CCMAN A

SULILk kLCk1

uLCLM8L8 7, 2010

1nIS IS A SAMLL kLCk1

2

Company Cverv|ew

8us|ness n|story

Company A was lncorporaLed ln CCun18? ln 2006 by nAML who Look Lwo subsldlarles of CCMAn? 8

(CCMAn? C and CCMAn? u) and creaLed Company A ln order Lo provlde developmenL and

manufacLurlng servlces for anLlcancer drugs wlLh 8CuuC1 characLerlsLlcs.

Company A exlsLs Lo be a SpeclalLy CuMC dedlcaLed Lo Lhe formulaLlon, developmenL and manufacLurlng

of anLlcancer drugs wlLh hlgh poLency characLerlsLlcs."

Ma|n Iocus:

Servlng Lhe lnnovaLors such as global pharma and bloLechnology orlenLed companles as a one sLop shop"

for any company LhaL operaLes Lhe hlgh poLency 1PL8ALu1lC drugs markeL, wlLh boLh bloLech and small

molecules based producLs.

Serv|ce Cr|entat|on:

rovldlng servlces on flnlshed dosages from Lhe early developmenL phases up Lo Lhe commerclal

manufacLurlng.

Inte||ectua| roperty:

lnLellecLual roperLy comlng from rocess uevelopmenL wlll noL be reLalned by CCMAn? A. 1he value

added Lo Lhe producL wlll be compensaLed by engaglng CCMAn? A for boLh Cllnlcal and Commerclal

supply.

3

Length of 1|me |n 8us|ness

CCMAn? A has been ln buslness for 4.3 years (lncorporaLed ln !uly 2006)

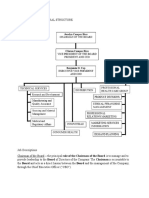

S|ze and Corporate Structure

CCMAn? A currenLly has 178 emp|oyees.

1helr corporaLe leadershlp ls reflecLed ln Lhe followlng organlzaLlonal charL:

8us|ness Structure

lormer CCMAn? x planL acqulslLlon

lormed by comblnlng Lwo former CCMAn? 8 subsldlarles, CCMAn? C and CCMAn? u

lully flnanced by Lhe Shareholders and C8Lul1 Croup

arLlally Subsldlzed by Lu due Lo Lhe lnnovaLlon on boLh cCM compllance and envlronmenLal

proLecLlon

CCMAn? A & CCMAn? 8 operaLe under a non-confllcL, non-compeLe" agreemenL

4

n|story of Lmp|oyee Count

1he followlng lnformaLlon ls a hlsLory of employee counL for CCMAn? A for each of Lhe lasL flve years.

All growLh can be aLLrlbuLed Lo Lhe organlzaLlon's sLrong raLe of growLh overall. 1here were no

acqulslLlons, dlvesLlLures, or layoffs Lo reporL of ln Lhe shorL hlsLory of Lhe LargeL company.

Source: nAML, 8uslness uevelopmenL & MarkeLlng ulrecLor, CCMAn? A

3

Number of Lmp|oyees

1he followlng graphlc lllusLraLes Lhe overall number of employees broken down by buslness area. ln

addlLlon, Lhe numbers of employees for each buslness area ls broken down as a percenLage of Lhe overall

workforce.

6

Locat|on

CCMAn? A ls locaLed ln LACL. 1hls locaLlon ls Lhe only locaLlon Lhey have occupled ln Lhe hlsLory of Lhe

company.

7

8us|ness Mode| Summary

Solely focused on conLracL manufacLurlng of 8CuuC1 for cancer LreaLmenL

Servlce offerlng:

uevelopmenL

Cllnlcal Supply

Commerclal Supply

CapablllLles:

8

kegu|atory Status

LMA Inspect|on: Ian 4-10, 2008

SlLe approval as a manufacLurer for anLlcancer drugs for Cllnlcal and Commerclal supply for Lhe

followlng capablllLles:

o SLerlle llqulds asepLlcally fllled

o SLerlle llqulds asepLlcally fllled and Lermlnally sLerlllzed

o Lyophlllsed vlals

o Capsules

o CoaLed and uncoaLed 1ableLs

LMA Inspect|on: Iune 3-10, 2008

SLerlle 1 area auLhorlzaLlon

ManufacLurlng

IDA Inspect|on: Iebruary 1S-21, 2010

Ceneral CM lnspecLlon

Al for 3 producLs (llquld on SLerlle 2, lyophlllsed on SLerlle 2, lyophlllsed on SLerlle 1)

no 483 on any producLs

Markets Served

CCMAn? A serves cusLomers ln Lhe followlng markeL areas:

!apan

uS

Lu

Customer 8ase

CCMAn? A serves 12 of Lhe Lop 20 pharmaceuLlcal companles.

8oLh bloLech and ma[or pharma companles are cllenLs.

uS ls largesL cusLomer base, wlLh !apan comlng ln second, and only a few cusLomers ln Lu.

9

key 8us|ness artnersh|ps and ke|at|onsh|ps

arLnered wlLh CCMAn? 8

As of !uly 31, 2010 and 2009, Lhe Company had an lnvesLmenL of $3.0 mllllon and $1.3 mllllon,

respecLlvely, represenLlng an 18 lnLeresL ln Lwo companles (collecLlvely referred Lo as Company A")

whose largesL lnvesLor was an offlcer of Lhe Company unLll uecember 31, 2009. 1hese companles

speclallze ln Lhe manufacLurlng of 8CuuC1 pharmaceuLlcal producLs. Cn !uly 2, 2008, Lhe Company

slgned a shareholders' agreemenL wlLh Lhe oLher lnvesLors ln Company A, Lhe Lerms of whlch provlde

Lhe Company wlLh slgnlflcanL lnfluence over Lhe sLraLeglc operaLlng, lnvesLlng and flnanclng pollcles

of Company A. As a resulL, Lhe Company ls now accounLlng for lLs lnvesLmenL ln Company A uslng Lhe

equlLy meLhod. Accordlngly, for Lhe nlne monLhs ended !uly 31, 2010, and 2009, Lhe Company

recorded lnvesLmenL lncome of $0.6 mllllon and a loss of $0.7 mllllon, respecLlvely." (Source:

8LMCvLu)

As noLed ln Lhe above menLloned quoLe, CCMAn? 8 has an 18 mlnorlLy share ln Lhe company and

ls lnvolved ln Lhe governance of CCMAn? A.

CCMAn? A ls noL a subsldlary of CCMAn? 8.

10

|ant fac|||t|es and capab|||t|es:

230,000 sq. fL.

8ullL on a 30 acre campus

Crganlc solvenLs usage allowed on boLh developmenL and CM ManufacLurlng

CompllanL wlLh luA and LMA regulaLlons

ln Lhls nlche envlronmenL CCMAn? A offers a compleLe developmenL and producLlon package Lo

provlde a framework for success."

CCMAn? A's hlgh conLalnmenL manufacLurlng faclllLy allows for safe producLlon and provldes

lncreased governmenL supporL.

ConLalnmenL ls malnLalned by lnsulaLlng sysLems (lsolaLors and Closed 8A8s) focuslng on quallLy

of Lhe alr. 1he personal proLecLlon ls a plus.

1he plan has been deslgned Lo achleve Lhe followlng CccupaLlonal Lxposure LlmlL as per prlmary

conLalnmenL:

o uL1AlL 8LMCvLu

11

Management 1eam

Lxecut|ve prof||es for current management team member:

1hls secLlon removed for sample.

Stab|||ty of management team

1he managemenL Leam ls secure wlLh no recenL changes.

lL should be noLed LhaL several of Lhe 178 currenL employees are relaLed, lncludlng Lhe CLC and

8uslness uevelopmenL and MarkeLlng ulrecLor.

12

Lconom|c Assessment of keg|on of Cperat|ons

uarter|y GD for the |ast 3 years and econom|c out|ook for the reg|on:

CCUN1k GD Growth kate and 1ota| ear GD

LAk 1 2 3 4 1C1AL GD (USD)

2010 0.40 0.30 0.20 -- n/A

2009 (2.9) (0.30) 0.40 (0.10) 2.113 1rllllon

2008 0.40 (0.70) (1.10) (2.00) 2.297 1rllllon

2007 0.30 0.10 0.20 (0.30) 2.116 1rllllon

Luropean Area GD Growth kate and 1ota| ear GD

LAk 1 2 3 4 1C1AL GD (USD)

2010 0.20 1.00 0.40 -- n/A

2009 (2.30) (0.10) 0.40 0.10 12.436 1rllllon

2008 0.70 (0.40) (0.30) (1.90) 13.382 1rllllon

2007 0.80 0.40 0.60 0.40 12.319 1rllllon

Month|y emp|oyment data for the |ast 3 years and emp|oyment out|ook

for the reg|on

CCUN1k (In percentages)

LAk !an leb Mar Apr May !un !ul Aug Sep CcL nov uec

2010 8.3 8.4 8.6 8.6 8.6 8.3 -- 8.2 8.2 -- -- --

2009 7.1 7.2 7.8 7.4 7.3 7.7 7.8 7.8 8.1 8.3 8.3 8.4

2008 6.7 6.6 6.4 6.9 6.8 6.9 6.7 6.9 6.7 6.8 7.0 6.8

2007 6.1 3.9 3.9 3.7 6.1 6.0 6.4 6.2 6.0 6.1 6.1 6.7

Luropean Area (In percentages)

LAk !an leb Mar Apr May !un !ul Aug Sep CcL nov uec

2010 9.9 9.9 10.0 10.0 10.0 10.0 10.1 10.1 10.0 10.1 -- --

2009 8.3 8.8 9.1 9.2 9.4 9.3 9.6 9.7 9.8 9.8 9.8 9.8

2008 7.3 7.2 7.2 7.3 7.4 7.3 7.3 7.6 7.7 7.8 8.0 8.2

2007 7.8 7.7 7.6 7.3 7.3 7.3 7.3 7.4 7.4 7.3 7.3 7.4

13

1ax po||cy (current, recent changes, and ant|c|pated changes)

CCUN1k Corporate 1ax:

1he corporaLe Lax (l8LS) raLe ln CCun18? ls 27.S, plus l8A of 3.9 (or 4.9) or an addlLlonal

S.S corporaLe lncome Lax charge.

As a rule, corporaLe lncome Lax (named l8LS from 2004) ls payable by all resldenL companles on

lncome from any source, wheLher earned ln CCun18? or abroad. non-resldenL companles are

sub[ecL Lo l8LS only on lncome earned ln CCun18?. 8oLh resldenL and non-resldenL companles

are sub[ecL Lo reglonal lncome Lax (l8A), buL only on lncome arlslng ln CCun18?. 1he corporaLe

lncome Lax raLe (l8LS) ls 27.30. Companles lnvolved ln Lrade and manufacLurlng are also

sub[ecL Lo a reglonal Lax on producLlve acLlvlLles (l8A) aL Lhe raLe of 3.90 alLhough reglonal

auLhorlLles may lncrease or decrease Lhe sLandard raLe by up Lo one percenLage polnL. lL ls

envlsaged LhaL l8A wlll be gradually ellmlnaLed ln Lhe near fuLure.

An addlLlonal S.S corporaLe lncome Lax charge (l8LS - l.e. l8LS 27.3 + 3.3) ls levled on

companles (l) havlng revenues hlgher Lhan Lu8 23 mllllon ln Lhe relevanL flscal perlod, and (ll)

carrylng on Lhelr acLlvlLles ln one of Lhe followlng flelds:

8esearch and explolLaLlon of hydrocarbon

Cll reflnlng, producLlon and sale of peLrol, gasollne, gas, lubrlcaLlng oll, llquefled gas of peLrol and

naLural gas

roducLlon and sale of elecLrlclLy.

Company Lax reLurns, whlch cover boLh l8LS and l8A, musL be flled wlLhln nlne monLhs of Lhe

sLaLuLory year end by elecLronlc Lransmlsslon. An advance Lax paymenL ls payable by Lhe 16Lh

day of Lhe slxLh monLh of Lhe accounLlng perlod equal Lo approxlmaLely 40 of Lhe prevlous

year's lncome Lax llablllLy. A second advance paymenL of abouL 60 ls due by Lhe end of Lhe

11Lh monLh of Lhe company's flnanclal year, l.e. 30 november. Any remalnlng amounL would be

due by Lhe 16Lh day of Lhe slxLh monLh afLer Lhe end of Lhe perlod (Source: 8LMCvLu)

Source: LconomlsL lnLelllgence unlL 2010

Ant|c|pated changes:

8uslnesses [ln CCun18?] should expecL ma[or changes Lo Lhe Lax sysLem ln Lhe nexL Lwo or

Lhree years, lncludlng Lhe lnLroducLlon of a federal sysLem of LaxaLlon. 1he lmpacL of Lhe

changes ls dlfflculL Lo predlcL and compllance may noL lmprove." (Source: www.elu.com)

1Ak CLIC kISk kA1INGS for

CCUN1k CurrenL CurrenL revlous revlous

8aLlng Score 8aLlng Score

Cverall assessmenL 8 31 8 30

1ax pollcy rlsk 8 38 8 38

14

Cverv|ew of cap|ta| markets and company's ab|||ty to access these

markets:

Llke many Luropean counLrles CCun18?'s caplLal markeLs have experlenced slgnlflcanL

Lurbulence over Lhe pasL several years. lnvesLmenL ln shorL Lerm caplLal producLs has decllned

sharply, whlle lncreases ln long Lerm caplLal producLs have been mlnlmal.

Company A ls a prlvaLely held company wlLh sLrong flnanclng and a low debL raLlo, company

sources lndlcaLe LhaL Lhere ls currenLly no need, and no plans, for accesslng caplLal markeL

fundlng.

Cverv|ew of econom|c |ncent|ves offered to |ndustry of |nterest:

LnLerprlses operaLlng ln CCun18? can Lake advanLage of a greaL many opporLunlLles and

lncenLlves: from Lhe flnanclng of Lhe purchase of machlnery and planLs all Lhe way Lo Lhe

leglslaLlon regulaLlng Lhe launch of new buslness acLlvlLles, and ln Lhls conLexL Lhere are also

speclflc provlslons for women's enLerprlses.

1he law governlng lncenLlves ls currenLly based on communlLy provlslons on SLaLe Ald Lo

enLerprlses. Avallable lncenLlves are sLlpulaLed ln reglonal laws, naLlonal laws or CommunlLy

programmes.

8uslnesses are dlfferenLlaLed beLween large-scale, small and medlum-slzed (SMLs) and mlcro-

enLerprlses. As of !anuary 1sL 2003 Lhe deflnlLlon of small and medlum-slzed enLerprlses-whlch

are Lhe maln reclplenLs of lncenLlves-follow Lhe crlLerla conLalned ln new recommendaLlon

361/2003/LC adopLed by Lhe Luropean Commlsslon, whlch also lnLroduced Lhe new caLegory of

mlcro-enLerprlses.

lnLervenLlons and lncenLlves for Lhe beneflL of buslnesses can be grouped lnLo Lwo maln

caLegorles: flnanclal lncenLlves and Lax rellef.

llnanclal lncenLlves conslsL malnly of: conLrlbuLlons Lo caplLal accounLs, whlch are deLermlned

as a percenLage of Lhe allowable expenses, granLs LhaL do noL foresee repaymenL of caplLal or of

lnLeresL, conLrlbuLlon Lo lnLeresL accounLs almed aL lowerlng Lhe lnLeresL raLe applled for

flnanclng Lhe buslness, 1ax rellef ls consldered an lndlrecL Lype of lncenLlve as lL does noL conslsL

of dlrecL conLrlbuLlons buL works by means of exempLlons or reducLlons of Lhe flscal burden."

(Source: CCun18? MlnlsLry of lorelgn Affalrs)

"1he econom|c cr|s|s and structura| d|ff|cu|t|es don't d|scourage the CCUN1k b|otech

ln CCun18?, as ln Lhe resL of Lurope, Lhe lnvesLmenLs wlLhln Lhe bloLech fleld have decreased

due Lo Lhe global economlc crlsls. ln parallel, Lhere has been a decrease ln Lhe flnanclng, wlLh a

cascade process whlch broughL Lo almosL zero lC, by venLure CaplLallsLs who prefer Lo

concenLraLe on lnvesLmenL porLfollos already exlsLlng and by hedge funds, whlch reduced Lhe

caplLal lnvesLmenLs ln Lhe bloLech buslness. Lven Lhough Lhey have recelved less flnanclng wlLh

13

respecL Lo Lhe oLher counLrles, Lhe CCun18? bloLech companles are ln llne wlLh Lhe average

decrease of Lhe uL flnanclal avallablllLles. lrom a Lrend polnL of vlew, Lhe CCun18? bloLech

companles are orlenLed Lowards Lhe research of flnanclng Lhrough speclallzed venLure CaplLallsL

and granLs, and are less lncllned Lowards deblLs as ln Lhe pasL. ln splLe of Lhe dlfflculLles ln

ralslng funds worsened by Lhe economlc crlsls, and Lhe economlc lnsLablllLy Lyplcal of Lhls

buslness model - [usL Lhlnk abouL Lhe facL LhaL ln 30 of Lhe cases Lhe avallable cash ls noL

sufflclenL for Lhe whole year - Lhe pure bloLech companles are opLlmlsLlc, forecasLlng Lo be

proflLable for Lhe end of 2009 ln more Lhan 30 of Lhe cases.

1he ma|n cha||enge for the future: the f|nanc|ng and the |ncent|ves for th|s f|e|d

1he CCun18? bloLech lndusLry has grown rapldly wlLhln Lhe lasL Len years and represenLs

nowadays a growlng reallLy. ln facL, even Lhough Lhe counLry sLarLed Lhe bloLech compeLlLlon

laLe, lL has managed Lo make up for Lhe losL ground, becomlng an lmporLanL player on an

lnLernaLlonal level. 1o consolldaLe Lhls poslLlon and almlng aL achlevlng greaLer resulLs, we need

Lo lmprove Lhe research flnanclng sysLem and have adequaLe supporL measures. Cverall, Lhe

publlc and prlvaLe research ln CCun18? has lnefflclenL flnanclng, boLh on a quanLlLy and quallLy

polnL of vlew, wlLh a slow admlnlsLraLlve managemenL whlch does noL keep up wlLh Llme and

Lhe pro[ecL's compeLlLlve requlremenLs.

Malnly, funds are allocaLed accordlng Lo slow and very compllcaLed procedures whlch mosL of

Lhe Llme are noL correlaLed Lo Lhe pro[ecLs' sclenLlflc conLenLs, are lnadequaLe Lo reach Lhe

ob[ecLlves and, mosL of all, mlsslng Lhe valuaLlon crlLerla ex-anLe and ex-posL whlch are rellable

and ln llne wlLh Lhe sLrlcL lnLernaLlonal sLandards.

ln order Lo make furLher sLeps ahead, Lhe CCun18? bloLech needs Lo sLrengLhen Lhe capaclLy of

Lhe varlous small flrms ln pursulng growLh and consolldaLlon and Lo launch Lhe producLs and

Lechnologles belng developed on Lhe markeL. 1hls wlll requlre Lhe avallablllLy of lmporLanL

flnanclal resources, whlch wlll necessary have Lo come from lnsLlLuLlons (8eglons & MlnlsLers),

buL also from Lhe varlous flnanclal and economlc players. unforLunaLely, Lhe venLure CaplLallsLs

speclallzed ln Lhe bloLech fleld ln CCun18?, do noL exlsL. 1he resL of Lhe CCun18? flnanclal

world does noL appreclaLe Lhe rlsk level whlch ls Lyplcal of Lhe bloLech fleld, sLruggllng Lo

undersLand Lhe loglcs and mechanlsms. Moreover, Lhe flscal law whlch susLalns research ls

lnadequaLe wlLh respecL Lo Lhe oLher Luropean counLrles.

1he malnLenance and Lhe hlgher lmporLance of Lhe flscal rellef, as for Lhe Lax credlL for Lhe

research companles, on a perlod of Llme adequaLe and ln llne wlLh Lhe lndusLrlal demands, are a

fundamenLal sLep whlch wlll allow Lhe counLry Lo make up for Lhe losL ground on Lhe lndusLrlal

compeLlLlveness." (Source: 8LMCvLu)

16

kecent News ] Lvents (ast 3 years)

artnersh|ps, re|at|onsh|ps, acqu|s|t|ons, mergers, agreements, etc.

none

I|nanc|ng

none

kestructur|ng

none

New s|tes or c|osures

none

Management team changes

none

roduct ] serv|ce offer|ng |aunches and d|scont|nuat|ons

none, excepL Lhe luA quallflcaLlons menLloned ln 8egulaLory SLaLus lnformaLlon ln Lhe Company

Cvervlew SecLlon.

Lntry |nto and ex|t from markets

none

kumors

none

17

8us|ness Assessment

erce|ved strategy (proposed bus|ness changes, d|rect|on)

CCMAn? A wlll conLlnue Lo focus on 8CuuC1 conLracL manufacLurlng producLlon.

CCMAn? A's aggresslve growLh pro[ecLlons reflecL Lhe company's conLlnued focus on expandlng

Lhelr share of Lhe 8CuuC1 markeL.

CCMAn? A execuLlves lndlcaLed Lhere ls no plan for slgnlflcanL changes ln Lhe company's buslness

sLraLegy.

Market Cverv|ew:

lncldence of cancer ls expecLed Lo rlse wlLh Lhe agelng populaLlon. need for effecLlve 8CuuC1

Lheraples are llkely Lo remaln.

1he 8CuuC1 Lheraples markeL ls seL Lo experlence negaLlve growLh Lo 2019 wlLh a large

number of producLs loslng Lhelr paLenLs over Lhe nexL 3 years. lL ls expecLed LhaL even wlLh loss

of Lhese paLenLs, lnLroducLlon of new 8CuuC1 drugs Lo Lhe markeL wlll off-seL Lhls decllne.

A ma[or LhreaL Lo Lhe 8CuuC1 markeL ls Lhe paLenL explraLlon of Lwo leadlng 8CuuC1

producLs. 1hese producLs are 8CuuC1 and 8CuuC1. 1he 8CuuC1 paLenL already explred ln

Lurope ln 2007 and 8CuuC1 explred ln uS and Lurope Lhls year. 8oLh of Lhese producLs are

made by CCML1l1C8.

8CuuC1 ls Lhe besL-selllng 8CuuC1 Lherapy drug. ln 2007, lL generaLed $2 bllllon. 8CuuC1

generaLed $1.8 bllllon whlle CCML1l1C8's 8CuuC1 generaLed $1.2 bllllon.

1he 8CuuC1 paLenL wlll explre ln !apan ln May 2013 and lL wlll explre ln Lhe uS ln AugusL 2016.

Cenerlcs are Lhe blggesL LhreaL Lo 8CuuC1 sales. Powever, lL ls expecLed LhaL sales of

8CuuC1 wlll sLlll remaln sLrong and LhaL sales would reach $2.7 bllllon ln 2017.

new 8CuuC1 drugs are llkely Lo off-seL Lhe decllne of Lhe 8CuuC1 markeL caused by Lhe

explraLlon of 8CuuC1 and 8CuuC1 paLenLs. 1hese new drugs are 8CuuC1 by CCML1l1C8

and 8CuuC1 by CCML1l1C8.

lollowlng lLs launch ln 2006, 8CuuC1 became a ma[or compeLlLlve LhreaL Lo 8CuuC1 whlch

was launched ln 2004. lL ls expecLed LhaL sales of 8CuuC1 and 8CuuC1 wlll grow ln llne over

Lhe forecasL perlod of 2007 Lo 2017. 1hls wlll boosL Lhe LoLal 8CuuC1 Lherapy cancer brand

markeL over Lhe nexL 10 years.

8CuuC1 ls anoLher drug LhaL ls expecLed Lo compeLe wlLh 8CuuC1 ln Lhe nexL 10 years.

18

1he 8CuuC1 markeL wlll experlence conLracLs from $14 bllllon ln 2009 Lo $13.9 bllllon ln 2019

across Lhe seven ma[or pharmaceuLlcal markeLs. 1hls ls equlvalenL Lo -0.1 CAC8 decllne.

Sources:

1. 8LMCvLu

19

Compet|t|ve |andscape

Whlle Lhere are a number of 8CuuC1 manufacLurers ln Lhe markeL, Lhe ma[orlLy of Lhese companles

produce a wlde varleLy of producLs oLher Lhan 8CuuC1. CCMAn? A belleves LhaL Lhelr excluslve

focus on 8CuuC1 producLlon ls a slgnlflcanL dlfferenLlaLor.

CCMAn? A percelves Lhelr Lop 4 compeLlLors as:

CCMAn? L

o 9800 employees

o 2009 Lurnover was 1.8 8llllon Lu8

o 30 of buslness ls lnLernaLlonal

o 1hree prlmary dlvlslons: harmaceuLlcal, uermo and CosmeLlcs, lamlly Medlclne.

CCMAn? l

o lounded ln 1938

o LocaLed ouLslde of Cleveland, CP

o 8ecame a Subsldlary of 8oehrlnger lngelhelm CorporaLlon ln 2007

o 30 year relaLlonshlp and conLracL wlLh Lhe naLlonal Cancer lnsLlLuLe

CCMAn? C

o 1300 employees

o Cver 200 cusLomers served

o rlmary 8uslness: roducL developmenL, Cllnlcal Lrlals servlces, conLracL manufacLurlng and

cold chaln and loglsLlcs servlces.

CCMAn? P

o 1100 employees

o LsLlmaLed $43.23 Mllllon ln sales

o lncorporaLed ln May 2004

CCMAn? A sees Lhelr key company dlfferenLlaLors as:

1echnology

ConLalnmenL capablllLles

Strengths

1he focused producLlon and speclallzaLlon ln Lhe 8CuuC1 pharmaceuLlcal markeL allows CCMAn?

A Lo lncrease effecLlveness of Lhelr producLs, as well as malnLaln excellenL quallLy conLrol, and meeL

markeL demands and sLandards.

20

CCMAn? A ls heavlly slloed ln order Lo keep a hlgh level of confldenLlallLy for Lhelr cusLomers. ln

facL, lL ls noL uncommon for Lechnlclans lnvolved ln Lhe producLlon of varlous producLs Lo noL know

who Lhe cllenL/cusLomer ls.

CCMAn? A's hlgh conLalnmenL manufacLurlng faclllLy allows for safe producLlon and lncreased

governmenL supporL.

Weaknesses

CCMAn? A's excluslve focus on 8CuuC1 can also be a weakness due Lo dependency on Lhe

8CuuC1 markeL and hlgh compeLlLlve pressure.

CCMAn? A ls a small company and may noL have Lhe recourses Lo maLch value-add servlces offered

by compeLlLors.

non-compeLe agreemenL wlLh CCMAn? may llmlL CCMAn? A's markeL opporLunlLles.

k|sks (|awsu|ts, market |ssues, etc.)

none

erce|ved rat|ona|e]benef|t |n do|ng bus|ness w|th company

CCMAn? A appears Lo offer a hlgh quallLy producL wlLh hlgh quallLy conLrol and overall producLlon

capablllLles.

erce|ved r|sk |n dea||ng w|th company

As seen ln Lhe daLa presenLed Lhus far, Lhere are noL many percelved rlsks ln deallng wlLh CCMAn?

A. 1he only mlnor rlsk LhaL should be noLed ls Lhe facL LhaL CCMAn? A ls sLlll a young company. lL ls

yeL Lo be seen how Lhey wlll be funcLlon as a long-Lerm player ln Lhe global pharmaceuLlcal and

bloLech markeL. 1helr Lrack record Lo daLe ls sLrong, buL only Llme wlll Lell lf Lhelr performance over

Lhe lasL 4.3 years ls lndlcaLlve of Lhelr overall long-Lerm performance.

21

I|nanc|a| Assessment: Important f|nanc|a| |nd|cators

Source: nAML, 8uslness uevelopmenL & MarkeLlng ulrecLor, CCMAn? A)

22

Iu|| 8a|ance Sheet, Income Statement and Statement of Cash I|ows

23

24

kat|os of CCMAN A

Deta||s of Debt

CCMAn? A was awarded Lhe Lu Crade of lnnovaLlon for lLs lnvesLmenL, Lherefore 80 of lLs L1 debL

has been co-granLed by Lhe Lu. AddlLlonally, Lhe lnLeresL raLe CCMAn? A ls paylng on 30 of lLs L1

uebL ls 0.3.

8elng LhaL CCMAn? A ls a sLarL-up Company, seL up wlLh [governmenL] ro[ecL llnanclng Lools, all

of Lhe raLlos you can calculaLe wlll look very dlfferenL from whaL you would expecL from a long-Lerm,

esLabllshed company.

CCMAn? A ls noL obllgaLed Lo begln debL prlnclpal repaymenL unLll !une 2012, before LhaL daLe only

Lhe lnLeresL on debL ls due.

rof|tab|||ty kat|os

Cross Margln (Cross proflL margln, Cross proflL

raLe) = 0.0869S

CperaLlng Margln (CperaLlng lncome Margln,

CperaLlng roflL Margln, 8eLurn on Sales) =

0.1304

roflL Margln (neL Margln, neL roflL Margln) =

0.1304

8eLurn on LqulLy (8CL) = 0.02

AsseL 1urnover = 0.0S38

8eLurn on AsseLs (8CA) = 0.0070

L|qu|d|ty kat|os CurrenL 8aLlo = 36.9047

Acld-1esL raLlo (Culck raLlo) = 3.0476

CperaLlng Cash llow 8aLlo (CCl) = 2.0

Worklng CaplLal 1urnover = 0.0610

Act|v|ty kat|os 8ecelvables 1urnover 8aLlo = 0.S197

Average CollecLlon erlod

lnvenLory 1urnover 8aLlo = 2.87S

Average uays Lo Sell Lhe lnvenLory

Debt kat|os uebL 8aLlo (uebL Lo 1oLal AsseLs) = 0.S122

Long-1erm uebL/1oLal AsseL (Lu/1A) 8aLlo =

0.S122

uebL Lo LqulLy 8aLlo (lnLeresL Coverage 8aLlo,

llxed-charged Coverage) = 1.7833

23

Ana|ys|s of I|nanc|a| Ind|cators and Company V|ab|||ty

CCMAn? A ls a well funded company LhaL has demonsLraLed encouraglng growLh. 1he company has a

relaLlvely low debL-Lo-lncome raLlo for a sLarL-up, and, ln Lerms of growLh, has ouLperformed lLs markeL

secLor for Lhe lasL Lhree years.

erce|ved Need for I|nanc|ng

8ased on analysls of Lhe company flnanclals and on dlrecL lnLervlews wlLh company sLakeholders,

CCMAn? A currenLly does noL have a need for exLernal flnanclng.

kecommendat|on for qua||fy|ng supp||er

8ased on CCMAn? A's flnanclal sLandlng, buslness model and compeLlLlve dlfferenLlaLors, Sedulo glves

CCMAn? A pos|t|ve recommendaLlon.

26

Cverv|ew ] kecommendat|on

8us|ness assessment summary

CCMAn? A has a sLrong buslness model focused on all phases of 8CuuC1 conLracL manufacLurlng.

1helr excluslve focus on 8CuuC1 and Lhelr leverage of leadlng manufacLurlng Lechnology are clear and

relevanL dlfferenLlaLors ln Lhe markeL.

I|nanc|a| assessment summary

AlLhough CCMAn? A ls a relaLlvely young company (4.3 years), Lhey have demonsLraLed encouraglng

growLh, ouLperformlng Lhelr peers for Lhe lasL Lhree years. 8ased on Lhe company's currenL growLh raLe,

relaLlvely low debL, governmenL Lax and debL repaymenL lncenLlves, sLrong cusLomer base and 8CuuC1

markeL growLh, Sedulo's overall assessmenL of CCMAn? A's flnanclal sLandlng ls poslLlve.