Cash and Cash Equivalent

Uploaded by

Danielle Nicole MarquezCash and Cash Equivalent

Uploaded by

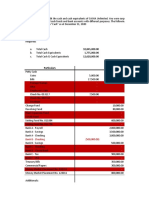

Danielle Nicole MarquezProblem 8-1 CASH AND CASH EQUIVALENTS (GACUTNO)

Traveler's Check ₱50,000

Postal money order 30,000

Petty Cash Fund 4,000

Treasury bills, due 3/31/2019 (purchased 12/31/2018) 200,000

Current account at Metrobank 2,000,000

Payroll account 500,000

Treasury warrants 300,000

Total cash and cash equivalents ₱3,084,000

Answer: A

Problem 8-2 (Cabalquinto)

Reported cash & cash equivalents 6,325,000

Certificate of deposits-120 days maturity -500,000

Postdated check -125,000

Maintaining balance- legally restricted -500,000

Adjusted cash & cash equivalent 5,200,000

PROBLEM 8-3 (Purugganan)

Bills and coins on hand PHP 52,780.00

Traveler's check 22,400.00

Petty cash 350.00

Money order 800.00

Checking account balance in BPI 22,000.00

Cash and Cash Equivalents 12/31/18 PHP 98,330.00

Problem 8-4

(Locsin)

Cash on Hand P 80,000

Checking account No. 143 -

BPI 200,000

Checking account No. 155 -

BPI (30,000)

Securities classified as cash equivalents 3,600,000

Cash and Cash Equivalent P 3,850,000

Securities classified as cash equivalent;

Securities Date Acquired Maturity Date Amount

120 - day Certificate of Deposit 10/12/2018 31/01/2019 600,000

BSP - Treasury Bills (No.2) 31/10/2018 20/01/2019 1,000,000

Money Market Funds 21/11/2018 10/02/2019 2,000,000

PROBLEM 8-5 CASH AND CASH EQUIVALENTS (ELLORIMO)

Bank cheque account ₱58,400

Bank savings account (collectible immediately) 23,440

Cash 10,000

Treasury bonds-maturing 2 months 8,500

Cash and cash equivalents ₱100,340

Answer: B

Problem 8-6 (Orca)

Petty Cash Fund ₱ 70,000

Less: Unreplenished expense voucher 15000

Employee's Check 5000 -20000

₱ 50,000

Current account- Metrobank 4000000

Company's Post-dated check 100000

Cash and Cash Equivalent ₱ 4,150,000

Problem 8-7 (Delos Reyes)

1) C

Let X = Principal Amount

Principal X

Less: Compensating Balance 5%X

Add: Current Balance 50,000

Amount needed ₱ 3,375,000.00

X.05X + 50,000 = 3,375,000

.95X = 3,375,000-50,000

.95X/.95 = 3,325,000/.95

X = 3,500,000

2) C

Annual interest payment 420,000

(3,500,000 x 12%)

Interest income on the loan proceeds in the compensating

balance

[(3,500,000 - 3,375,000) x 4%] 5,000

Net interest 415,000

Divide by loan proceeds

(3,500,000-175,000) 3,375,000

Effective interest rate 12.30%

PROBLEM 8-8 Petty Cash Fund (Meana)

Requirement No. 1

Currencies 3,000

Coins 450

A check drawn by the company payable to the order

of the petty cash custodian, representing her salary 3,800

Adjusted Petty Cash Fund 7,250

Requirement No. 2: Adjusting Entries

Debit Credit

1) Transportation expense 650

Office supplies expense 160

Repairs expense 400

Advances to employees 600

Miscellaneous expense 240

Postage 200

Petty Cash fund 2,250

2) Unused stamps 50

Postage 50

3) Petty cash fund 700

Miscellaneous Income 700

4) Advances to employees 1,200

Petty cash fund 1,200

Requirement No. 3

Currencies 3,000

Coins 450

Petty cash vouchers:

Transportation 650

Office supplies 160

Repair of computer 400

Loans to employees 600

Miscellaneous expenses 240

Postage 200

A check drawn by the company payable to the

order of the petty cash custodian, representing her 3,800

salary

An employee’s check returned by the bank because 1,200

of insufficient funds

A piece of paper with names of several employees

together with a contribution for a wedding gift for

an employee. Attached to the sheet of paper is a 500 11,200

currency of

Less: Petty Cash Accountabilities 10,000

PCF imprest balance

A piece of paper with names of several employees

together with a contribution for a wedding gift

for an employee. Attached to the sheet of paper 500 10,500

is a currency of

Petty cash overage 700

Problem 8-9 Petty Cash Fund (Duarte)

Required: Compute the amount of cash shortage.

Petty Cash Count Sheet

January 3, 2018; 8:30AM

Denomonation Quantity Total

Bills 500 3 1,500.00

100 5 500.00

20 20 400.00

10 12 120.00

Coins 1 50 50.00

0.25 60 15.00

Total Bills and Coins 2,585.00

Checks for Deposits:

Maker Date Payee Amount

Al, Beautician 26/12/2018 Cash 5,000.00

Rex, Hairdresser 19/12/2018 Raymund 6,100.00

Zev, customer 29/12/2018 Raymund 6,500.00

Total Checks for deposit 17,600.00

I.O.U's Date Amount

Rhad, employee 20/12/2018 50.00

Andrix 23/12/2018 100.00

Total I.O.U's 150.00

Vouchers

Date Particulars Amount

12/15/18 Transportation 65.00

12/16/18 Office Supplies 70.00

12/17/18 Xerox fees 80.00

12/18/18 Postage 150.00

1/2/19 Newspaper 10.00

1/2/19 Freight Charges 50.00

Total Vouchers 425.00

Sales Invoice

Date Invoices Amount

12/30/18 #143 4,000.00

12/31/18 #144 5,100.00

1/2/19 #145 3,050.00

Total Invoice 12,150.00

Bills and Coins 2,585.00

Checks for deposit 17,600.00

I.O.U's 150.00

Vouchers paid 425.00

Total Petty Cash Accounted 20,760.00

Less: Petty Cash Accountabilities Cash Collections 12,150.00

PC Fund Ledger Balance 5,000.00

Check collection from customer 6,500.00

Petty Cash Overage (2,890.00)

Problem 8-10 (BONABON)

Bank Book

Unadjusted balance 10,094 8,228

Erroneous bank -

credit 500

DIT: November 3,600

-

OC: November 2,628

Credit memo:

October 1,600

November 750

Debit memo:

NSF: November - 665

BSC: October - 20

November - 22

- 35

Check No. 148 1,000

Check No. 150 - 270

Adjusted balance 10,566 10,566

1. B

2. A

3. B

18, 269 + 750 = 19, 019

4. D

5. A

Cash in bank 1,600

Notes

receivable 1,000

Interest income 600

Cash in bank 750

Interest income 750

Accounts receivable 665

Cash in bank 665

Bank service charge 42

Cash in bank 42

Rent expense 35

Cash in bank 35

Cash in bank 1,000

Equipment 1,000

Advertising expense 270

Cash in bank 270

PROBLEM 8-11 : Deposit in Transit (Deza)

Deposit in transit, beg. 50,000

Add: Book debits for the month 400,000

Less: CM recorded this month 5,000

Error - check received (January) 36,000

Error - check issued (January) 27,000

Add: Error - check received (February) 16,000 348,000

Total 398,000

Less: Bank debits for this month 360,000

Less: CM for this month 6,000

Erroneous bank credit - February 2,500

Erroneous bank charge - January 1,000 350,500

Deposit in transit, end. 47,500

Problem 8-12 (Castillo)

Outstanding Checks, Beg. 12,880 (SQUEEZE)

Add: Book Credits 85,800

Less: Error (1,800)

Service Charge (30) 83,970

Total 96,850

Less: Bank Debits 97,650

Less: DAIF Check returned (2,300)

DM for this month (3,000) 92,350

Outstanding Checks, End 4,500

Problem 8-13 (Vargas)

Outstanding checks, beginning ₱50,000

Add: Checks issued by the company this month 1,250,000

Total checks to be paid by the bank 1,300,000

Less: Checks paid by the bank this month 1,100,000

Outstanding checks, end ₱200,000

Deposit in transit, beginning ₱150,000

Add: Deposit made by the company this monoth 900,000

Total deposits to be acknowledged by the bank 1,050,000

Less: Deposit acknowledged by the bank this month 800,000

Deposit in transit, ending ₱250,000

May-31 Receipts Disbursements Jun-30

Unadjusted balances - book 1,095,000 1,200,000 1,250,000 1,045,000

- -

Bank service charge - May 31 5,000 5,000

-

Service charges recorded - June 30 25,000 25,000

-

CM for collection of note - May 31 300,000 300,000

CM for collection by bank - June 30 275,000 275,000

-

NSF checks - June 30 50,000 50,000

Adjusted balances ₱1,390,000 ₱1,175,000 ₱1,325,000 ₱1,240,000

PROBLEM 8-14 (Villalon)

JUNE

31-May Cash Receipts Cash Disbursement 30-Jun

Unadjusted Book Balance 1,251,000 1,300,000 1,500,000 1,051,000

NSF- debit Memo (110,000) (110,000)

75,000 (75,000)

Collections- credit memo 125,000 (125,000)

150,000 150,000

Error- Understated check deposit 9,000 (9,000)

21,000-12,000

Adjusted Book Balance 1,275,000 1,316,000 1,465,000 1,126,000

Outstanding checks, beg. 150,000

Checks issued

book disbursement 1,500,000

DM last month (110,000) 1,390,000

Total 1,540,000

Checks paid by bank

Bank disbursement 1,300,000

DM this month 75,000

Error bank charge- june 30,000

Error bank credit- may 45,000 (1,150,000)

Outstanding Checks, end 390,000

JUNE

31-May Cash Receipts Cash Disbursement 30-Jun

Unadjusted bank Balance 1,250,000 1,400,000 1,300,000 1,350,000

OC (150,000) (150,000)

390,000 (390,000)

DIT 200,000 (200,000)

153,000 153,000

Error bank charge

may 20,000 (20,000)

june (30,000) 30,000

Error bank credit

may (45,000) (45,000)

june (17,000) (17,000)

Adjusted Book Balance 1,275,000 1,316,000 1,465,000 1,126,000

1 C

2 D

3 C

4 D

5 A

6 D

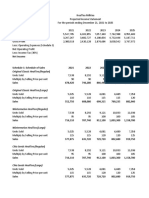

PROBLEM 8-15 PROOF OF CASH (Marquez)

Question No. 1

Beginning Balance, July 1 P 128,384

Add: Cash Receipts (July) 1,364,858

Cash Receipts (August) 1,839,744

Total P 3,332,986

Less: Cash Disbursements (July) 1,330,882

Cash Disbursements (August) 1,712,892

Bank reconciliation item 750

Unadjusted Balance P 288,462

ANS. A

Question No. 2

Outstanding check, Aug. 31 P 67,122

Add: Checks paid by the bank

Bank debits except service P 1,702,830

charge

Less: Erroneous bank charge 1,166

Debit memo 4,950 1,696,714

Total P 1,763,836

Less: Checks issued by the

company this August 1,712,982

Outstanding check, July 31 P 50,944

ANS. C

Questions No. 3-5

BANK July 31 Cash Receipts Cash August 31

Disbursements

Unadjusted Balances 180,250 1,830,752 *1,702,918 308,084

Outstanding checks

July 31 (50,944) (50,944)

August 31 67,122 (67,122)

Deposit in transit

July 31 32,844 (32,844)

August 31

Erroneous bank charge - - (1,166) 1,166

Adjusted Balances 162,150 1,839,744 1,717,930 283,964

*Checks-plus debit memos 1,702,830

Service charge-new checks 88

Total 1,702,918

BOOK July 31 Cash Receipts Cash August 31

Disbursements

Unadjusted Balances P162,360 P1,839,744 **P1,713,642 P288,462

Error in recording 540 540

check no. 216 taken up

as P1,930 but should

be P1,390

Debit memo for 4,950 (4,950)

interest on note

Bank service charge

July 31 (52) (52)

August 31 88 (88)

NSF for July 31 (698) (698)

Adjusted Balances P162,150 P1,839,744 P1,717,930 P283,964

**Checks issued P1,712,892

Bank Reconciliation, 8/1 750

Total P1,713,642

ANS. 3.) A

4.) B

5.) A

Problem 8-16 (Quia) Proof of Cash

Disbursement Adjusted

Beginning Balance Receipts s Balance

Balance per Bank 69,000.00 171,500.00 113,000.00 127,500.00

Deposit In Transit

30-Nov 11,000.00 (11,000.00) -

31-Dec 20,000.00 20,000.00

Outstanding Check

30-Nov (7,000.00) (7,000.00) -

31-Dec 21,500.00 (21,500.00)

Errors

(500.00) (500.00) -

NSF check not

recorded (40,000.00) (40,000.00) -

Adjusted Balance 73,000.00 140,000.00 87,000.00 126,000.00

Beginning Adjusted

Balance Receipts Disbursements Balance

Balance per Book 66,000.00 113,800.00 85,000.00 94,800.00

Credit Memo

30-Nov 8,800.00 (8,800.00) -

31-Dec 35,000.00 35,000.00

Debit Memo

30-Nov (1,800.00) (1,800.00)

31-Dec 2,000.00 (2,000.00)

Adjusted Balance 73,000.00 140,000.00 87,000.00 126,000.00

3 4

Outstanding check, beg 7,000.00

Check

issued 75,000.00

Total 82,000.00

Less: Cleared Checks 113,000.00

Less: Debit Memo

NSF Check

08-Dec 10,000.00

19-Dec 40,000.00 50,000.00

Bank Service Charge 2,000.00

Error 500.00 60,500.00

Outstanding check, end 21,500.00 1

Bank to Book

Bank Receipts, beg 171,500.00

Add: Deposit In Transit

30-Nov (11,000.00)

31-Dec 20,000.00 9,000.00

Less:

Error Correction (500.00)

NSF Check (40,000.00)

Bank Receipts, end 140,000.00 2

Bank Balance, end 126,000.00

Book Balance, end 126,000.00

Cash Short or Over - 5

PROBLEM 8-17 Proof of Cash (Dela Cruz)

1) Outstanding Cheks, Beginning 16,250

Add: Book Disbursement 128,750.00

Less: Debit Memo (2,500.00) (131,250)

Total 142,500

Less: Check paid by the bank 133,750.00

Eroneous Bank Charged (3,750.00) (130,000)

Outstanding Checks, Ending 12,500

2) Deposit in Transit, Beginning 12,500

Add: Deposit made by the Company 152,500

Total 165,000

Less: Deposit Acknowledge by the Bank (145,000)

Deposit End 20,000

3) Unadjusted Cash in Bank 37,500

Add: Under-footed Cash Receipts 2,500

Total 40,000

Less: Unrecorded Bank Service Charges (2,250)

(3,250 + 1,500 - 2,500)

Adjusted Cash in Bank 12/31/18 37,750

4) Bank Service charge in December Bank Statement 3,250

Less: Bank Service charge recorded in December 2,500.00

Bank Service charge recorded in November (1,500.00) (1,000)

Unrecorded Bank Service Charge 12/31/18 2,250

5) Unadjusted Cash in Bank 16,250

Less: Bank Service Charge in November (1,500)

Adjusted Cash in Bank, November 14,750

Unadjusted Cash in Bank, November 16,250 (squeeze)

Add: Book Receipts 150,000

Total 166,250

Less: Book Disbursement -128,750

Unadjusted Cash in Bank, December 37,500

Chapter 8: Cash and Cash Equvalent (Sta Ana)

December 31

B.

1. Outstanding Checks Beg. (Squeeze) 8000

Add: Check issued this month

Book

Disbursement 148,000

Less: DM recorded this month 2,500 145,500

Total 153,500

Less: Bank disbursement 150,000

NSF Rdeposited 3,000

DM for this month 1,500

Add: Paid out in currency 2,000 147,500

Outstanding Checks End. 6,000

BANK

Sept 30 Receipt Disbursement Oct 30

Unadjusted Balance - Bank 100,000 200,000 150,000 150,000

Undeposited Collection

September 30 5,000 (5,000)

October 31 7,000 7,000

Outstanding Checks End.

September 30 (8,000) (8,000)

October 31 6,000 (6,000)

Paid out in currency 2,000 2,000

A.

Adjusted Balance - Bank A 97,000 204,000 150,000 151000

Problem 8-19 (Alegre)

1.) A

Balance per bank statement ₱ 1,000,000.00

Add: Deposit In Transit 80,000.00

Deduct: Outstanding Check (60,000.00)

Adjusted Cash Balance (Acct. 143) ₱ 1,020,000.00

2.) A

Outstanding Check, Beg. (Acct. 544) ₱ 250,000.00

Add: Checks issued during the month (DM, previous

is deducted) 3,490,000.00

Total ₱ 3,740,000.00

Deduct: Checks paid by the bank this month (DM,

current is deducted) (1,880,000.00)

Outstanding Check, End (Acct. 544) ₱ 1,860,000.00

Add: Outstanding Check (Acct. 143) 60,000.00

Total Outstanding Check, 12/31/18 ₱ 1,920,000.00

3.) B

4.) B November 30 Receipts Disbursements December 31

₱ ₱

Unadjusted Bank Balance (Acct. 544) 2,200,000.00 ₱ 1,000,000.00 2,000,000.00 ₱ 1,200,000.00

Deposit In Transit

Nov. 30 90,000.00 (90,000.00)

Dec. 31 240,000.00 240,000.00

Outstanding Check

Nov. 30 (250,000.00) (250,000.00)

Dec. 31 1,860,000.00 (1,860,000.00)

Errors 20,000 (20,000.00)

₱

Adjusted Balances ₱ 2,060,000.00 1,130,000.00 ₱ 3,610,000.00 (₱ 420,000.00)

5.) C

Adjusted Balance (Acct. 143) ₱ 1,020,000.00

Adjusted Balance (Acct. 544) (420,000.00)

Total Adjusted Balance, 12/31/18 ₱ 600,000.00

Deposit In Transit, Beg. ₱ 90,000.00

Add: Book Deposits during the month

(CM, previous is deducted) 1,130,000.00

Total ₱ 1,220,000.00

Deduct: Bank Deposits during the month

(CM, current is deducted) (980,000.00)

Deposit In Transit, End ₱ 240,000.00

Problem 8-20 (Astoveza)

1.)

Account No. 143 Bank Book

Unadjusted balances 1,000,000 1,099,400

Deposit in Transit 80,000

Misplaced Check -20,000

Outstanding Check -60,000

Undelivered Check 15,000

Note charged by the bank - -74,400

Adjusted balance 1,020,000 1,020,000

2.)

Account No. 143 60,000

Account No. 144 1,860,000

Total outstanding check 1,920,000

3-4)

Beg Receipts Disbursement End

Unadjusted bank balance 2,200,000 1,000,000 2,000,000 1,200,000

DIT - last month 90,000 -90,000

DIT - this month 240,000 240,000

OC - last month -250,000 -250,000

-

OC - this month 1,860,000 1,860,000

Erroneous bank charge 20,000 -20,000

Adjusted balances 2,060,000 1,130,000 3,610,000 -420,000

5.)

Adjusted balances:

Account No. 143 1,020,000

Account No. 144 -420,000

Total adjusted balances 600,000

1.) A 2.) A 3.) B 4.) B 5.) C

Problem 8-21 (Valmonte)

Book

Previous Current

Receipts Disbursement

Month Month

Balance: 200,000 150,000 80,000 270,000

Credit Memo:

Previous Month 9,000 (9,000) - -

Current Month - 13,000 - 13,000

Debit Memo:

Previous Month (100) - (100) -

Current Month - - 150 (150)

Mutilated Check 700 - - 700

Company Check - (1,200) (1,200) -

Adjusted Balance 209,600 152,800 78,850 283,685

Bank

Previous Current Month

Receipts Disbursements

Month

Balance: 206,600 159,000 88,650 276,950

Deposit in Transit:

Previous Month

Current Month 10,000 (10,000) - -

- 11,000 - 11,000

Outstanding

Check:

(4,200) - (4,200) -

Previous Month

Current Month - - 1,800 (1,800)

Erroneous bank

credit - Jan (6,000) - (6,000) -

Erroneous bank

credit - Feb - (4,000) - (4,000)

Erroneous bank

charge - Jan 3,200 (3,200) - -

Erroneous bank

charge – Feb - - (1,400) 1,400

Adjusted Balance 209,600 152,800 78,850 283,550

Problem 8-22 (Serdena)

Bank Book

May 31, balance May 31, balance 242,310.50

Less: Outstanding Checks Less:

Unrecorded Notes with

421 8,434.00 interest 30,900.00

488 4,300.00 273,210.50

522 6,524.00 Adjusted Cash Balance (221,052.50)

992 9,551.50 Cash Shortage 52,158.00

995 4,577.00

996 5,961.00 (39,347.50)

Add: Undeposited

Receipts 35,000.00

Adjusted Cash Balance 221,052.50

Problem 8-23 (Gane)

Bank Book

Unadjusted Balance 42,400 46,500

Deposit in Transit 5,000

Outstanding Checks (11,500)

Debit Memo (100)

Credit Memo 900

Adjusted Balance 35,900 47,300

1. C 2. D

3. B

Adjusted Cash in Bank Balance (Cash Accounted

35,900

Cash in Bank (Cash Accountability) 47,300

Cash Shortage as of June 30 11,400

4. D

July Collections per Duplicate Receipts 18,800

Collected Duplicate Slips

Total Duplicate Slips 11,000

Undeposited Collections 5,000 6,000

Cash on Hand 12,800

Actual Cash on Hand 4,800

Cash as of July 1-15 8,000

5. D

Understatement of Cash in Bank per Book 900

(46,500- 45,600)

Overstatement of Cash in Bank per Bank 1,600

(42,400 - 44,000)

Understatement of Outstanding Checks 7,900

(11,500 - 3,600)

Overstatement of Undeposited Collections 100

(5,000 - 5,100)

Credit Memo 900

Cash Shortage 11,400

Problem 8-25 (Abines)

PROBLEM 8-24 (Bangga) Question No. 4

Question No. 1 Unadjusted bal. per books P 293,500

Deposit in transit, unadjusted bal. P 175,250 Add: Credit memo for note coll. 15,000

Less: Customer's Post-dated check 50,000 Unreleased check 14,750

Adjusted Deposit in transit P 125,250 Company's post-dated check 37,210

Total P 360 460

Question No. 2 Less: Customer s post-dated check (50,000)

OC, unadjusted balance P 246,760 Cash in bank per books bal. P 310,360

Less: Unreleased check (14,750) Less: Adjusted cash in bank balance 250,460

Company's post-dated check (37,210) Cash shortage (P60,000)

Adjusted Outstanding checks P 194,790

Question No. 3 Question No. 5

Unadjusted bal. per bank P 350,000 Unadjusted bal. per books P293,500

Add: Deposit in transit 125,250 Less: Adjusted cash in bank balance 250,460

Less: Outstanding checks (194,790) Net adjustments P 43,040

Erroneous bank credit (30,000)

Adjusted cash in bank bal. P 250,460

1. BANK

Unadjusted Balance 101,000

Less -9,000

Add: DIT 10,000

Adjusted Balance 102,000 B.

2 Accounts Payable

Ending 120,000 - Beginning

Payment 360,000 480,000 Purchases

4,800,000 4,800,000

or

Purchases 480,000

Less: Unpaid

(120,000)

Paid/Payments 360,000 A.

3 Merchandise Inventory

Beginning - 60,000 Ending

Purchases 480,000 420,000 COGS B.

480,000 480,000

4 100% Sales 560,000 C.

75% Less:COGS -120,000

25% GP 360,000

5 BOOK BANK

Beginning 240,000 101,000 Unadjusted

Collected 420,000

(9,000)

Paid 360,000 10,000 DIT

Loan Proceeds 200,000

Loan Paid

(140,000)

OPEX

(180,000)

Total 180,000 102,000 Adjusted Balance per Bank

6,400 Add: PCF

B. 71,600 Shortage

1. B. P102,000

2. A. P360,000

3. B. P420,000

4. C. 560,000

5. B. P71,600

You might also like

- CHAPTER 1 - Audit of Cash and Cash EquivalentsNo ratings yetCHAPTER 1 - Audit of Cash and Cash Equivalents78 pages

- Audit Planning and Risk Assessment InsightsNo ratings yetAudit Planning and Risk Assessment Insights30 pages

- This Study Resource Was: Problem 8-8 Petty Cash FundNo ratings yetThis Study Resource Was: Problem 8-8 Petty Cash Fund3 pages

- Unit 1 Audit of Property PLant and EquipmentNo ratings yetUnit 1 Audit of Property PLant and Equipment5 pages

- Consolidated Financial Statements AnalysisNo ratings yetConsolidated Financial Statements Analysis17 pages

- Refresher Course: Audit of Cash and Cash Equivalents100% (1)Refresher Course: Audit of Cash and Cash Equivalents4 pages

- Quiz 9 - Subs Test - Audit of Inventory (KEY)No ratings yetQuiz 9 - Subs Test - Audit of Inventory (KEY)4 pages

- Notes On Correction of Errors With AnswerNo ratings yetNotes On Correction of Errors With Answer12 pages

- Applied Auditing Solution Manual Nginaescala AsuncionNo ratings yetApplied Auditing Solution Manual Nginaescala Asuncion118 pages

- P7 - Investment in Debt Securities & Other Non-Current Financial AssetsNo ratings yetP7 - Investment in Debt Securities & Other Non-Current Financial Assets46 pages

- Financial Assets and Equity InvestmentsNo ratings yetFinancial Assets and Equity Investments38 pages

- 2 Problems Problem 2-1 Analyzing Various Receivable TransactionsNo ratings yet2 Problems Problem 2-1 Analyzing Various Receivable Transactions9 pages

- Chap 3: Problem 4: Multiple Choice-ComputationalNo ratings yetChap 3: Problem 4: Multiple Choice-Computational24 pages

- Unit 2 Audit of Cash and Cash EquivalentsNo ratings yetUnit 2 Audit of Cash and Cash Equivalents26 pages

- Cash Balance Reporting and Reconciliation GuideNo ratings yetCash Balance Reporting and Reconciliation Guide7 pages

- Business Law: "Serving Towards Your CPANo ratings yetBusiness Law: "Serving Towards Your CPA19 pages

- Review Notes Corporation - Is An Artificial Being Created byNo ratings yetReview Notes Corporation - Is An Artificial Being Created by39 pages

- A Feasibility Study For National University: Healtea Milk TeaNo ratings yetA Feasibility Study For National University: Healtea Milk Tea6 pages

- A. B. 2. A. B. 3. A. B. C. D. 4.: Profit Loss Profit LossNo ratings yetA. B. 2. A. B. 3. A. B. C. D. 4.: Profit Loss Profit Loss13 pages

- AudProb Quiz No. 6 2nd Term SY 2019 2020No ratings yetAudProb Quiz No. 6 2nd Term SY 2019 20202 pages

- College of Business and Accountancy Online Connectivity Survey Course Code: BTAXREV Section: ACTP02No ratings yetCollege of Business and Accountancy Online Connectivity Survey Course Code: BTAXREV Section: ACTP022 pages

- Accounts Receivable/ Notes Receivable Sales On Account/Gross Sales 4,260,000No ratings yetAccounts Receivable/ Notes Receivable Sales On Account/Gross Sales 4,260,0002 pages

- Steps To Redeem Vouchers - Amaze Savings AccountNo ratings yetSteps To Redeem Vouchers - Amaze Savings Account8 pages

- Suggested - Answer - CAP - II - June - 2016 6No ratings yetSuggested - Answer - CAP - II - June - 2016 675 pages

- Revised Loyalty Card Application Form (HQP-PFF-108)100% (2)Revised Loyalty Card Application Form (HQP-PFF-108)2 pages

- Joint Venture Agreement for Gold Financing100% (1)Joint Venture Agreement for Gold Financing13 pages

- Non-Performing Assets: A Comparative Study of SBI & ICICI Bank From (2014-2017)No ratings yetNon-Performing Assets: A Comparative Study of SBI & ICICI Bank From (2014-2017)32 pages

- Michel Chossudovsky The Globalization of Poverty AndNew World Order100% (14)Michel Chossudovsky The Globalization of Poverty AndNew World Order400 pages

- My Letter of Credit Transfer by Deed To S of TNo ratings yetMy Letter of Credit Transfer by Deed To S of T2 pages

- Subsidiary Books - Cash Book E - Notes SolutionsNo ratings yetSubsidiary Books - Cash Book E - Notes Solutions25 pages

- Case Study: Definition, How To Write, Format and ExamplesNo ratings yetCase Study: Definition, How To Write, Format and Examples12 pages

- Banking: Regional Rural Bank, Cooperative Bank, Commercial BankNo ratings yetBanking: Regional Rural Bank, Cooperative Bank, Commercial Bank24 pages