payable 3,000,000

Mortgage payable 3,750,000

Contributed capital 6,000,000

Deficit (2,250,000)

sh is

It is expected that administrative expenses amounting to P400,000 will be paid. The loan payable is

Th

secured by the Machinery & Equipment which is estimated to be sold at P2,250,000. The mortgage

payable is fully secured by the estimated realizable value of the Building. At the end of liquidation, the

estimated percentage settlement to the partially secured creditor is 92%.

Req. 1: What is the amount of the total free assets?

a. P1,020,000 c. P4,050,000

b. P5,170,000 d. P 7,500,00

Req. 2: What is the estimated gain (loss) on the realization of the building?

a. P1,120,000 c. P(2,330,000)

b. P0 d. (6,080,000)

Req. 3: What is the estimated payment to all liabilities?

a. P11,170,000 c. P15,000,000

b. P7,420,000 d. P8,920,000

https://www.coursehero.com/file/69854230/CORPORATE-LIQUIDATIONdocx/

3. The following data were ascertained for the month of September in the Statement of realization and

liquidation of Enron Corp.: Assets to be realized for October were P18,000. Assets realized during the

month were P338,000. Unrecorded assets during the month were P25,000. Assets not sold or collected

at the end of August were P380,000. Liabilities assumed were P28,000. Liabilities not liquidated at the

end of August were P350,000. Liabilities paid were P268,800. Supplementary charges were 86,350 and

supplementary credits were P59,700. Cash balance at the beginning of the month was P10,500.

Req. 1: What is the gain or loss in the statement of realization and liquidation?

a. P75,650 c. P19,650

b. P(75,650) d. P(19,650)

Req. 2: What is the estate equity at the end of September?

a. P(35,150) c. P(60,150)

b. P116,150 d. P20,850

4. In a statement of affairs, assets pledged for partially secured creditors are:

a. Included with assets pledged for fully secured creditors

m

b. Offset against partially secured liabilities

er as

c. Included with free assets

co

d. Disregarded

eH w

5. In accounting for corporate liquidation, which of the following statements is incorrect?

a. Fully secured creditors no longer share in the remaining free assets after payment of unsecured

o.

liabilities without priority.

rs e

b. Assets used as security for partially secured liabilities are offsetted to their secured debts and can

ou urc

no longer be used to pay unsecured liabilities.

c. Unsecured credits with priority such as liabilities to employees and taxes due to government can

always be fully recovered by the said creditors in every corporate liquidation.

d. The unsecured portion of the liabilities to partially secured creditors are added to unsecured credits

o

without priority in the computation of recovery percentage of the unsecured creditors without

priority.

aC s

vi y re

6. The free assets of the entity under corporate liquidation will be distributed to:

a. Unsecured creditors with and without priority

b. Partially secured creditors , Unsecured creditors with and without priority

c. Unsecured creditors with and without priority and shareholders

d. Fully secured, partially secured, unsecured creditors and shareholders

ed d

ar stu

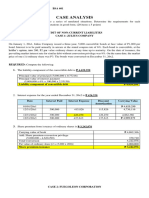

7. AAA Corporation is undergoing liquidation and has the following condensed Statement of

Financial Position as of December 1, 2021:

Cash 1,998,500 Salaries payable 875,000

sh is

Receivables 5,964,000 Accounts payable 1,898,750

Merchandise 1,400,000 Bonds payable 7,000,000

Th

Prepaid expenses 43,750 Bank loan payable 3,850,000

Building, net 6,037,500 Note payable 1,400,000

Goodwill 962,500 Ordinary shares 2,100,000

Total Assets 16,406,250 Deficit (717,500)

Total Liabilities & Equity 16,406,250

The bonds payable are secured by the building having a realizable value of P6,300,000

Of the accounts payable, P1,050,000 is secured by ¼ of the receivable which is estimated to

be 20% uncollectible. The remainder in the book value of the receivables which has a

realizable value of P4,112,500 to used to secure the bank loan payable

The merchandise has a realizable value of P927,500

In addition to the recorded liabilities are accrued interest on bonds payable amounting to

P70,000 and trustees expenses amounting to P43,750 and taxes P52,500

The prepaid expenses and goodwill have no realizable values

https://www.coursehero.com/file/69854230/CORPORATE-LIQUIDATIONdocx/

1. What is the amount of the estimated deficiency?

a. (658,700)

b. (588,700)

c. (1,064,000)

d. (294,000)

2. What is the loss on asset realization?

a. (1,874,950)

b. (868,700)

c. (2,137,450)

d. (1,131,200)

3. What is the amount received by the partially secured creditor?

a. 6,916,308

b. 6,901,986

m

c. 6,798,575

er as

d. 6,969,361

co

eH w

4. What is the amount received by the unsecured creditors without priority?

o.

a. 2,360,059

b.

c.

2,416,208

1,758,073 rs e

ou urc

d. 1,799,900

8. Finish Corporation has been undergoing liquidation since January 1. Its condensed statement of

o

realization and liquidation for the month of June is presented below:

aC s

vi y re

Interest received in cash on investment 10,500

Purchases on account 105,000

Liabilities liquidated 2,450,000

Assets realized 2,100,000

ed d

Payment of expenses of trustee 525,000

ar stu

Liabilities to be liquidated, June 1 4,574,500

Sales on Account 50,000

Assets to be realized, July 1 2,940,000

sh is

liabilities not liquidated, June 30 2,229,500

Sales for cash 1,750,000

Th

Assets not realized, May 31 6,650,000

What is the net gain (loss) on realization and liquidation?

a. 1,225,000

b. ( 479,500)

c. (1,225,000)

d. 479,500

Answer

4. B

https://www.coursehero.com/file/69854230/CORPORATE-LIQUIDATIONdocx/

5. C

6. C

7. ACBC

8. B

m

er as

co

eH w

o.

rs e

ou urc

o

aC s

vi y re

ed d

ar stu

sh is

Th

https://www.coursehero.com/file/69854230/CORPORATE-LIQUIDATIONdocx/

Powered by TCPDF (www.tcpdf.org)