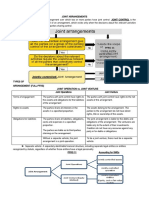

JOINT ARRANGEMENT

• "an arrangement of which two or more parties have joint

control." (PFRS 11.4)

• Essential elements in the definition of joint arrangement:

a. Contractual arrangement

b. Joint control

CONTRACTUAL AGREEMENT

• A contractual agreement for the sharing of joint control over

an investee distinguishes an interest in a joint arrangement

from other types of investments, such as investment in

equity securities measured at fair value (PFRS 9), investment

in associate (PAS 28) and investment in subsidiary (PFRS 3

and PFRS 10).

• PFRS 11 is not applicable without such an agreement.

• The contractual arrangement may be evidenced in various

ways, for example, by a contract, by minutes of discussions

between the parties, or by inclusion in the articles or by-laws.

JOINT CONTROL

• Joint control is "the contractually agreed sharing of control

of an arrangement, which exists only when decisions about

the relevant activities require the unanimous consent of the

parties sharing control." (PFRS 11.7)

• Joint control exists when all the parties sharing joint control

over the arrangement act collectively (together) in

directing the activities that significantly affect the returns

of the arrangement.

TYPES OF JOINT ARRANGEMENT

JOINT OPERATION

• is a joint arrangement whereby the parties that have joint

control of the arrangement have rights to the assets and

obligations for the liabilities of the arrangement.

JOINT VENTURE

• is a joint arrangement whereby the parties that have joint

control of the arrangement have rights to the net assets of

the arrangement.

TYPES OF JOINT ARRANGEMENT

• An entity applies judgment when determining the type of

joint arrangement in which it is involved by:

A. Considering its rights and obligations arising from the

arrangement.

B. Assessing its rights and obligations in relation to the:

• structure and legal form of the arrangement,

• terms of the contractual agreement, and

• other facts and circumstances.

ASSESSMENT OF RIGHTS AND

OBLIGATIONS

Structure and legal form of the arrangement:

• a. A joint arrangement that is not structured through a separate

vehicle is a joint operation.

• b. A joint arrangement in which the assets and liabilities relating

to the arrangement are held in a separate vehicle can be either

a joint venture or a joint operation.

Separate vehicle - "a separately identifiable financial structure,

including separate legal entities or entities recognized by statute,

regardless of whether those entities have a legal personality."

PROBLEM 1

AA, BB and CC sign an agreement to collectively purchase a yacht and to hire

a company to manage and operate the yacht in their behalf. The cost and

revenue earned shall be shared by the three parties based on their ownership

percentage. All major decisions must be agreed by three companies. The cost

of the yacht was 56,000,000 with an estimated life of 20 years. The

management fee in operating the yacht was 11,200,000. Revenue earned

was 18,480,000 on the first year. AA invested 16,800,000 for 30% interest.

1. Compute the share of AA in the revenue of the joint operation for the first

year

2. Compute the share of AA in the expenses of the joint operation for the first

year

3. Compute for the ending capital of AA for the first year

PROBLEM 1

AA, BB and CC sign an agreement to collectively

purchase a yatch and to hire a company to manage

and operate the yatcht in their behalf. The cost and

1. 18,480,000 X 30% =

revenue earned shall be shared by the three parties 5,544,000

based on their ownership percentage. All major

decisions must be agreed by three companies. The 2. 18,480,000 – 11,200,000 –

cost of the yacht was 56,000,000 with an estimated

life of 20 years. The management fee in operating the 2,800,000 X 30% = 1,344,000

yacht was 11,200,000. Revenue earned was

18,480,000 on the first year. AA invested 16,800,000 3. 16,800,000 + 1,344,000 =

for 30% interest.

18,144,000

1. Compute the share of AA in the revenue of the

joint operation for the first year

2. Compute the share of AA in the net income of the

joint operation for the first year

3. Compute for the ending capital of AA for the first

year

PROBLEM 5: PAGE 243

A. JOURNAL ENTRIES

PROBLEM 5: PAGE 243

B. Profit after management fee and bonus

PROBLEM 5: PAGE 243

C. Cash Settlement

CASE # 2

PROBLEM 5: CASE NO. 2 PAGE 243

B. Profit after management fee and bonus

C. Cash Settlement

CASE NO. 3

PROBLEM

• A and B formed a joint operation on January 2024 to operate two

stores to be managed by each joint operator until April 2024. They

agreed to contribute cash for A: 30,000 and B: 20,000.

• P/L are divided in the capital ratio. The following are the relevant

data:

A B

Receipts 78,920 70,695

Disbursement 62,275 65,965

• On April 30, the remaining joint operation non-cash assets in the

hands of the joint operators were sold for 50,000 cash. The joint

operations was terminated and settlement was made between A and

B.

• How was 60,000 was divided between operators?

PROBLEM

A, CAPITAL B, CAPITAL

RECEIPTS 78,920 CONTRIBUTION 30,000 RECEIPTS 70,695 CONTRIBUTION 20,000

DISBURSEMENT 62,275 DISBURSEMENT 65,965

PROFIT 12,825 PROFIT 8,550

78,920 105,100 70,695 94,515

CASH: 26,180 CASH: 23,820

No separate records are maintained

– management account

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by: MILLA

N)

Separate records are maintained

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by: MILLA

N)

JOINT VENTURE

• Equity method is used.

• If JV is SME, choose any of the following

method:

• Equity Method

• FV Method

• Cost Method

IN SUMMARY:

INVESTMENT MODEL

COST MODEL FV MODEL EQUITY MODEL

Investment Cost Investment Investment Investment

Transaction Cost Investment P/L Investment

Dividend Income P/L P/L Investment

Net Income N/A N/A Investment/ P/L

Fair Value N/A Applicable P/L N/A

Impairment Loss Applicable P/L N/A Applicable

JOINT VENTURE FOR SME: PROBLEM

On January 1, 2024, SME J acquired 25% of the equity of L Corporation for

128,000/ SME J shares in the joint control over the relevant activities of the

JV in relation to its operations. Transaction costs of 2% of the purchase

price of the shares were incurred by SME J.

On December 15,2024, L Corporation paid dividend of 18,000 and at year-

end recognized a profit of 60,000

Published price quotations do not exists of L Corp. Using valuation

techniques SME J determined the FV of its investments in L Corp is

140,000. Cost to sell are estimated at 5% of the FV of the investment.

Provide journal entries.

COST MODEL FV MODEL EQUITY

MODEL

Investment Cost Inv in JV 128 Inv in JV 128 Inv in JV 128

Cash 128 Cash 128 Cash 128

Transaction Cost Inv in JV 2.56 P/L 2.56 Inv in JV 2.56

Cash 2.56 Cash 2.56 Cash 2.56

Cash Dividend Dividend Rec 4.5 Dividend Rec 4.5 Dividend Rec 4.5

P/L 4.5 P/L 4.5 Inv. In JV

4.5

Share in Net N/A N/A Inv in JV 15

Profit P/L 15

Fair Value N/A Inv in JV 12 N/A

P/L 12

Impairment Loss N/A N/A P/L 8.060

Inv in JV 8.060