‘Auditing Problems SETA

INSTRUCTIONS: Select the best answer for each of the

following questions. ALL questions are compulsory and

MUST be attempted. Mark only one answer for each item on

the answer sheet provided. Strictly NO ERASURES ALLOWED.

Erasures willsrender your examination answer sheet INVALID,

Use PENCIL NO. 2 only. GOODLUCK!@

PROBLEM NO, 10!" > aad

During your audit of the records of the Indiana Corporation for

the year ended December 31, 2014, the following facts were

disclosed:

Raw materials inventory, 1/1/2014 720,200

- Raw materials purchases- 5,232,800

© Direct labor * 6,300,000

Manufacturing overhead applied

(150%tof direct labor) + 279,450,000

Finished goods inventory, 1/1/2014

Selling expenses

Administrative expenses

Your examination disclosed the following addition:

a) Purchases of raw materials,

Month s Unit Price Amount

January - February $5,000 P17.76 976,800

March ~ Apr 45,000 20.00 ‘900/000

May ~ June 25,000 19.60 490,000

July - August 35,000 20.00 700,000,

‘September - October 45,000 20.40 918,000

November - December 60,000 20.80 1,248,000

265,000 9,232,800

Audling Problems

_ sera

APIITEMND

b) Data with respect to quantities are as follows:

Explanat naa ews

Raw materials 35,000 ?

Work in process (80% completed) oO 25,000

Finished goods 15,000 40,000

Sales, 205,000 units

) Raw materials are issued at the beginning of the manufacturing

Process, During the year, no returns, spoilage, or wastage

‘occurred. Each unit of finished goods contains one unit of raw

materials.

d) Inventories are stated at cost as follows:

‘+ Raw materials ~ according to the FIFO method

* Direct labor - at an average rate determined by correlating

total direct labor cost with effective production during the

period

‘+ Manufacturing overhead - at an applied rate of 150% of

direct labor cost

Questions:

Based on the above and the result of your audit, answer the

following:

1, The raw materials inventory as of December 31, 2014 is

a. P1,976,000 c. P936,000

b. P1,352,000 4. P897,800

‘The work in process inventory as of December 31, 2014 is

a. Pi,780,000 c. P1,885,565

b. P1,751,294 d. P1,776,000

3. The finished goods inventory as of December 31, 2014 is

a. P3,352,000 ¢. P3,553,130

b. P3,334,000 d. P3,284,588

Pape TAA aac BR bpentinPBETT

by)SETA

4. The.cost of goods sold for the-year ‘ended December 31, 2014

is

a. P16,897,000 ¢. P15,857,000

b. P16 ;568,304 @.- P16,875,000

5. When testing the valuation assertion, the auditor would most

likely

a. Observe the taking of physical inventory.

b, Examine receiving reports for inventory, tracing their

recorded amounts.

© Perform price tests to the related cost flow assumption.

4. Confirm inventory on consignment.

PROBLEM NO. 2

The general ledger trial balance of Miami Corporation includes the

foltowing balance sheet accounts at December 31, 2014:

Cash 1,056,000

Accounts receivable 1,220,000

Inventory 441,000

Trading securities 200,000

Available for sale investments 500,000

Prepaid insurance 50,000

Deferred tax asset 150,000

Bank overdraft 100,000

Additional information:

Cash

+ The sales book wasdeft open-up to January 5, 2015, and cash

sales totaling P150,000 were considered as sales in December.

= Checks of P93,000 .in payment of liabilities were .prepared

before December 31, 2014, recorded in the books, but not

mailed or delivered to payees. ———-— ve

+ Post-dated checks totaling[ P78,000are being held by the

Cashier as part of Cash. The Tompany’s experience shows

post-dated checks are eventually realized.

Pea to Sas an opeaiP ase

np - 190,779 7

{use 4

|

|

|

Auditing Problems aera

+ Customer's check fof 35900 Hepostea with but returned by

Bank, "NSF* on er 27, 2014. Return was recorded in

the books,

* The Cash account includes P400,000 of compensating balance

against a short-term bank loan. The compensating balance is

legally restricted as to withdrawal.

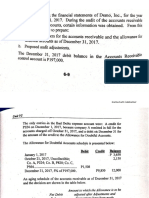

Accounts receivable

The accounts receivable consists of the following:

‘Trade accounts receivable P 650,000

Allowance for uncollectible accounts (20,000)

Claim against shipper for goods lost in transit 30,000

ling price of unsold goods sent by Miami on

consignment at 130% of cost (included in

's ending inventory at cost) 260,000

it on lease of warehouse used for

‘storing some inventories 300,000 ~*

Total 241.220.9000

Inventory

A physical count of inventory at December 31, 2014 revealed that

Miami had inventory on hand at that date with a cost of

. 340,000 ‘.)

ee 61 000 2,485,000

W? 92,436,800 6. 2,513,800

PROBLEM NO. 3

Among the account halances of Toronto Corporation at December

33, 2013 are the following

Patent, net

Installment contract recewable

‘Audeng Probiome, seta

Relevant transactions and other information for 2014 were as

follows:

a) The patent was purchased for P3,150,000 on September 1,

2010. On that date, the remaining legal life was fifteen years,

which was also determined to be the u fe. i

b) The installment contract receivable represents the balance of

the consideration received from the sale of a factory

Raptors Company on March 31, 2012, for P12,000,000.

Raptors made a P3,000,000 down payment and signed a five-

3% note for the P9,000,000 balance. The first of equal

.000 at December 31, 2014. The 2014 payment was

received on tune.

©) On January 2, 2034, Toronto purchased a trademark for

2,509,000. Toronto considers the life of the trademark to be

wndefunite.

0) On May 1, 2014, Toronto sold the patent in exchange for a

5,000,000 non-interest bearing note due on May 1, 2017.

Y ished exchange price for the pat

the note had no reagy market. The prevailing rate of interest

for a note of ths type at May 1, 2014 was 14%. The present

value of 1 for three penods at 14% 15 0.675. The collection of

the note recewable is reasonably assured,

©) On duly 1, 2014, Toronto paid 18,800,000 for 759,000

ordinary shares of Canada Corporation, which repre

25%

stment in) ‘The fair value of all of Cay

le assets net of liabilities equals their carrying amount

10,000. The market price of Canada’s ordinary share

ber 31, 2014 was P26,00 per share.

Ween Fen a ee