2025 Recap: Milestones and Events

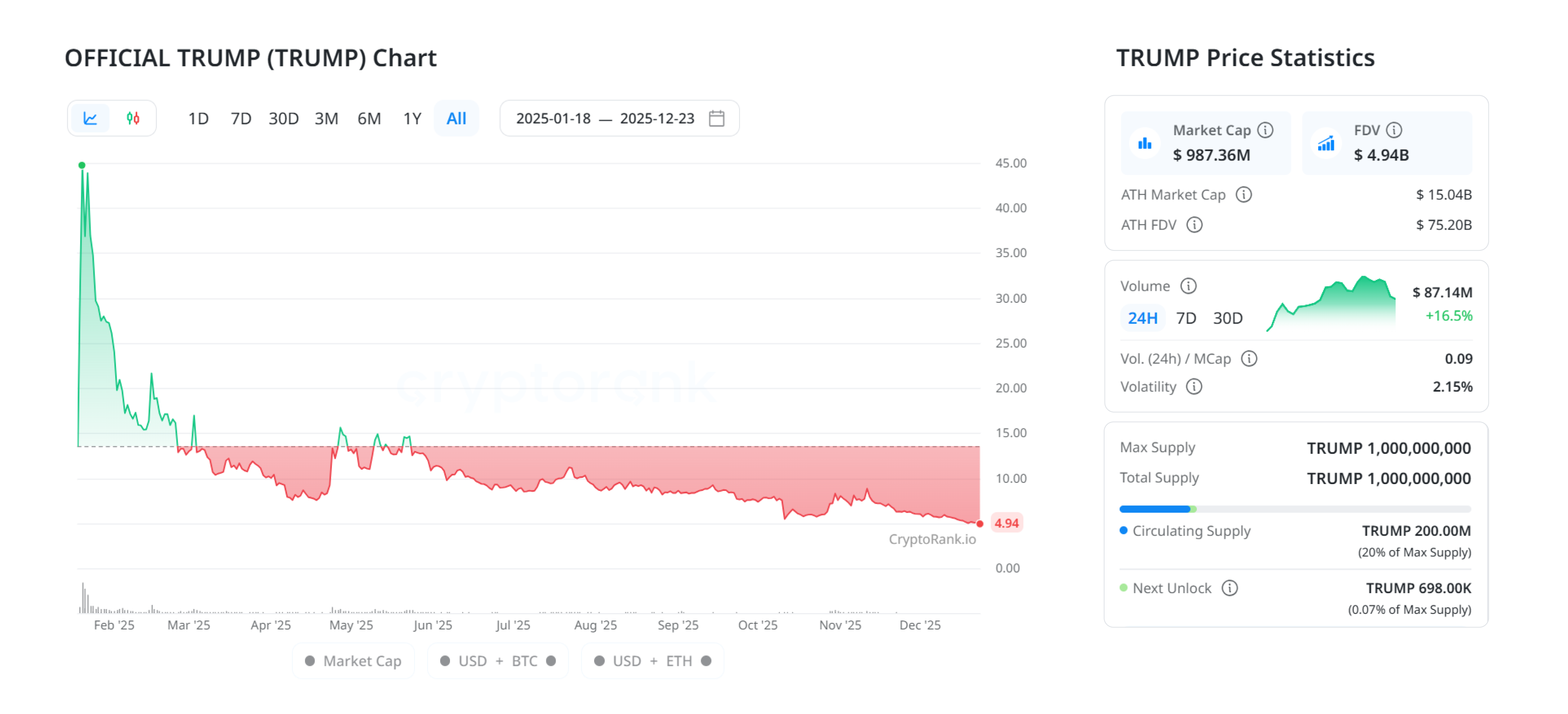

January 17 — $TRUMP Memecoin Launch

The launch of the $TRUMP memecoin marked the beginning of 2025 and sparked widespread debate within the crypto community over whether it was a positive or negative development for the broader market. Some participants argued that the memecoin drained liquidity from the ecosystem and framed Trump’s stance on crypto as speculative gambling rather than long-term innovation. Others viewed the launch as a powerful signal of mainstream adoption, arguing that few events demonstrate crypto’s cultural penetration more clearly than a memecoin associated with a sitting U.S. president.

Data obtained by API

January 20 — Trump’s Inauguration

The beginning of 2025 coincided with the inauguration of Donald Trump as the 47th President of the United States. Trump’s election opened new opportunities for the crypto sphere, triggering structural changes in crypto-related regulation and driving a shift in institutional attitudes toward crypto assets.

As a result, institutional adoption accelerated, reshaping the structure of crypto ownership. The growing role of institutional participants has pushed Web3 development closer to TradFi, while market dynamics have evolved toward lower volatility and more mature price behavior.

January 23 — Executive Order: U.S. Creates Digital Asset Strategy & Strategic Bitcoin Reserve

On January 23, the United States marked a strategic shift in digital asset policy through a presidential executive order aimed at strengthening leadership in digital financial technology. The order revoked prior restrictive frameworks, promoted regulatory clarity, protected self-custody and permissionless blockchain access, and supported dollar-backed stablecoins while explicitly rejecting CBDCs.

The initiative also introduced the concept of a national digital asset stockpile, signaling deeper institutional and state-level integration of crypto into U.S. financial and geopolitical strategy.

February 14 – $LIBRA Token Scandal

The LIBRA memecoin scandal unfolded on February 14, after Argentine President Javier Milei mentioned the token on social media and presented it as a private initiative intended to support Argentina’s economy. The token, launched on Solana, briefly surged to a $4.5-5 billion market cap following his post. The rise was short-lived: within hours, LIBRA fell more than 90%, prompting accusations of a rug pull or coordinated pump-and-dump. Milei later deleted the post, stating he had not been aware of the project’s details and chose to stop endorsing it once he learned more. By then, the damage had already been done.

Data shows that 86% of investors incurred losses exceeding $250 million in total, while a smaller share of participants earned around $180 million in profits. Overall, the episode was net negative. After a series of similar incidents – with LIBRA being the most prominent – memecoin trading volumes began to decline as liquidity left the sector, adding more uncertainty to an already high-risk niche.

February 21 — Bybit Hack

On February 21, 2025, the crypto market was shaken by the largest security breach in its history, as hackers linked to North Korea exploited Bybit, stealing approximately $1.5 billion in digital assets. The attack, attributed to the Lazarus Group, highlighted the growing sophistication of state-backed cyber operations targeting cryptocurrency infrastructure.

At the same time, the Bybit team demonstrated a masterclass in crisis management, responding transparently and decisively while keeping withdrawals open, helping to stabilize market confidence despite the scale of the incident.

March 6 — Trump signed an Executive Order to establish a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile

On March 6, 2025, President Donald Trump signed an executive order establishing a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile, formally recognizing digital assets within U.S. sovereign financial strategy. The order designated Bitcoin as a permanent reserve asset funded by forfeited holdings and prohibited its sale, while non-Bitcoin digital assets were assigned to a separate stockpile subject to discretionary management.

April 2 — Liberation Day Tariffs Announced by President Donald Trump

On April 2, President Donald Trump announced the Liberation Day tariffs, a broad package of import duties aimed at reshaping U.S. trade relations and boosting domestic manufacturing. The move signaled a return to protectionist policy, raising costs across global supply chains and increasing macroeconomic uncertainty, while reinforcing inflation and geopolitical risk narratives across financial markets, including crypto.

In the days that followed, markets reacted sharply, with heightened volatility across equities, foreign exchange, and commodities as investors priced in renewed trade tensions. Amid growing pressure from markets, businesses, and international partners, the administration partially reversed the measures by delaying implementation and introducing exemptions for key sectors and trading partners. The rapid rollback eased immediate market stress and underscored both the sensitivity of global markets to abrupt policy shifts and the administration’s willingness to recalibrate in response to economic feedback.

May 7 — Petra ETH Upgrade

Ethereum implemented the Petra upgrade, marking another step in the network’s post-Merge evolution. The upgrade focused on incremental improvements to execution efficiency, validator operations, and protocol stability, reinforcing Ethereum’s role as institutional-grade settlement infrastructure rather than a high-volatility experimental network.

June 5 — Circle's IPO

On June 5, Circle completed its IPO on the NYSE under the ticker $CRCL, pricing shares at $31 and raising approximately $1.05 billion, implying a valuation of around $18 billion on a fully diluted basis. The stock opened significantly above the IPO price and surged more than 150% on the first trading day amid strong institutional demand, briefly trading above $100.

June 17 — U.S. Senate Passes GENIUS Act

On June 17, the U.S. Senate passed the GENIUS Act, marking a pivotal step toward comprehensive federal regulation of digital assets. The vote signaled bipartisan momentum behind establishing clear rules for stablecoins, digital asset market structure, and regulatory jurisdiction, moving the U.S. away from enforcement-driven ambiguity.

June 30 — xStocks Launches Tokenized Assets

In late June, xStocks launched its tokenized equities offering, bringing more than 60 fully collateralized U.S. stocks – including AAPL, NVDA, and TSLA – on-chain as SPL tokens. Each token represents a 1:1 claim on a real share held by a regulated custodian, ensuring full backing by the underlying security.

The launch provided users with a way to gain on-chain exposure to traditional equities through instruments that can be traded and stored directly in a blockchain environment. Market response was strong: within two weeks of the June 30 rollout, the total value of xStocks assets on-chain rose from roughly $35 million to over $100 million, highlighting early interest in tokenized equities.

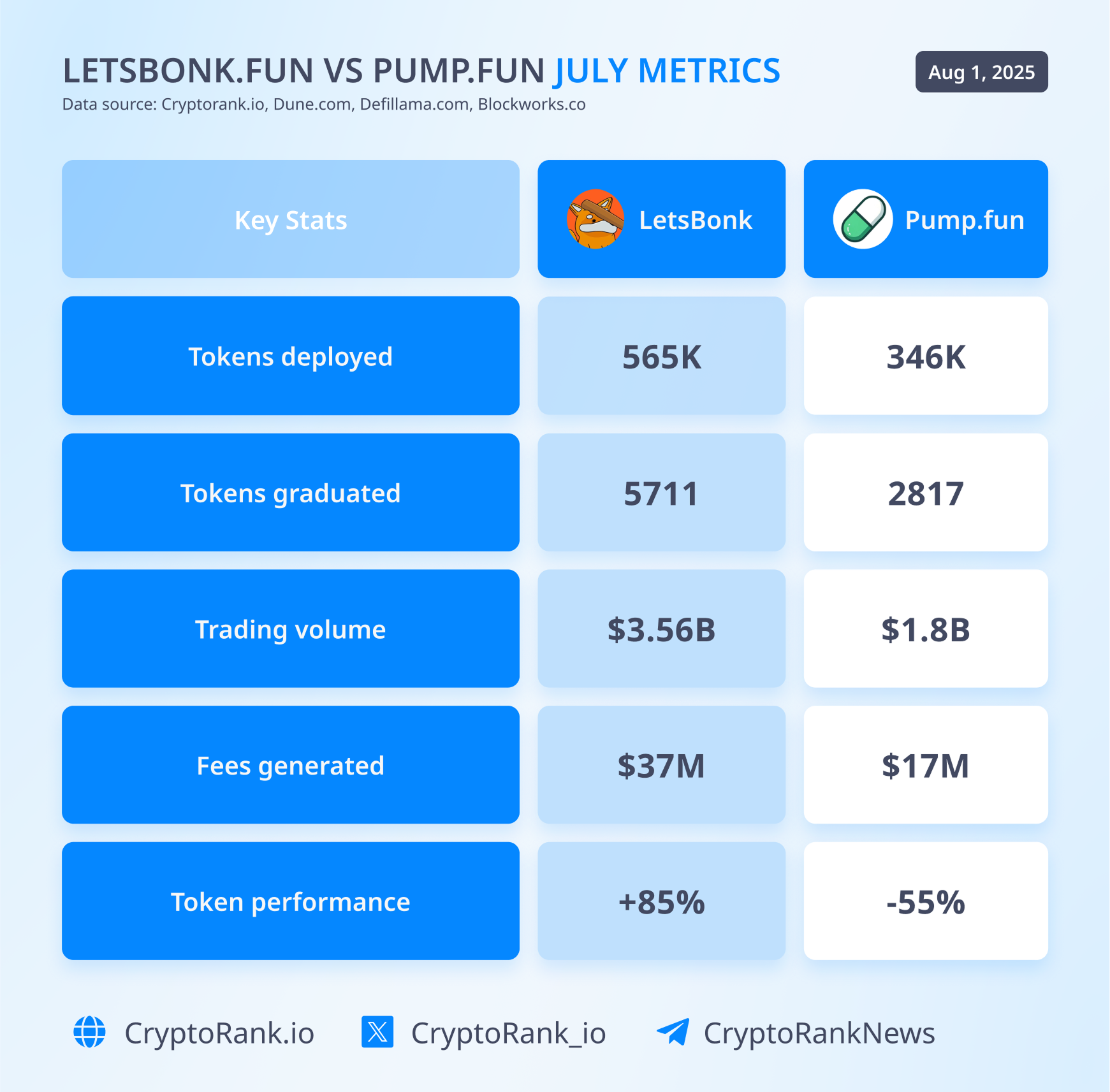

July 6 — Bonk.fun Challenges Pump.fun

July was the first, and so far the only, month when Pump.fun’s dominance among Solana launchpads was meaningfully challenged. The shift came with the rise of LetsBonk.fun, a launchpad built within the Bonk ecosystem. Starting July 6, LetsBonk outperformed Pump.fun across several metrics, including daily token launches, completed graduations, trading volume, and fee generation.

The Bonk season didn’t last long, however. By August, Pump.fun regained most of the activity and has continued expanding its market share since then, which now sits at roughly 85%.

July 18 — GENIUS Act Signed Into Law

On July 18, President Donald Trump signed the GENIUS Act into law, formalizing the first comprehensive federal framework for digital assets in the United States. The legislation clarified regulatory jurisdiction, established rules for stablecoin issuance and oversight, and defined market-structure standards for digital asset intermediaries. By replacing enforcement-led ambiguity with rule-based regulation, the GENIUS Act materially reduced legal uncertainty for institutional participants and marked a turning point in the integration of crypto markets into the U.S. financial system.

September 17 — Aster Launch

Aster launched on BNB Chain on September 17 with public support from CZ. The debut coincided with the TGE of the ASTER token, which rose about 10x in its first week. The platform quickly became one of the most active perpetual DEXs, and at its peak, Aster reported daily trading volumes in the tens of billions dollars.

However, this high activity metrics of a new market entrant drew attention of many crypto analysts. Questions around data integrity related to reported volumes and token distribution concentration led to the temporary delisting of its volume metrics by some data aggregators. Now that these issues have been addressed, Aster continues to rank among the top three perp DEXs by volume and fees.

October 4 — Aave TVL Hits $50 Billion

On October 4, Aave became the first decentralized application in history to surpass $50 billion in TVL. The milestone reflected sustained growth in on-chain lending demand, deeper institutional participation, and Aave’s role as foundational money-market infrastructure for DeFi. Crossing this threshold marked a turning point for decentralized finance, signaling that core DeFi protocols had reached systemically relevant scale comparable to traditional financial intermediaries.

October 6 — Bitcoin Set a New ATH

On October 6, 2025, Bitcoin set a new all-time high of $126,038. The move followed several weeks of steady growth: BTC held its support levels through late September, ETFs saw $3.53B inflows in September alone, and overall market sentiment was improving. On top of that, the dollar was weakening during a period of political uncertainty, and investors were increasingly expecting rate cuts – all of which added to the demand for Bitcoin.

However, only a few days later, the market reversed. As the U.S. announced tariffs on China, crypto began to bleed, leveraged positions were wiped out, and traders started taking profits. The first half of October saw several large liquidation events, and by the end of the month, Bitcoin had fallen well below its October 6 peak, finishing the month about 4% down despite setting a new record earlier.

October 7 — Polymarket Raises $2 Billion

On this day, Polymarket announced a new $2 billion strategic investment round at a $9 billion valuation. Intercontinental Exchange, the parent company of the NYSE, was the sole investor. This brought Polymarket’s total funding to $2.28 billion. Later in October, reports indicated that the project was seeking another round at a valuation of up to $15 billion. The level would mark more than 10x increase from its $1.2 billion valuation in June, when it raised $200 million in a round led by Founders Fund.

October 11 — Biggest Crypto Market Crash Since the FTX Collapse

On October 11, global markets experienced a sharp sell-off, triggering a broad risk-off move across equities, crypto, and commodities. The downturn was driven by a combination of macro uncertainty, crowded positioning, and forced deleveraging, leading to rapid liquidations across both centralized and decentralized markets.

In crypto, the crash resulted in a sudden contraction of liquidity, elevated funding volatility, and cascading liquidations in leveraged positions, reinforcing the growing correlation between digital assets and global macro conditions during periods of stress.

October 28 — SOL ETF Launch

In late October, the first Solana ETP and ETF products began trading, giving institutional investors a regulated way to access the Solana ecosystem. These funds allow investors to gain exposure to SOL through traditional brokerage accounts without needing to manage crypto wallets or exchange accounts. Several issuers listed their products on the NYSE and Nasdaq, and some ETFs introduced staking to get additional rewards.

Market interest was strong from the start, with $69.5 million in inflows recorded on the first day. As of December 30, cumulative net inflows into spot SOL ETFs stand at about $750 million. Bitwise’s BSOL accounts for roughly 80% of that amount, while other major products include Grayscale’s GSOL and Fidelity’s FSOL. The broader trend also reflects sustained demand: since the launch on October 28, there have been only 4 days of net outflows.

November 4 — xUSD Depeg Sparks Liquidity Shock in DeFi Markets

On November 4, 2025, Stream Finance’s yield-backed stablecoin xUSD suffered a severe depeg after the protocol disclosed a $93 million loss tied to an external asset manager. Following the disclosure, Stream Finance temporarily halted withdrawals and redemptions, removing the primary arbitrage mechanism that supported the peg. With exits limited to secondary markets, xUSD rapidly fell as much as 57% below $1, reflecting thin liquidity and collapsing confidence rather than immediate insolvency.

The depeg propagated across interconnected DeFi systems, particularly affecting assets such as deUSD and sdeUSD that relied on xUSD-linked liquidity and collateral assumptions.

November 21 — Kalshi Raises $1 Billion

Kalshi, a U.S.-based regulated prediction market platform, raised $1 billion in a new funding round at an $11 billion valuation, led by Sequoia Capital and CapitalG. Total funding now stands at $1.57 billion. The project more than doubled its valuation since October’s $300 million round at a $5 billion valuation. Notably, this was Kalshi’s third funding round with Sequoia as the lead investor. The new capital will support product expansion, broader market integrations, and scaling its regulated event-contracts infrastructure as demand for prediction markets continues to grow.

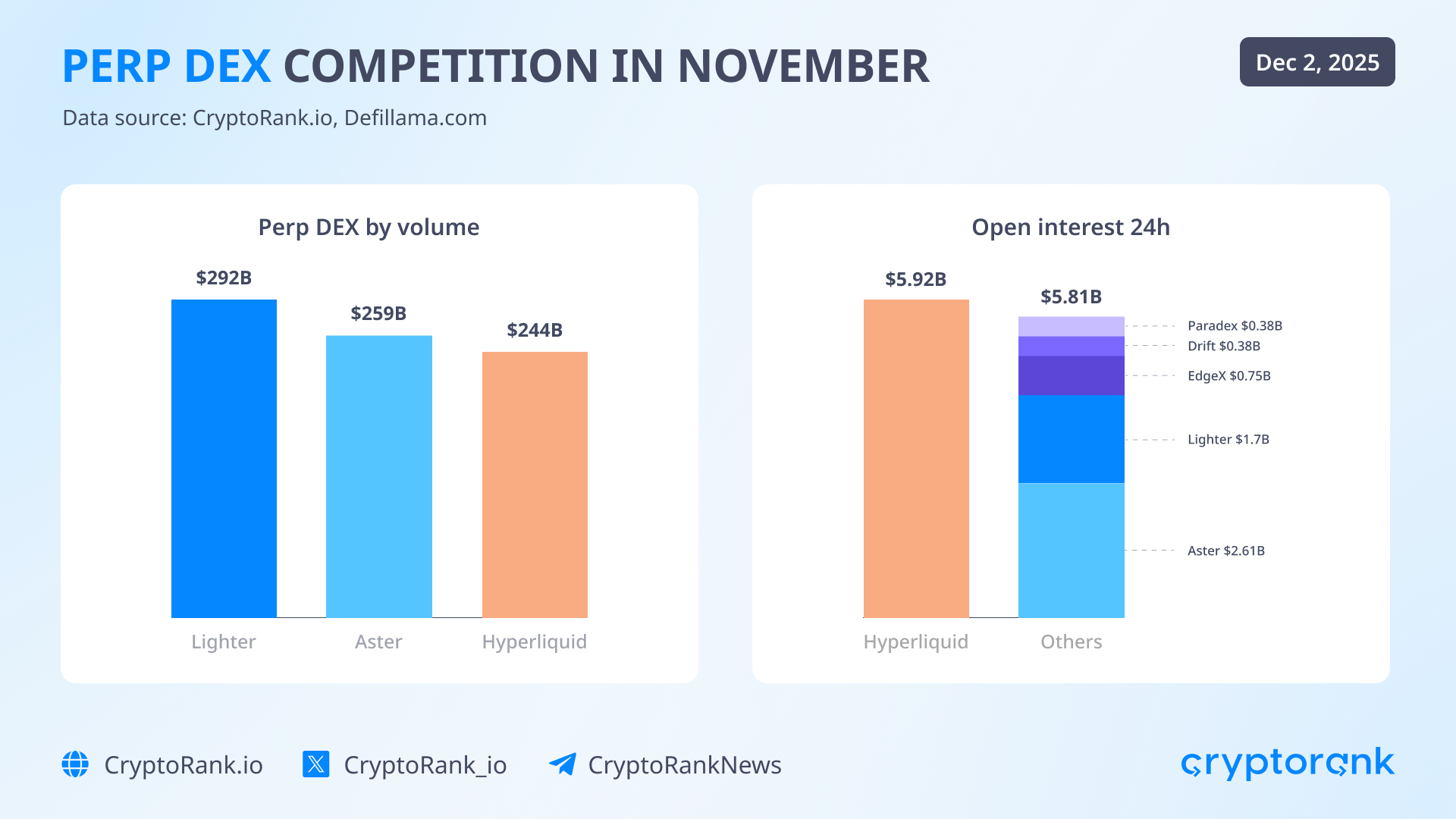

November 30 — Lighter Became The Top 1 Perp DEX by Volume

November witnessed the change of leader in the perp DEX trading sector, something that didn’t happen for over a year. Lighter climbed to the top, with $292M outperforming Aster ($259M) and Hyperliquid ($244M). The rise was gradual, but consistent, mostly driven by zero-fees for traders and ongoing points program.

The upcoming Lighter airdrop is also contributing to a high platform activity. Polymarket currently gives an 88% probability that the airdrop will take place before December 31, and registration is already open. The key question now is whether Lighter will be able to maintain its current activity levels once the airdrop is completed.

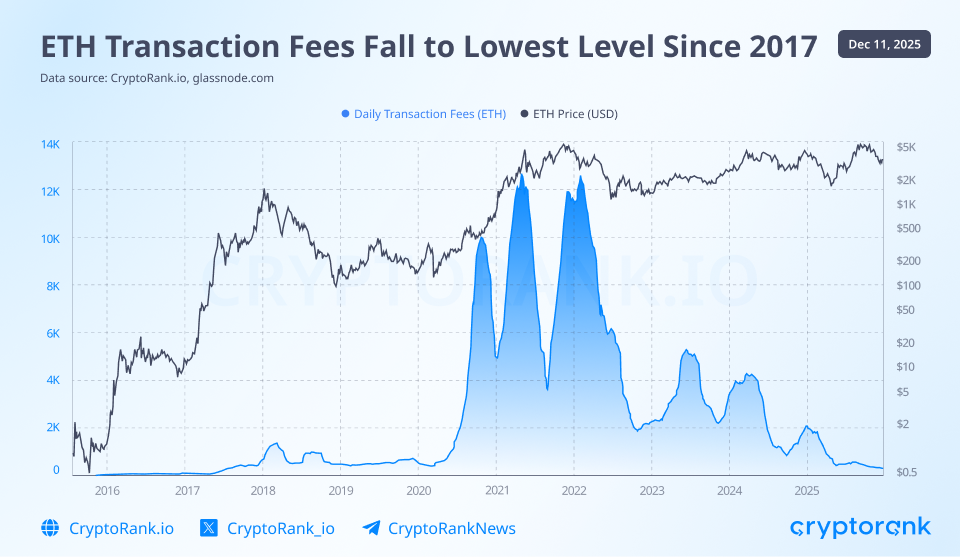

December 3 — Ethereum’s Fusaka upgrade

On December 3, Ethereum implemented the Fusaka upgrade, delivering a major improvement in network efficiency and cost structure. The upgrade introduced execution-layer and validator optimizations that significantly reduced congestion, pushing average gas fees to their lowest levels since 2017. As a result, Ethereum transactions became materially cheaper and more predictable, accelerating on-chain activity and strengthening Ethereum’s position as scalable, institutional-grade settlement infrastructure rather than a high-cost execution environment.

Conclusion

In our view, the signing of the GENIUS Act on July 18 was the most pivotal crypto event of 2025. It reshaped market dynamics throughout the year and laid a foundational framework for what comes next. Looking ahead to 2026, we expect the main narrative to shift toward the legal status of tokens, driven by ongoing legislative progress, alongside growing attempts to link token prices more directly to protocol revenues through buyback and burn mechanisms.