0% found this document useful (0 votes)

73 views4 pagesSample Business Case

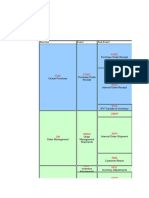

This document discusses inventory valuation and summarizes different scenarios involving raw material issuance, production, and variances. It provides three key points:

1. Inventory valuation tracks raw materials as an asset and work in process as an expense. Variances are gains or losses that impact assets and expenses.

2. If production is below requirements due to shrinkage, it results in a loss as assets decrease and expenses increase. If above requirements due to elongation, it results in a gain as assets increase and expenses decrease.

3. Variances can be tracked in a material variance account and later released to cost of goods sold to ultimately impact profits.

Uploaded by

imranyfgmCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

73 views4 pagesSample Business Case

This document discusses inventory valuation and summarizes different scenarios involving raw material issuance, production, and variances. It provides three key points:

1. Inventory valuation tracks raw materials as an asset and work in process as an expense. Variances are gains or losses that impact assets and expenses.

2. If production is below requirements due to shrinkage, it results in a loss as assets decrease and expenses increase. If above requirements due to elongation, it results in a gain as assets increase and expenses decrease.

3. Variances can be tracked in a material variance account and later released to cost of goods sold to ultimately impact profits.

Uploaded by

imranyfgmCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 4